Region:Asia

Author(s):Rebecca

Product Code:KRAB2276

Pages:97

Published On:January 2026

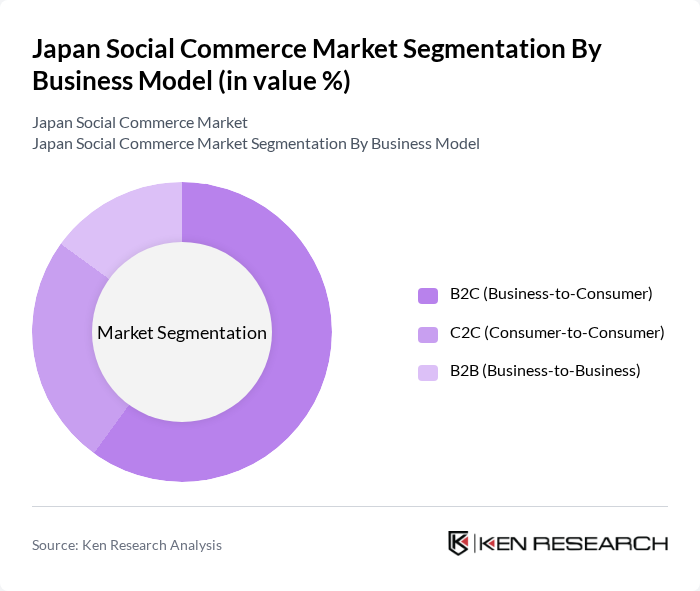

By Business Model:

The business model segmentation of the Japan Social Commerce Market includes B2C (Business-to-Consumer), C2C (Consumer-to-Consumer), and B2B (Business-to-Business). Among these, the B2C model is the most dominant, driven by the increasing number of brands, retailers, and direct-to-consumer players leveraging social media platforms and live-streaming features to reach consumers directly, consistent with the broader role of Japan as a key social commerce market within Asia Pacific. The convenience of online shopping, integration with cashless payment options, and the ability to engage with brands through social media have made B2C a preferred choice for consumers. C2C is also gaining traction, particularly among younger demographics who prefer peer-to-peer transactions via marketplace and flea-market style apps, while B2B is growing as businesses recognize the potential of social platforms and digital communities for networking, lead generation, and sales of professional services and solutions.

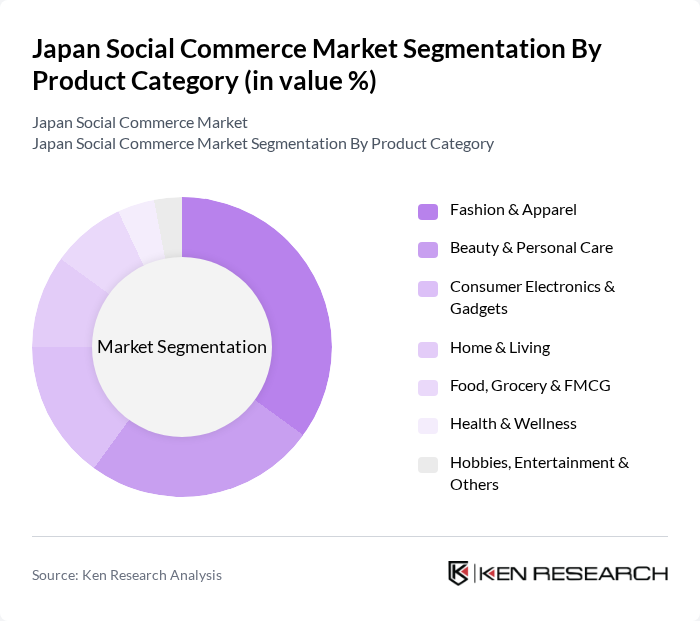

By Product Category:

The product category segmentation includes Fashion & Apparel, Beauty & Personal Care, Consumer Electronics & Gadgets, Home & Living, Food, Grocery & FMCG, Health & Wellness, and Hobbies, Entertainment & Others. Fashion & Apparel leads the market, driven by the popularity of online shopping among consumers who seek the latest trends and styles, and by the prominence of fashion as the top social commerce category globally and across Asia Pacific. Beauty & Personal Care follows closely, as social media influencers and live-stream commerce heavily promote skincare, cosmetics, and personal care products. Consumer Electronics & Gadgets also see significant sales, particularly among tech-savvy consumers that adopt new devices and accessories via digital channels. Other categories like Food, Grocery & FMCG are growing as convenience, quick commerce options, and integration of grocery and daily necessities into social and digital commerce become a priority for consumers, while Health & Wellness and Hobbies, Entertainment & Others benefit from lifestyle-focused content and community-based recommendations.

