Region:Middle East

Author(s):Rebecca

Product Code:KRAE2872

Pages:86

Published On:February 2026

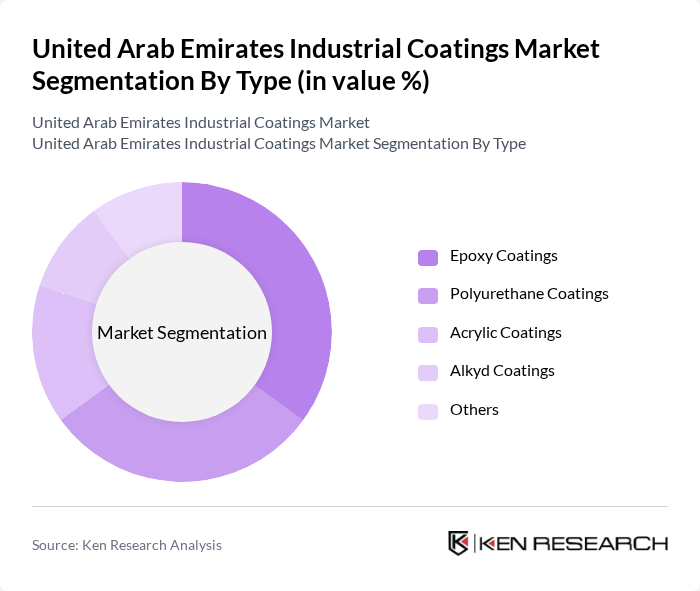

By Type:The market is segmented into various types of coatings, including Epoxy Coatings, Polyurethane Coatings, Acrylic Coatings, Alkyd Coatings, and Others. Each type serves distinct applications and industries, catering to specific performance characteristics and customer preferences.

Among these, Epoxy Coatings dominate the market due to their superior adhesion, chemical resistance, and durability, making them ideal for industrial applications. The construction and automotive sectors are significant consumers of epoxy coatings, driven by their need for long-lasting and protective finishes. The increasing focus on infrastructure development and maintenance further propels the demand for epoxy coatings, solidifying their leadership in the market.

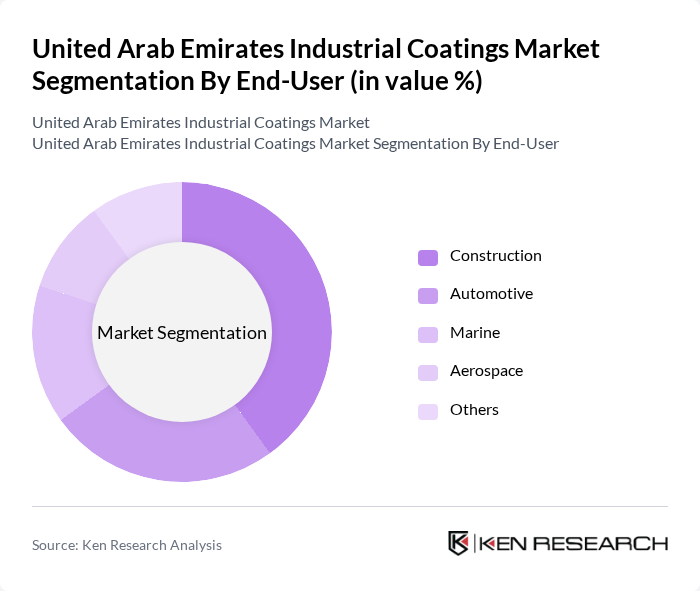

By End-User:The market is segmented based on end-users, including Construction, Automotive, Marine, Aerospace, and Others. Each segment has unique requirements and preferences, influencing the types of coatings utilized.

The Construction sector is the leading end-user, accounting for a significant portion of the market share. This dominance is attributed to the ongoing infrastructure projects and real estate developments in the UAE, which require high-performance coatings for protection against environmental factors. The automotive sector follows closely, driven by the demand for durable and aesthetically pleasing finishes in vehicles.

The United Arab Emirates Industrial Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jotun Group, AkzoNobel, PPG Industries, Sherwin-Williams, BASF Coatings, RPM International, Hempel A/S, Asian Paints, Berger Paints, Nippon Paint, Tikkurila, Valspar, Sika AG, DuPont, Covestro AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE industrial coatings market appears promising, driven by ongoing investments in infrastructure and technological advancements. As the construction sector continues to expand, the demand for innovative and sustainable coatings will rise. Additionally, the increasing focus on eco-friendly products will likely lead to the development of new formulations that meet regulatory standards. Companies that adapt to these trends and invest in R&D will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Coatings Polyurethane Coatings Acrylic Coatings Alkyd Coatings Others |

| By End-User | Construction Automotive Marine Aerospace Others |

| By Application | Protective Coatings Decorative Coatings Industrial Coatings Specialty Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Performance Characteristics | Corrosion Resistance Chemical Resistance Temperature Resistance Aesthetic Qualities Others |

| By Technology | Conventional Coating Technology Advanced Coating Technology Nano Coating Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Coatings | 150 | Project Managers, Procurement Officers |

| Automotive Coatings | 100 | Production Managers, Quality Control Supervisors |

| Aerospace Coatings | 80 | Engineering Managers, Compliance Officers |

| Marine Coatings | 70 | Fleet Managers, Maintenance Supervisors |

| Industrial Equipment Coatings | 90 | Operations Managers, Technical Directors |

The United Arab Emirates Industrial Coatings Market is valued at approximately USD 1.2 billion, driven by growth in the construction and automotive sectors, as well as increasing demand for protective coatings across various industries.