Region:Asia

Author(s):Geetanshi

Product Code:KRAE2201

Pages:91

Published On:February 2026

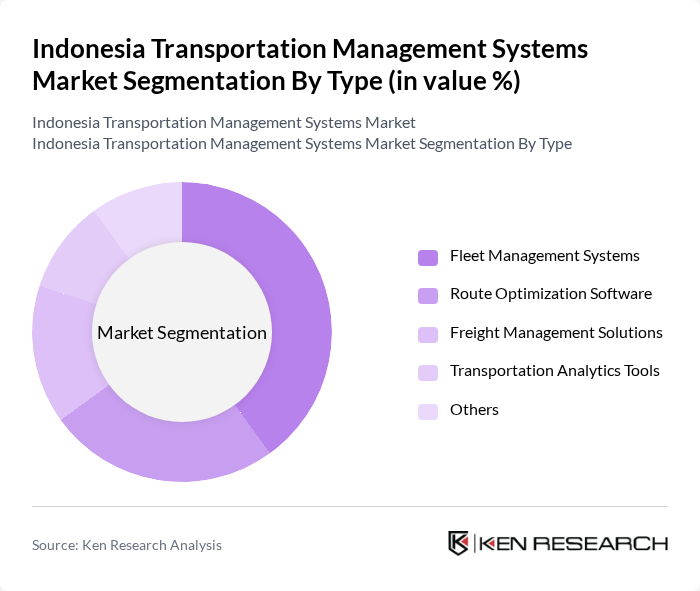

By Type:The market is segmented into various types, including Fleet Management Systems, Route Optimization Software, Freight Management Solutions, Transportation Analytics Tools, and Others. Fleet Management Systems are currently leading the market due to their ability to enhance operational efficiency and reduce costs for businesses. The increasing focus on optimizing fleet operations and improving service delivery is driving the demand for these systems. Route Optimization Software is also gaining traction as companies seek to minimize transportation costs and improve delivery times.

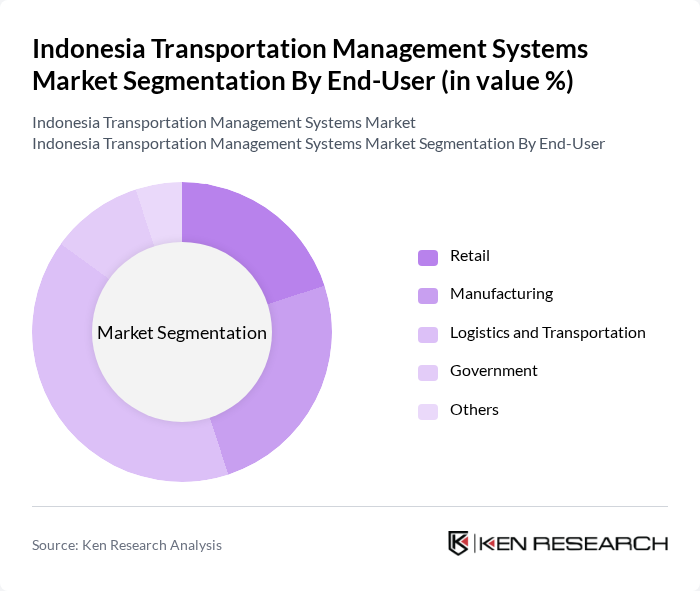

By End-User:The end-user segmentation includes Retail, Manufacturing, Logistics and Transportation, Government, and Others. The Logistics and Transportation sector is the dominant segment, driven by the increasing need for efficient supply chain management and real-time tracking of goods. Retail and Manufacturing sectors are also significant contributors, as they rely heavily on transportation management systems to streamline their operations and enhance customer satisfaction.

The Indonesia Transportation Management Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, JDA Software Group, Inc., Manhattan Associates, Inc., Descartes Systems Group Inc., Trimble Inc., C.H. Robinson Worldwide, Inc., TMW Systems, Inc., Kuebix, a Trimble Company, FourKites, Inc., Project44, Transporeon Group, Locus.sh, Fleet Complete, Omnicomm contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's transportation management systems market appears promising, driven by ongoing urbanization and government initiatives. As cities expand, the demand for efficient logistics solutions will continue to rise, prompting further investments in technology. Additionally, the integration of AI and IoT technologies is expected to enhance operational efficiency. Companies will increasingly focus on customer-centric solutions, ensuring that transportation systems are not only efficient but also responsive to consumer needs, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Fleet Management Systems Route Optimization Software Freight Management Solutions Transportation Analytics Tools Others |

| By End-User | Retail Manufacturing Logistics and Transportation Government Others |

| By Mode of Transportation | Road Transportation Rail Transportation Air Transportation Maritime Transportation Others |

| By Deployment Type | On-Premise Cloud-Based Hybrid Others |

| By Region | Java Sumatra Kalimantan Sulawesi Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Service Type | Consulting Services Implementation Services Maintenance and Support Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Systems | 45 | Transit Authority Managers, Operations Supervisors |

| Logistics and Freight Services | 52 | Logistics Managers, Supply Chain Analysts |

| Urban Mobility Solutions | 38 | Urban Planners, Mobility Service Providers |

| Maritime Transport Operations | 42 | Port Authority Officials, Shipping Line Executives |

| Road Transportation Fleet Management | 48 | Fleet Managers, Transportation Coordinators |

The Indonesia Transportation Management Systems market is valued at approximately USD 15 billion, driven by the increasing demand for efficient logistics solutions, rapid urbanization, and infrastructure development across the country.