Region:Middle East

Author(s):Rebecca

Product Code:KRAB2272

Pages:92

Published On:January 2026

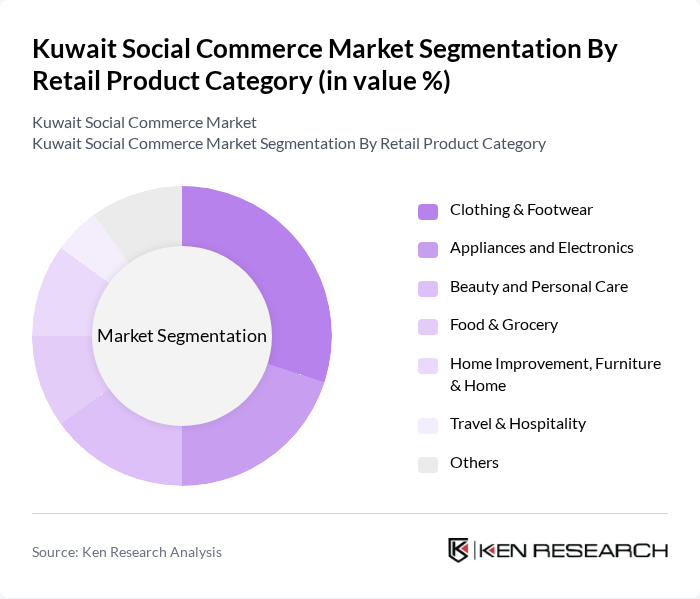

By Retail Product Category:The retail product categories in the social commerce market include Clothing & Footwear, Appliances and Electronics, Beauty and Personal Care, Food & Grocery, Home Improvement, Furniture & Home, Travel & Hospitality, and Others. Among these, Clothing & Footwear is the leading segment, supported by strong online fashion and apparel demand across Kuwait’s broader e-commerce market and the heavy use of Instagram, Snapchat, and TikTok for fashion discovery, brand storytelling, and influencer partnerships. The convenience of purchasing apparel through social platforms, coupled with highly targeted advertising, live shopping formats, and user-generated content such as outfit-of-the-day posts and reviews, has significantly boosted sales in this category.

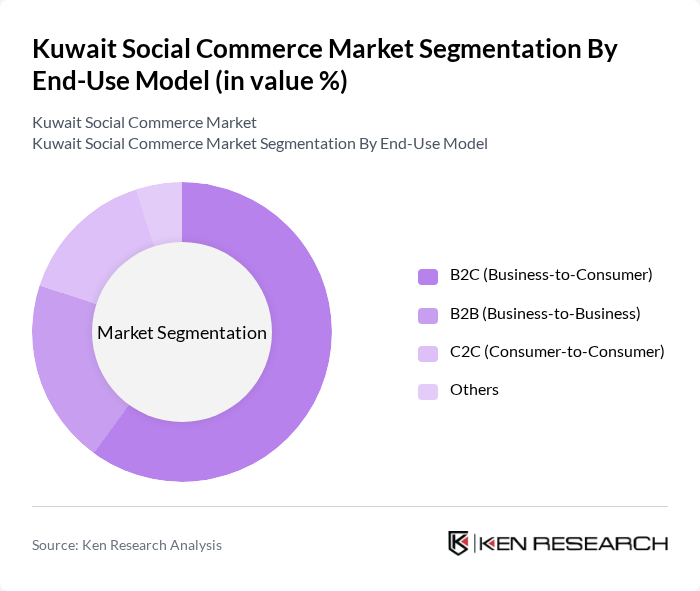

By End-Use Model:The end-use models in the social commerce market include B2C (Business-to-Consumer), B2B (Business-to-Business), C2C (Consumer-to-Consumer), and Others. The B2C model dominates the market, mirroring the broader Kuwait e-commerce structure where consumer-facing transactions account for the majority of online revenues. This model allows businesses to directly engage with consumers through social media platforms using shoppable posts, live commerce, in-app checkout, and integrated payment solutions, and it benefits from the growing trend of personalized marketing, data-driven retargeting, and direct interaction via chats and social messaging, which enhances customer loyalty and increases sales.

The Kuwait Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Talabat, Carriage, Deliveroo, Ounass, Xcite by Alghanim Electronics, Amazon (including legacy Souq.com), Namshi, Jarir Bookstore, Lulu Hypermarket, Alshaya Group, Centrepoint / Landmark Group, Boutiqaat, Zain Kuwait, stc Kuwait, Ooredoo Kuwait, KNET, MyFatoorah, Tap Payments contribute to innovation, geographic expansion, and service delivery in this space.

The future of the social commerce market in Kuwait appears promising, driven by technological advancements and changing consumer preferences. As digital literacy improves, more consumers are expected to embrace online shopping, particularly through social media platforms. The integration of innovative technologies, such as artificial intelligence and machine learning, will enhance personalized shopping experiences. Additionally, the growing emphasis on sustainability will likely influence purchasing decisions, prompting brands to adopt eco-friendly practices to attract conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Retail Product Category | Clothing & Footwear Appliances and Electronics Beauty and Personal Care Food & Grocery Home Improvement, Furniture & Home Travel & Hospitality Others |

| By End-Use Model | B2C (Business-to-Consumer) B2B (Business-to-Business) C2C (Consumer-to-Consumer) Others |

| By Consumer Demographics | Age Groups (Gen Z, Millennials, Gen X, 60+) Gender Income Levels Urban vs Non-Urban Others |

| By Device Type | Mobile Desktop Tablet Others |

| By Social Commerce Format | Video Commerce (Short-form & Live) Social Network-led Commerce Social Reselling Group Buying & Deal Communities Product Review & Recommendation Platforms Others |

| By Social Media / Messaging Platform | Snapchat TikTok WhatsApp and Messaging Apps Others |

| By Monetization & Marketing Strategy | Influencer & Creator-led Commerce Brand-owned Social Stores Social Ads with In-app Checkout Affiliate & Social Reseller Networks Loyalty, Membership & Subscription Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Behavior in Social Commerce | 120 | Online Shoppers, Social Media Users |

| Small Business Utilization of Social Platforms | 90 | Small Business Owners, Marketing Managers |

| Influencer Marketing Impact | 70 | Social Media Influencers, Brand Managers |

| Trends in Digital Payment Methods | 60 | Finance Managers, E-commerce Executives |

| Consumer Trust and Security Concerns | 80 | General Consumers, Cybersecurity Experts |

The Kuwait Social Commerce Market is valued at approximately USD 1.0 billion, driven by the increasing use of social media platforms, mobile commerce, and changing consumer behaviors favoring online shopping.