Region:Asia

Author(s):Rebecca

Product Code:KRAE3382

Pages:88

Published On:February 2026

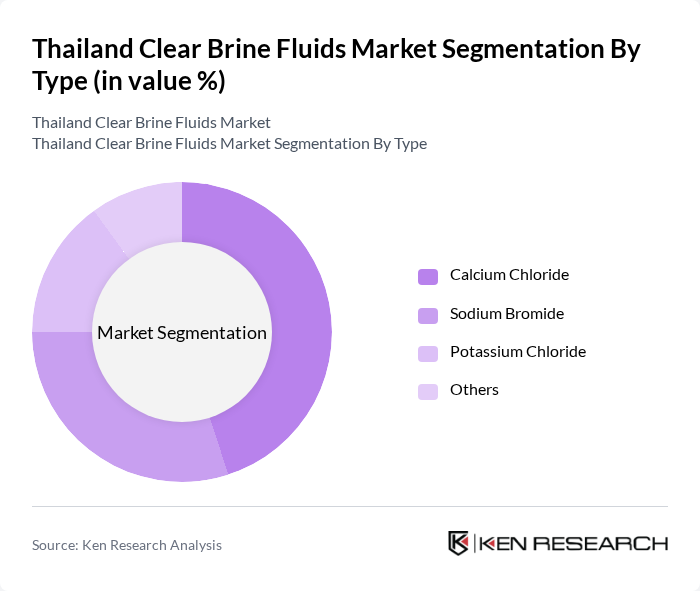

By Type:The clear brine fluids market can be segmented into various types, including Calcium Chloride, Sodium Bromide, Potassium Chloride, and Others. Among these, Calcium Chloride is the leading sub-segment due to its high density and effectiveness in controlling formation pressures during drilling operations. Sodium Bromide follows closely, favored for its stability and non-toxic properties, making it suitable for various applications. Potassium Chloride and other formulations are also utilized but to a lesser extent.

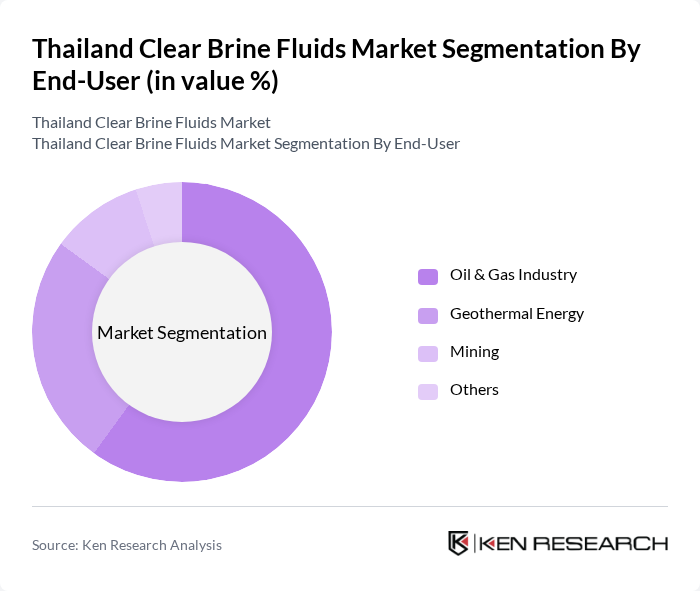

By End-User:The market is segmented based on end-users, including the Oil & Gas Industry, Geothermal Energy, Mining, and Others. The Oil & Gas Industry is the dominant segment, driven by the extensive use of clear brine fluids in drilling and completion processes. The Geothermal Energy sector is also growing, as it requires specialized fluids for efficient heat transfer and resource extraction. Mining applications, while significant, represent a smaller portion of the market compared to oil and gas.

The Thailand Clear Brine Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton, Schlumberger, Baker Hughes, Newpark Resources, Tetra Technologies, Chemstream Holdings, Axiom Chemicals, DOW Chemical, Solvay, Albemarle Corporation, Cargill, BASF, Clariant, Innospec, FMC Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand clear brine fluids market is poised for significant growth, driven by increasing investments in offshore drilling and advancements in fluid technology. As the demand for sustainable and efficient drilling solutions rises, companies are likely to focus on developing eco-friendly brine fluid alternatives. Additionally, strategic partnerships with local oil firms will enhance market penetration and foster innovation. The integration of digital technologies for fluid management will further streamline operations, ensuring that the market remains competitive and responsive to evolving industry needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Calcium Chloride Sodium Bromide Potassium Chloride Others |

| By End-User | Oil & Gas Industry Geothermal Energy Mining Others |

| By Application | Drilling Fluids Completion Fluids Workover Fluids Others |

| By Region | Central Thailand Northern Thailand Southern Thailand Eastern Thailand |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Product Formulation | Water-Based Oil-Based Synthetic-Based Others |

| By Regulatory Compliance | ISO Certified Products Non-Toxic Formulations Environmentally Friendly Options Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oilfield Service Providers | 100 | Technical Managers, Operations Directors |

| Chemical Suppliers | 80 | Sales Managers, Product Development Leads |

| Drilling Contractors | 70 | Project Managers, Field Engineers |

| Regulatory Bodies | 50 | Policy Analysts, Environmental Compliance Officers |

| Research Institutions | 60 | Research Scientists, Industry Analysts |

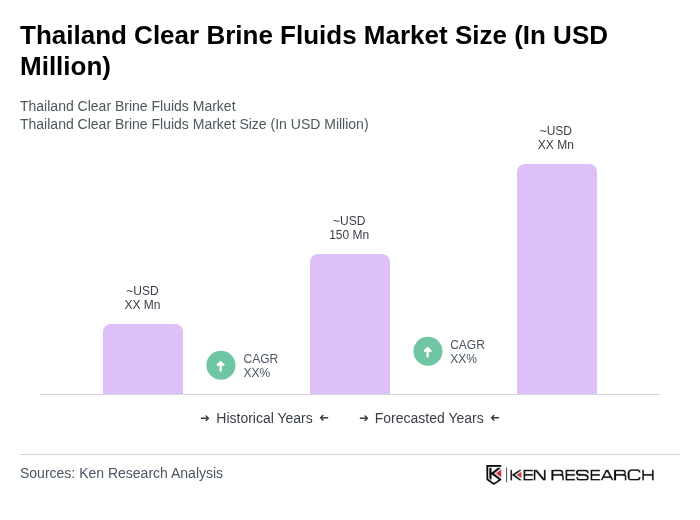

The Thailand Clear Brine Fluids Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This valuation is primarily driven by the increasing demand from the oil and gas industry for drilling and completion processes.