Region:Middle East

Author(s):Rebecca

Product Code:KRAB2273

Pages:90

Published On:January 2026

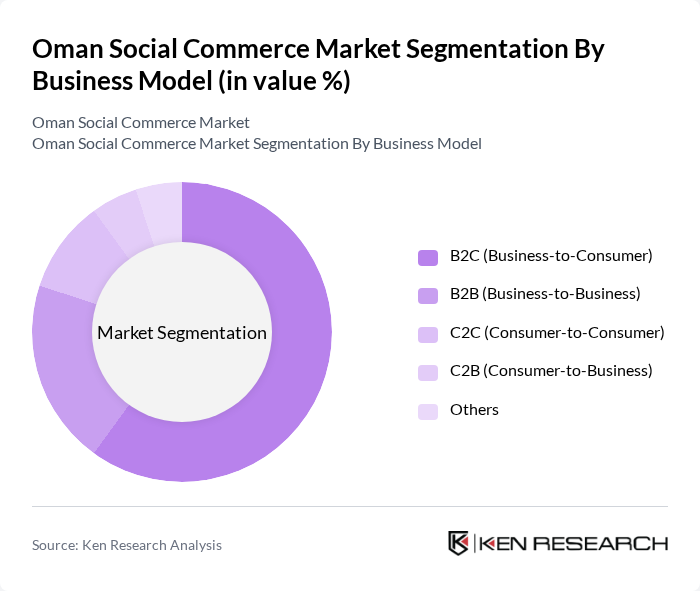

By Business Model:The business model segmentation of the Oman Social Commerce Market includes various approaches through which transactions are conducted. The B2C (Business-to-Consumer) model is the most prevalent, as it allows retailers, food-delivery platforms, and service providers to sell directly to consumers via social media storefronts, shoppable posts, and chat?based ordering. The B2B (Business-to-Business) model is also gaining traction, particularly among wholesalers, distributors, and suppliers that use social platforms and messaging apps for lead generation, catalog sharing, and order management. C2C (Consumer-to-Consumer) platforms are popular for peer-to-peer sales of second-hand goods, niche products, and home?based businesses using Instagram, WhatsApp and local classifieds. C2B (Consumer-to-Business) is emerging as consumers and creators offer content, feedback, and custom products or services to businesses, often monetized through collaborations and affiliate programs. Other models include hybrid approaches that combine elements of these categories, such as marketplaces and influencers who simultaneously enable B2C and C2C transactions.

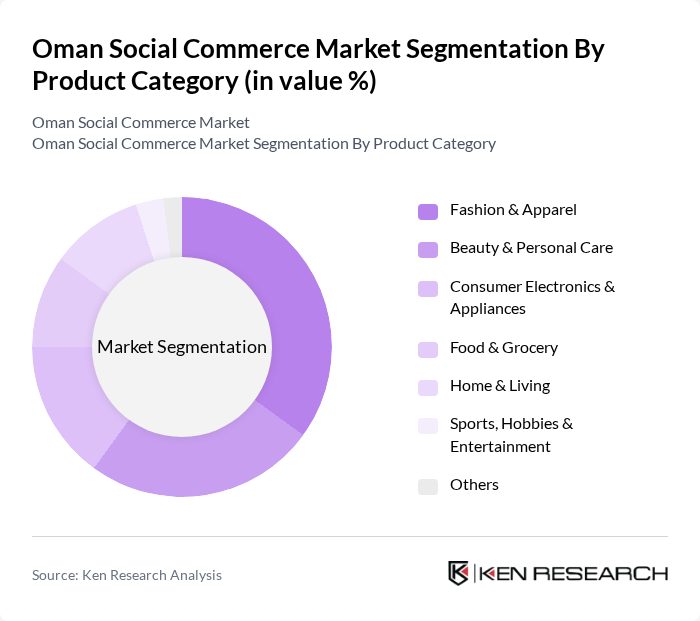

By Product Category:The product category segmentation highlights the diverse range of goods sold through social commerce platforms in Oman. Fashion & Apparel leads the market, driven by the popularity of online shopping for clothing, modest wear, and accessories promoted heavily via Instagram and Snapchat. Beauty & Personal Care products are also significant, reflecting consumer interest in personal grooming and the strong role of beauty influencers and salons using social media for promotion and booking. Consumer Electronics & Appliances are increasingly being purchased online and via social channels, supported by trusted retail brands and marketplaces that advertise deals and launches on social media. Food & Grocery sales are growing as consumers seek convenience through social-media?integrated food?delivery platforms and local grocery sellers taking orders through messaging apps. Home & Living products, along with Sports, Hobbies & Entertainment items, are also gaining traction, catering to various consumer needs including home décor, fitness products, and games promoted through local influencers and community groups.

The Oman Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omantel, Ooredoo Oman, Talabat Oman, Amazon (formerly Souq.com), Noon, LuLu Hypermarket Oman, Carrefour Oman (Majid Al Futtaim Retail), Thawani Pay, Bank Muscat, National Bank of Oman, Muscat Media Group, Asyad Group, Oman Oil Marketing Company, Omantel Digital / ICT Solutions, Key Local Influencer & SME Social Commerce Brands (Representative Sample) contribute to innovation, geographic expansion, and service delivery in this space.

The future of social commerce in Oman appears promising, driven by technological advancements and changing consumer behaviors. As smartphone penetration continues to rise and digital payment solutions become more accessible, the market is likely to witness increased engagement. Additionally, the integration of innovative technologies such as augmented reality will enhance the shopping experience, making it more interactive. Brands that prioritize consumer trust and invest in localized marketing strategies will be well-positioned to capitalize on these emerging trends and drive growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Business Model | B2C (Business-to-Consumer) B2B (Business-to-Business) C2C (Consumer-to-Consumer) C2B (Consumer-to-Business) Others |

| By Product Category | Fashion & Apparel Beauty & Personal Care Consumer Electronics & Appliances Food & Grocery Home & Living Sports, Hobbies & Entertainment Others |

| By Demographics | Age Groups (18-24, 25-34, 35-44, 45+) Gender Income Levels Urban vs Rural Others |

| By Payment Method | Credit/Debit Cards Mobile Wallets Bank Transfers Cash on Delivery Buy Now Pay Later (BNPL) Others |

| By Social Commerce Format | Social Network–Led Stores (e.g., Instagram Shop, Facebook Shop) Live Commerce / Live Shopping Social Reselling & Group Buying Influencer-Driven Stores Messaging & Chat Commerce (e.g., WhatsApp, Messenger) Others |

| By Device | Mobile Desktop / Laptop Tablet Others |

| By Buyer Type | Individual Consumers Micro & Small Businesses Medium & Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Behavior in Social Commerce | 120 | Online Shoppers, Social Media Users |

| Small Business Engagement in Social Commerce | 100 | Small Business Owners, Marketing Managers |

| Influencer Marketing Effectiveness | 80 | Social Media Influencers, Brand Managers |

| Platform-Specific User Experience | 60 | Frequent Users of Social Commerce Platforms |

| Trends in Digital Payment Adoption | 90 | Consumers Using Digital Payment Methods |

The Oman Social Commerce Market is valued at approximately USD 700 million, reflecting a significant growth trend driven by increased smartphone penetration, internet connectivity, and the rising popularity of social media as a shopping channel.