Region:Asia

Author(s):Rebecca

Product Code:KRAB2271

Pages:84

Published On:January 2026

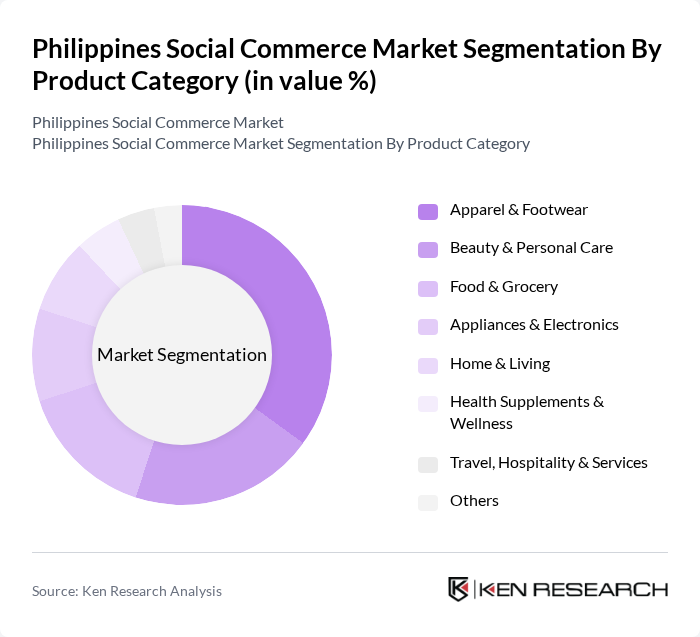

By Product Category:The product category segmentation of the Philippines Social Commerce Market includes various subsegments such as Apparel & Footwear, Beauty & Personal Care, Food & Grocery, Appliances & Electronics, Home & Living, Health Supplements & Wellness, Travel, Hospitality & Services, and Others. Among these, the Apparel & Footwear segment is currently dominating the market due to the rising fashion consciousness among consumers and the influence of social media trends. The convenience of online shopping for clothing and accessories has led to increased consumer spending in this category.

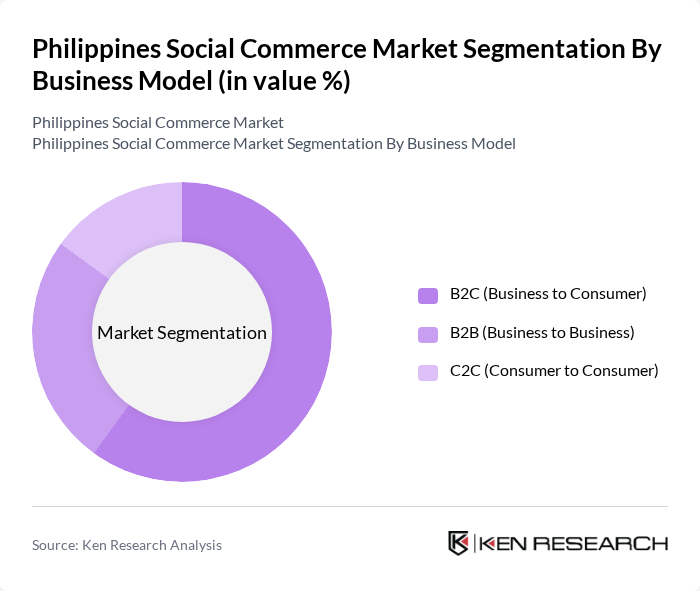

By Business Model:The business model segmentation includes B2C (Business to Consumer), B2B (Business to Business), and C2C (Consumer to Consumer). The B2C model is leading the market, driven by the increasing number of online retailers and brands leveraging social media platforms to reach consumers directly. This model allows for personalized marketing strategies and direct engagement with customers, enhancing the shopping experience.

The Philippines Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lazada Philippines, Shopee Philippines, Zalora Philippines, Facebook Marketplace, Instagram Shopping, TikTok Shop Philippines, GrabMart Philippines, GCash, Maya (formerly PayMaya), Carousell Philippines, Kumu, foodpanda Philippines, Lalamove Philippines, UnionBank of the Philippines, Metropolitan Bank & Trust Company (Metrobank) contribute to innovation, geographic expansion, and service delivery in this space.

The future of social commerce in the Philippines appears promising, driven by technological advancements and evolving consumer preferences. As digital payment solutions become more accessible, the market is likely to witness increased transaction volumes. Additionally, the integration of augmented reality (AR) and virtual reality (VR) technologies into shopping experiences is expected to enhance consumer engagement. These trends, coupled with the growing influence of local influencers, will likely shape the landscape, fostering innovation and expanding market reach in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Apparel & Footwear Beauty & Personal Care Food & Grocery Appliances & Electronics Home & Living Health Supplements & Wellness Travel, Hospitality & Services Others |

| By Business Model | B2C (Business to Consumer) B2B (Business to Business) C2C (Consumer to Consumer) |

| By Device Type | Mobile Desktop/Laptop |

| By Platform Format | Video Commerce (Live & Short-Video) Social Network–Led Commerce Social Reselling Group Buying & Deal Platforms Product Review & Recommendation Platforms |

| By Payment Method | Credit Card Debit Card Bank Transfer Prepaid Card Digital & Mobile Wallets Other Digital Payments Cash |

| By Location of Transaction | Domestic Cross-border |

| By City Tier | Tier-1 Cities Tier-2 Cities Tier-3 Cities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Engagement in Social Commerce | 120 | Active Social Media Users, Online Shoppers |

| SME Participation in Social Commerce | 100 | Business Owners, Marketing Managers |

| Influencer Marketing Impact | 80 | Social Media Influencers, Brand Collaborators |

| Consumer Trust and Security Concerns | 100 | Online Shoppers, Digital Payment Users |

| Trends in Social Media Advertising | 90 | Digital Marketers, Advertising Executives |

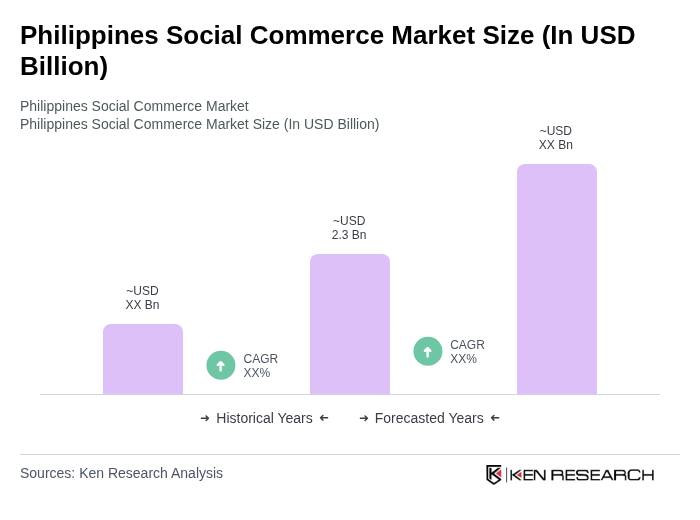

The Philippines Social Commerce Market is valued at approximately USD 2.3 billion, driven by the increasing smartphone penetration and social media usage, which facilitate seamless online shopping experiences for consumers across the country.