Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6336

Pages:94

Published On:October 2025

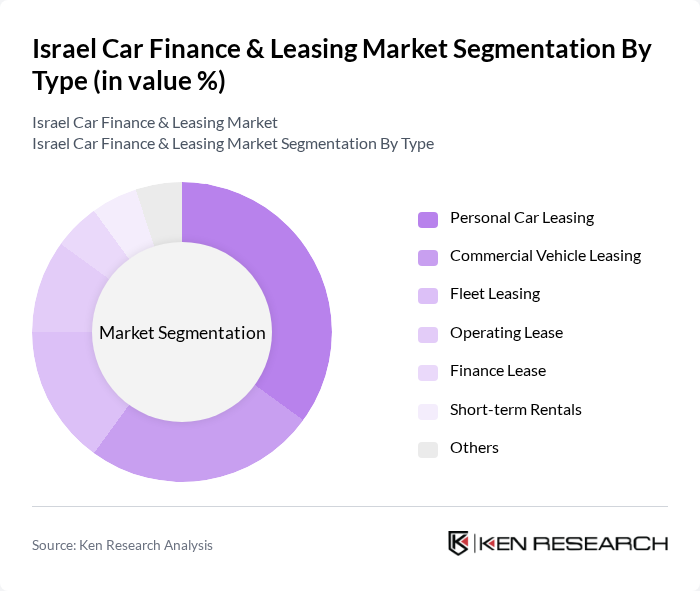

By Type:The market is segmented into various types of leasing options, including personal car leasing, commercial vehicle leasing, fleet leasing, operating lease, finance lease, short-term rentals, and others. Each of these segments caters to different consumer needs and preferences, with personal car leasing being particularly popular among individual consumers seeking flexibility and affordability.

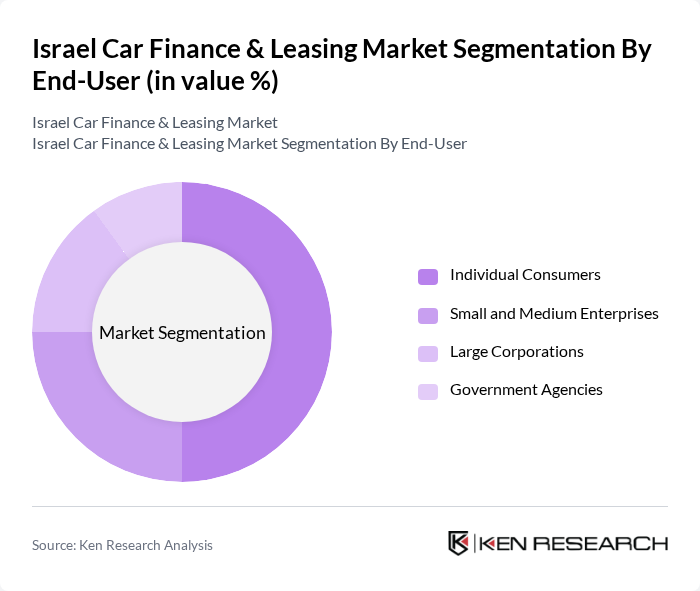

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), large corporations, and government agencies. Individual consumers dominate the market, driven by the increasing preference for leasing over purchasing vehicles, which offers lower upfront costs and greater flexibility.

The Israel Car Finance & Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Leasys Israel, AutoLease, Bank Hapoalim, Leumi Card, Mizrahi Tefahot Bank, Isracard, Cal Auto, Hertz Israel, Avis Israel, Car2Go, Gett, DriveNow, Shlomo Sixt, Budget Israel, Car Finance Israel contribute to innovation, geographic expansion, and service delivery in this space.

The Israel car finance and leasing market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The shift towards online financing solutions is expected to streamline processes, making vehicle financing more accessible. Additionally, the rise of subscription-based car services will cater to consumers seeking flexibility. As sustainability becomes a priority, financing options for electric vehicles will likely gain traction, aligning with government incentives and consumer demand for greener alternatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Leasing Commercial Vehicle Leasing Fleet Leasing Operating Lease Finance Lease Short-term Rentals Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Government Agencies |

| By Vehicle Type | Sedans SUVs Trucks Vans Electric Vehicles Hybrid Vehicles Others |

| By Financing Type | Lease Financing Loan Financing Hire Purchase Others |

| By Duration | Short-term Leasing Long-term Leasing Flexible Leasing |

| By Payment Structure | Fixed Payments Variable Payments Balloon Payments |

| By Distribution Channel | Direct Sales Online Platforms Dealerships Brokers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Leasing Companies | 100 | Leasing Managers, Financial Analysts |

| Banking Institutions Offering Auto Loans | 80 | Loan Officers, Risk Assessment Managers |

| Consumers Engaged in Car Financing | 150 | Recent Car Buyers, Leaseholders |

| Automotive Dealerships | 70 | Sales Managers, Finance Managers |

| Industry Experts and Analysts | 50 | Market Researchers, Economic Analysts |

The Israel Car Finance & Leasing Market is valued at approximately USD 3.5 billion, reflecting a significant growth driven by increasing consumer demand for flexible financing options and the rise of electric vehicles.