Region:Asia

Author(s):Rebecca

Product Code:KRAB2275

Pages:99

Published On:January 2026

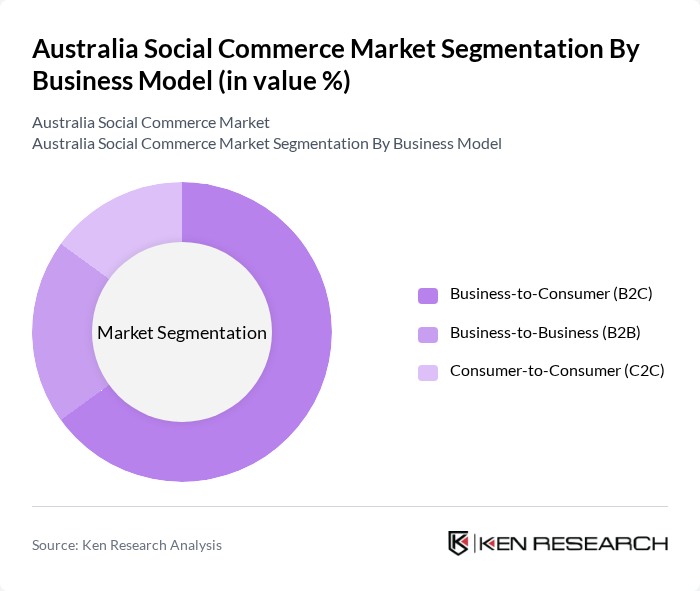

By Business Model:

The Australia Social Commerce Market is segmented into three primary business models: Business-to-Consumer (B2C), Business-to-Business (B2B), and Consumer-to-Consumer (C2C). Among these, the B2C segment is the most dominant, consistent with global patterns where B2C accounts for close to two?thirds of social commerce revenues, driven by direct consumer engagement on social platforms. The increasing number of consumers shopping directly from brands via social media storefronts, integrated checkout, and live shopping features, combined with targeted advertising, creator? and influencer?led campaigns, and user?generated content, has significantly boosted consumer engagement and sales in this segment.

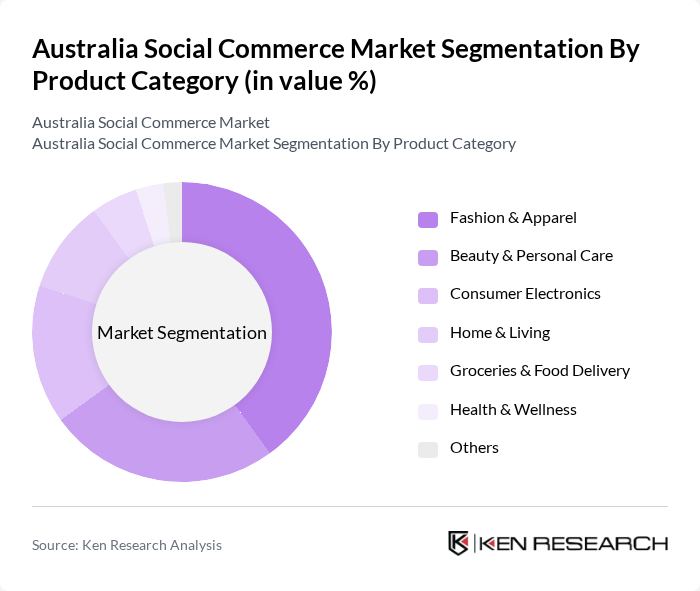

By Product Category:

The market is also segmented by product categories, including Fashion & Apparel, Beauty & Personal Care, Consumer Electronics, Home & Living, Groceries & Food Delivery, Health & Wellness, and Others. The Fashion & Apparel category leads the market, in line with global trends where fashion accounts for the largest share of social commerce spending, supported by trend?driven purchases and high visual engagement. This leadership is fueled by the popularity of influencer marketing, creator?driven styling content, and the visual nature of social media platforms, which effectively showcase products through photos, short?form video, and live streams to drive discovery, social proof, and conversion.

The Australia Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Meta Platforms, Inc. (Facebook & Instagram), TikTok (ByteDance Ltd.), Pinterest, Inc., Snapchat Inc., Shopify Inc., Amazon Australia, eBay Australia, Kogan.com, Catch.com.au, The Iconic, Adore Beauty, Pet Circle, Afterpay, Zip Co, Canva contribute to innovation, geographic expansion, and service delivery in this space through social storefronts, in?app checkout, integrated advertising, and creator?commerce partnerships.

The future of social commerce in Australia appears promising, driven by technological advancements and evolving consumer preferences. As mobile usage continues to rise, brands will increasingly adopt innovative strategies, such as augmented reality and live shopping events, to enhance customer engagement. Additionally, the focus on sustainability and ethical practices will shape consumer expectations, compelling businesses to adapt. Overall, the integration of social media and e-commerce will likely redefine the shopping experience, fostering a more interactive and personalized environment for consumers.

| Segment | Sub-Segments |

|---|---|

| By Business Model | Business-to-Consumer (B2C) Business-to-Business (B2B) Consumer-to-Consumer (C2C) |

| By Product Category | Fashion & Apparel Beauty & Personal Care Consumer Electronics Home & Living Groceries & Food Delivery Health & Wellness Others |

| By Social Commerce Format | In-app Social Shopping (Shoppable Posts & Stores) Live Commerce / Live Streaming Group Buying & Social Deals Influencer-led Storefronts & Affiliate Links Community & Group-based Marketplaces |

| By Platform Type | Social Networks (Facebook, Instagram, Snapchat, Others) Short-form Video Platforms (TikTok, YouTube Shorts, Others) Visual Discovery Platforms (Pinterest, Others) Messaging & Community Platforms (WhatsApp, Messenger, Discord, Others) |

| By Transaction Type | Direct Platform Checkout Redirect-to-Website / App In-app Messaging & Conversational Commerce |

| By Payment Method | Credit/Debit Cards Digital Wallets (Apple Pay, Google Pay, PayPal, Others) Buy Now Pay Later (BNPL) Services Bank Transfers Others |

| By Buyer Demographics | Gen Z Millennials Gen X Baby Boomers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Engagement in Social Commerce | 150 | Active Social Media Users, Online Shoppers |

| Small Business Utilization of Social Platforms | 100 | Small Business Owners, Marketing Managers |

| Influencer Marketing Impact | 80 | Social Media Influencers, Brand Managers |

| Trends in Social Media Advertising | 120 | Digital Marketing Specialists, Advertising Executives |

| Consumer Preferences in Online Shopping | 140 | General Consumers, E-commerce Enthusiasts |

The Australia Social Commerce Market is valued at approximately AUD 27.7 billion, driven by the increasing use of social media platforms, mobile commerce growth, and evolving consumer behaviors favoring online shopping integrated with social interactions.