The Japan Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rakuten Group, Inc., LY Corporation (LINE & Yahoo! Japan), ZOZO, Inc., Mercari, Inc., DMM.com LLC, BASE, Inc., PayPay Corporation, Kakaku.com, Inc., CyberAgent, Inc. (Ameba), Instagram (Meta Platforms, Inc.), Facebook (Meta Platforms, Inc.), X Corp. (X Japan, formerly Twitter Japan), TikTok (ByteDance Ltd., Japan Operations), Shopify Japan K.K., Other Emerging Social Commerce Platforms contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's social commerce market appears promising, driven by technological advancements and evolving consumer preferences. As mobile usage continues to rise, businesses are expected to enhance their digital strategies, focusing on personalized shopping experiences. The integration of AI and machine learning will likely play a pivotal role in optimizing customer interactions. Furthermore, the increasing demand for sustainable and ethical products will shape marketing strategies, compelling brands to align with consumer values and preferences in their offerings.

| Segment | Sub-Segments |

|---|---|

| By Business Model | B2C (Business-to-Consumer) C2C (Consumer-to-Consumer) B2B (Business-to-Business) |

| By Product Category | Fashion & Apparel Beauty & Personal Care Consumer Electronics & Gadgets Home & Living Food, Grocery & FMCG Health & Wellness Hobbies, Entertainment & Others |

| By Buyer Demographics | Gen Z (10–24 Years) Millennials (25–40 Years) Gen X (41–56 Years) + Years |

| By Purchase Journey Influence Model | Recommendation / Review-Driven Influencer / KOL-Driven Live Commerce Social Ads & Shoppable Posts |

| By Payment Method | Credit/Debit Cards Mobile Wallets & QR Payments Bank Transfers Buy Now Pay Later (BNPL) Others |

| By Social / Digital Platform | LINE & LINE Shopping TikTok X (formerly Twitter) Other Platforms (YouTube, Pinterest, etc.) |

| By Seller Type | Large Enterprises & Brands SMEs & D2C Brands Individual Sellers & Creators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Marketing Strategies | 120 | Marketing Managers, Digital Strategists |

| Consumer Engagement in Social Commerce | 110 | Social Media Users, Brand Followers |

| SME Participation in Social Commerce | 100 | Business Owners, E-commerce Managers |

| Influencer Marketing Impact | 80 | Influencers, Brand Collaborators |

| Trends in Mobile Commerce | 90 | Mobile App Users, Tech-savvy Consumers |

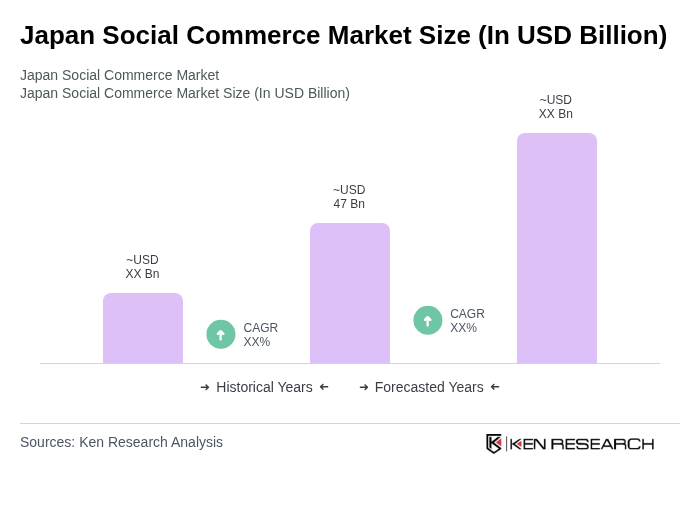

The Japan Social Commerce Market is valued at approximately USD 47 billion, with recent assessments indicating revenue generation of around 47,442 million in a recent year. This growth is attributed to increased smartphone penetration and the popularity of social media platforms.