Region:Middle East

Author(s):Rebecca

Product Code:KRAE3384

Pages:100

Published On:February 2026

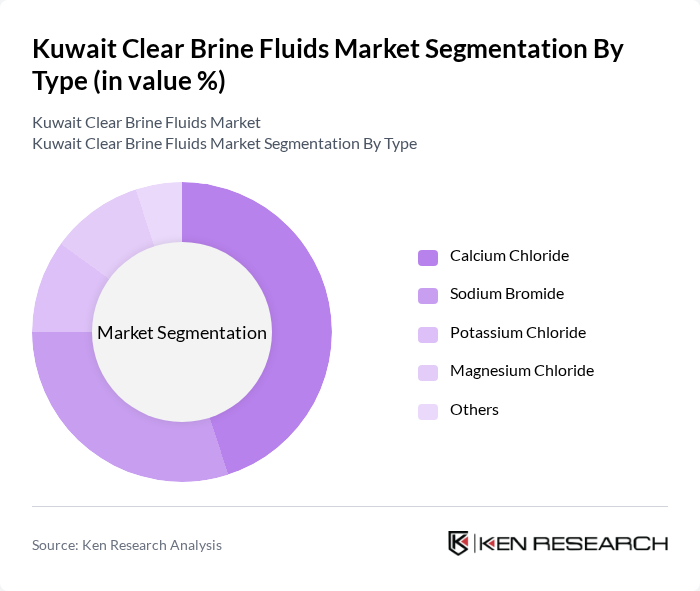

By Type:The clear brine fluids market can be segmented into various types, including Calcium Chloride, Sodium Bromide, Potassium Chloride, Magnesium Chloride, and Others. Among these, Calcium Chloride is the most widely used due to its effectiveness in high-density applications and its ability to prevent hydrate formation during drilling operations. The demand for Sodium Bromide is also significant, particularly in completion fluids, as it provides excellent thermal stability and is less corrosive compared to other types. The market is characterized by a growing preference for customized formulations that meet specific operational requirements.

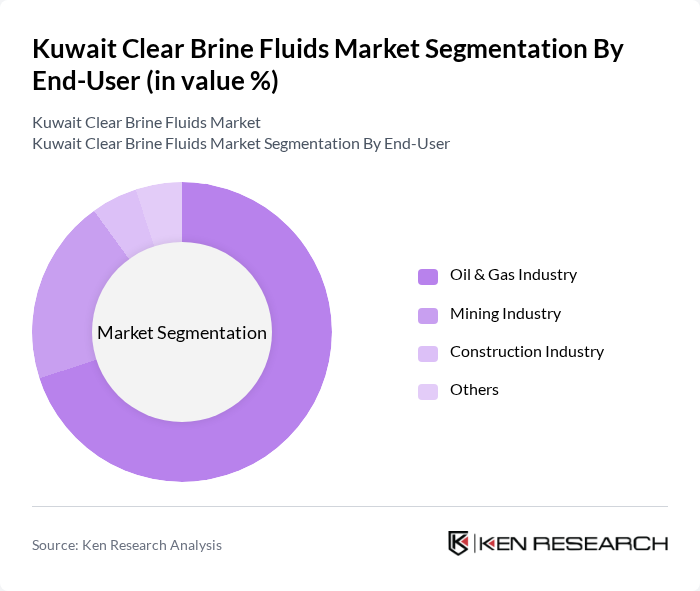

By End-User:The clear brine fluids market is primarily driven by the oil and gas industry, followed by the mining and construction sectors. The oil and gas industry is the largest end-user, utilizing clear brine fluids for drilling and completion processes. The mining industry also contributes significantly, as these fluids are essential for mineral extraction processes. The construction industry is emerging as a growing segment, where clear brine fluids are used for soil stabilization and dust control in construction sites.

The Kuwait Clear Brine Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schlumberger, Halliburton, Baker Hughes, Newpark Resources, Tetra Technologies, Weatherford International, Chemstream Holdings, DOW Chemical Company, Albemarle Corporation, KMG Chemicals, AECOM, National Oilwell Varco, Cargill, BASF, Solvay contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait clear brine fluids market appears promising, driven by ongoing technological advancements and a strong focus on sustainability. As the oil and gas sector continues to invest in innovative drilling solutions, the demand for high-performance brine fluids is expected to rise. Additionally, the increasing emphasis on eco-friendly practices will likely lead to the development of non-toxic brine formulations, aligning with global sustainability trends and enhancing market competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Calcium Chloride Sodium Bromide Potassium Chloride Magnesium Chloride Others |

| By End-User | Oil & Gas Industry Mining Industry Construction Industry Others |

| By Application | Drilling Fluids Completion Fluids Workover Fluids Others |

| By Region | Northern Kuwait Southern Kuwait Central Kuwait |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Product Formulation | Standard Formulations Customized Formulations Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oilfield Service Providers | 100 | Procurement Managers, Operations Directors |

| Drilling Contractors | 80 | Drilling Engineers, Project Managers |

| Chemical Suppliers | 70 | Sales Managers, Product Development Specialists |

| Regulatory Bodies | 50 | Policy Makers, Environmental Compliance Officers |

| Research Institutions | 60 | Research Scientists, Industry Analysts |

The Kuwait Clear Brine Fluids Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for clear brine fluids in oil and gas exploration and various industrial applications.