Thailand Transportation Management Systems Market Overview

- The Thailand Transportation Management Systems market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for efficient logistics and transportation solutions, coupled with the rapid urbanization and infrastructure development in the region. The integration of advanced technologies such as IoT and AI in transportation management systems has further propelled market growth, enhancing operational efficiency and reducing costs.

- Key cities such as Bangkok, Chiang Mai, and Pattaya dominate the market due to their significant economic activities and high population density. Bangkok, being the capital, serves as a major hub for logistics and transportation, attracting investments in smart transportation solutions. The growing tourism sector in Chiang Mai and Pattaya also contributes to the demand for efficient transportation management systems, making these cities pivotal in the market landscape.

- In 2023, the Thai government implemented the "Smart Transport System" initiative, aimed at modernizing the country's transportation infrastructure. This initiative includes a budget allocation of USD 300 million for the development of intelligent transportation systems (ITS) that enhance traffic management, reduce congestion, and improve public transport services. The regulation emphasizes the adoption of technology-driven solutions to create a more sustainable and efficient transportation ecosystem.

Thailand Transportation Management Systems Market Segmentation

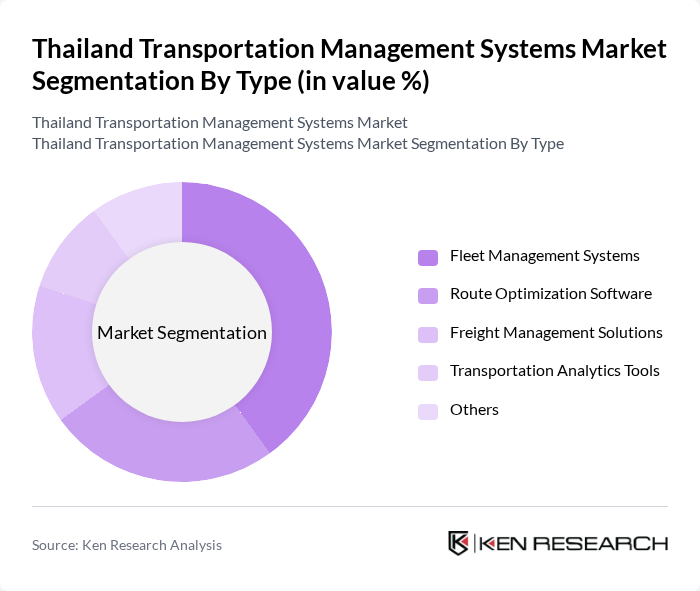

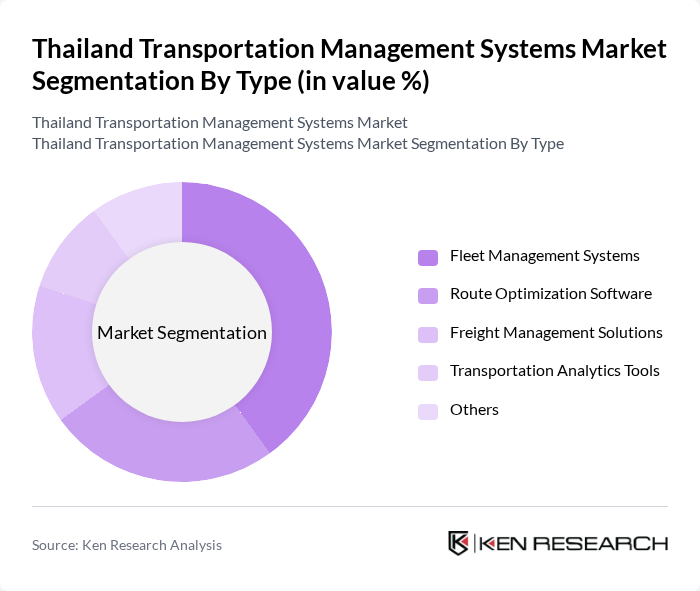

By Type:The market is segmented into various types, including Fleet Management Systems, Route Optimization Software, Freight Management Solutions, Transportation Analytics Tools, and Others. Fleet Management Systems are currently leading the market due to their ability to enhance operational efficiency, reduce costs, and improve vehicle utilization. The increasing focus on real-time tracking and monitoring of fleets has driven the adoption of these systems across various industries, making them a preferred choice for businesses looking to optimize their transportation operations.

