Region:Asia

Author(s):Rebecca

Product Code:KRAE3383

Pages:81

Published On:February 2026

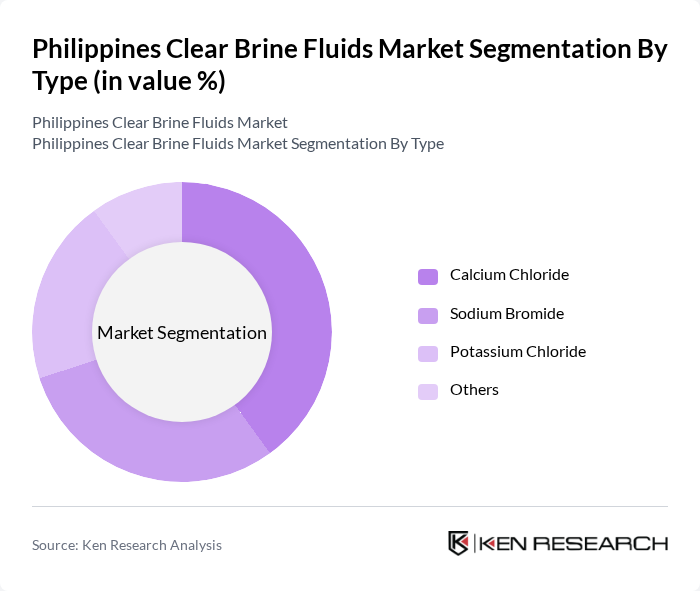

By Type:

The clear brine fluids market is primarily dominated by Calcium Chloride, which is favored for its high density and effectiveness in various drilling applications. Its ability to control formation pressures and prevent wellbore instability makes it a preferred choice among operators. Sodium Bromide follows closely, known for its non-toxic properties and effectiveness in completion fluids. The demand for Potassium Chloride is also significant, particularly in specific drilling environments where its unique properties are beneficial. Overall, the trend towards using more efficient and environmentally friendly solutions is shaping consumer preferences in this market.

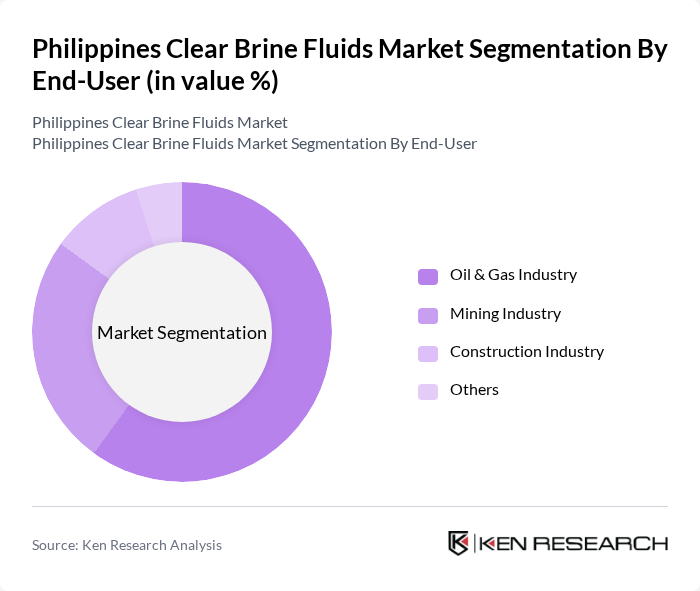

By End-User:

The Oil & Gas Industry is the leading end-user of clear brine fluids, accounting for a significant portion of the market. This dominance is attributed to the extensive use of these fluids in drilling and completion processes, where they play a crucial role in maintaining wellbore stability and controlling formation pressures. The Mining Industry also contributes notably, utilizing clear brine fluids for various applications, including mineral extraction and processing. The Construction Industry's share is smaller but growing, as the need for effective fluid solutions in construction projects increases.

The Philippines Clear Brine Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton, Schlumberger, Baker Hughes, Newpark Resources, Weatherford International, Chemstream Holdings, Tetra Technologies, Axiom Chemicals, DMC Global, DOW Chemical Company, Innospec, Cargill, BASF, Solvay, Clariant contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines clear brine fluids market is poised for significant growth, driven by increasing offshore drilling activities and a shift towards sustainable practices. As environmental regulations tighten, the demand for eco-friendly brine solutions is expected to rise. Additionally, advancements in digital technologies for fluid management will enhance operational efficiency. Companies that invest in R&D and strategic partnerships with local oil firms will likely capitalize on emerging opportunities, ensuring a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Calcium Chloride Sodium Bromide Potassium Chloride Others |

| By End-User | Oil & Gas Industry Mining Industry Construction Industry Others |

| By Application | Drilling Fluids Completion Fluids Workover Fluids Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Luzon Visayas Mindanao |

| By Customer Type | Large Enterprises SMEs Government Agencies Others |

| By Product Formulation | Standard Formulations Customized Formulations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Companies | 100 | Drilling Engineers, Project Managers |

| Service Providers for Drilling Fluids | 80 | Product Managers, Technical Sales Representatives |

| Regulatory Bodies | 50 | Policy Makers, Environmental Compliance Officers |

| Research Institutions | 40 | Research Scientists, Industry Analysts |

| End-users in Oil & Gas | 70 | Operations Managers, Supply Chain Coordinators |

The Philippines Clear Brine Fluids Market is valued at approximately USD 150 million, driven by demand from the oil and gas sector, mining industry, and construction sector, which utilize these fluids for various applications in drilling and completion processes.