Region:Middle East

Author(s):Rebecca

Product Code:KRAB2274

Pages:94

Published On:January 2026

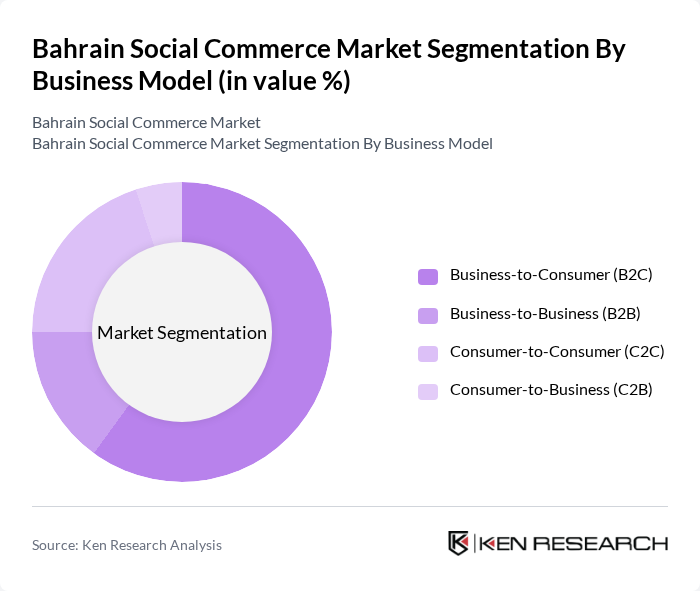

By Business Model:

The business model segmentation of the Bahrain Social Commerce Market includes four key subsegments: Business-to-Consumer (B2C), Business-to-Business (B2B), Consumer-to-Consumer (C2C), and Consumer-to-Business (C2B). B2C is the most dominant model, consistent with the broader Bahrain e?commerce market where consumer transactions account for the majority of online sales. This dominance is driven by the increasing number of consumers shopping online through social media platforms, the convenience of direct purchasing from brands, and the influence of social media advertising and influencer content. C2C is also gaining traction, particularly among younger demographics who prefer peer-to-peer transactions facilitated by platforms such as Instagram, Snapchat, and WhatsApp groups, enabling resale, micro?entrepreneurship, and home?based businesses.

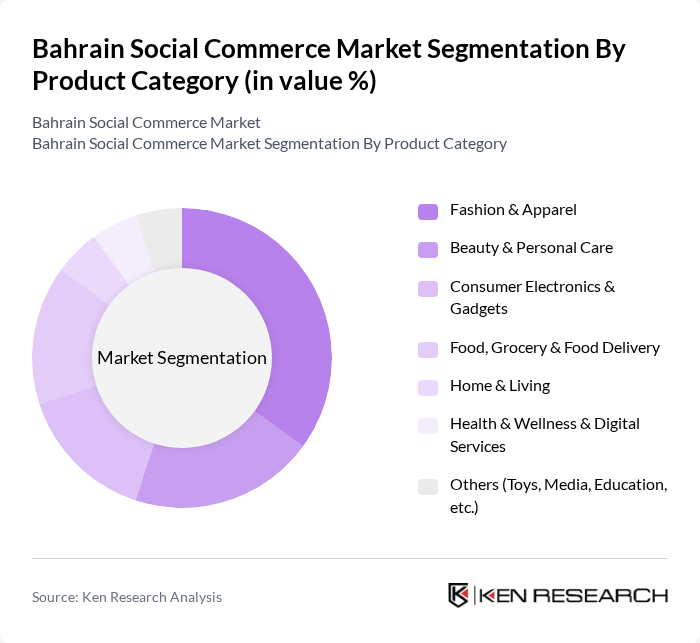

By Product Category:

The product category segmentation includes Fashion & Apparel, Beauty & Personal Care, Consumer Electronics & Gadgets, Food, Grocery & Food Delivery, Home & Living, Health & Wellness & Digital Services, and Others. The Fashion & Apparel segment leads the market, aligned with broader e?commerce patterns in Bahrain where fashion is a key online category and is heavily promoted via influencers and visual platforms. Consumers are increasingly drawn to fashion items showcased by influencers, local designers, and global brands on Instagram and Snapchat, leading to higher engagement and conversion in this category. The Food and Grocery segment is also growing rapidly, supported by strong adoption of food delivery and quick?commerce apps such as Talabat and other aggregators, which rely on social media campaigns and in?app social features to drive repeat purchases.

The Bahrain Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Talabat, Noon, Amazon (including Amazon.sa cross-border), Carrefour Bahrain (Majid Al Futtaim Retail), Lulu Hypermarket Bahrain, Namshi, Ounass, Mumzworld, Dukakeen, Awal Shop / local Instagram-native sellers, Zain Bahrain (digital & fintech platforms), STC Bahrain, Local Influencer-led Brands & Creator Stores, Cross-border GCC Platforms (e.g., Shein, Fordeal), Payment & Enabler Ecosystem Players (e.g., BenefitPay, Tap Payments) contribute to innovation, geographic expansion, and service delivery in this space.

The future of social commerce in Bahrain appears promising, driven by technological advancements and evolving consumer preferences. As digital literacy initiatives gain traction, more consumers are expected to engage with online platforms confidently. Additionally, the integration of advanced technologies like artificial intelligence and machine learning will enhance personalized shopping experiences, making social commerce more appealing. The collaboration between local brands and influencers is likely to strengthen market presence, fostering a vibrant ecosystem that supports sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Business Model | Business-to-Consumer (B2C) Business-to-Business (B2B) Consumer-to-Consumer (C2C) Consumer-to-Business (C2B) |

| By Product Category | Fashion & Apparel Beauty & Personal Care Consumer Electronics & Gadgets Food, Grocery & Food Delivery Home & Living Health & Wellness & Digital Services Others (Toys, Media, Education, etc.) |

| By Buyer Type | Individual Consumers Micro & Small Businesses Medium & Large Enterprises |

| By Social Platform / Channel | Instagram & Instagram Shops Facebook & Facebook Shops TikTok & TikTok Shop Snapchat & Other Visual Platforms WhatsApp, Telegram & Messaging Commerce |

| By Transaction & Payment Method | Card Payments (Credit/Debit) Mobile Wallets & BNPL Bank Transfers Cash on Delivery Other Digital Payments |

| By Selling Format | Influencer-led Stores & Creator Commerce Brand-owned Social Stores Marketplace Storefronts via Social Live-stream & Video Commerce Group Buying & Community Deals |

| By Customer Engagement Type | Shoppable Posts & Stories Live Streaming & Real-time Events Social Communities & Groups Social Messaging & Chat Commerce User-Generated Content & Reviews |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Behavior in Social Commerce | 150 | Online Shoppers, Social Media Users |

| Small Business Utilization of Social Platforms | 120 | Small Business Owners, Marketing Managers |

| Impact of Influencer Marketing | 90 | Influencers, Brand Managers |

| Trends in Social Media Advertising | 80 | Digital Marketing Professionals, Ad Agency Executives |

| Consumer Trust and Security Concerns | 100 | General Consumers, Cybersecurity Experts |

The Bahrain Social Commerce Market is valued at approximately USD 1.25 billion, reflecting significant growth driven by increased smartphone usage, social media engagement, and changing consumer behaviors favoring online shopping.