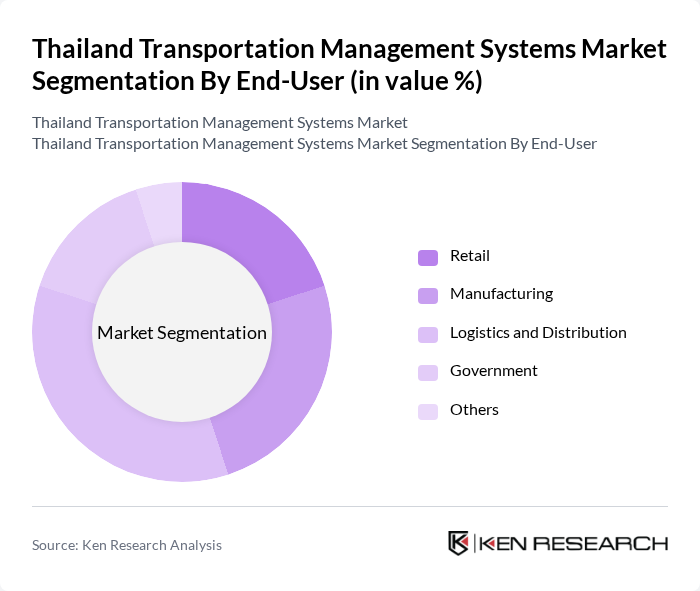

By End-User:The end-user segmentation includes Retail, Manufacturing, Logistics and Distribution, Government, and Others. The Logistics and Distribution sector is the dominant segment, driven by the increasing need for efficient supply chain management and the rise of e-commerce. Companies in this sector are increasingly adopting transportation management systems to streamline their operations, improve delivery times, and enhance customer satisfaction, making it a critical area for market growth.

Thailand Transportation Management Systems Market Competitive Landscape

The Thailand Transportation Management Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, JDA Software Group, Inc., Manhattan Associates, Inc., Descartes Systems Group Inc., Trimble Inc., C.H. Robinson Worldwide, Inc., TMW Systems, Inc., Kuebix, a Trimble Company, Cerasis, Inc., Freightview, LLC, Project44, Inc., FourKites, Inc., Locus.sh, and Transporeon Group contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Transportation Management Systems Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Thailand's urban population is projected to reach 50 million in the near future, up from 48 million in 2020, according to the World Bank. This rapid urbanization drives the need for efficient transportation management systems (TMS) to handle increased traffic and logistics demands. The urbanization rate is expected to rise to 75% in the near future, necessitating advanced TMS solutions to optimize urban mobility and logistics operations, thereby enhancing overall efficiency in transportation networks.

- Government Investment in Infrastructure:The Thai government allocated approximately $50 billion for infrastructure development in the near future, focusing on transportation networks. This investment aims to improve road, rail, and port facilities, which are crucial for TMS adoption. Enhanced infrastructure will facilitate smoother logistics operations, reduce transit times, and lower costs, thereby driving the demand for sophisticated transportation management systems that can integrate with these new developments and optimize resource allocation.

- Rising Demand for Efficient Logistics Solutions:The logistics sector in Thailand is expected to grow to $30 billion in the near future, driven by the booming e-commerce market. With online retail sales projected to reach $10 billion, businesses are increasingly seeking efficient logistics solutions to meet consumer demands. This surge in demand for logistics efficiency propels the adoption of TMS, which can streamline operations, enhance delivery speed, and improve customer satisfaction, making them essential for competitive advantage.

Market Challenges

- High Initial Investment Costs:The implementation of advanced transportation management systems often requires significant upfront investment, estimated at around $1 million for mid-sized companies. This financial barrier can deter smaller businesses from adopting TMS, limiting market growth. Additionally, ongoing maintenance and software updates can further strain budgets, making it challenging for companies to justify the initial costs against potential long-term savings and efficiency gains.

- Lack of Skilled Workforce:The transportation sector in Thailand faces a shortage of skilled professionals, with an estimated 30% of logistics companies reporting difficulties in finding qualified personnel. This skills gap hampers the effective implementation and utilization of TMS, as companies struggle to train existing staff or attract new talent. The lack of expertise can lead to underutilization of TMS capabilities, ultimately affecting operational efficiency and competitiveness in the market.

Thailand Transportation Management Systems Market Future Outlook

The future of Thailand's transportation management systems market appears promising, driven by technological advancements and increasing demand for efficiency. As urbanization continues, the integration of smart technologies will enhance logistics operations. The focus on sustainability will also shape the market, with companies seeking eco-friendly solutions. Furthermore, the collaboration between logistics firms and technology providers is expected to foster innovation, leading to more sophisticated TMS that can adapt to evolving market needs and regulatory requirements.

Market Opportunities

- Expansion of E-commerce Logistics:With e-commerce sales projected to reach $10 billion in the near future, there is a significant opportunity for TMS providers to develop tailored solutions that cater to the unique logistics challenges of online retailers. This growth will drive demand for systems that enhance order fulfillment, inventory management, and last-mile delivery efficiency, creating a lucrative market segment for innovative TMS solutions.

- Integration of AI and IoT:The integration of artificial intelligence and Internet of Things (IoT) technologies into transportation management systems presents a substantial opportunity. In the near future, the adoption of AI in logistics is expected to increase by 25%, enabling predictive analytics and real-time decision-making. This technological advancement will enhance operational efficiency, reduce costs, and improve service levels, making TMS more attractive to businesses seeking competitive advantages.