Region:Middle East

Author(s):Rebecca

Product Code:KRAC1080

Pages:88

Published On:October 2025

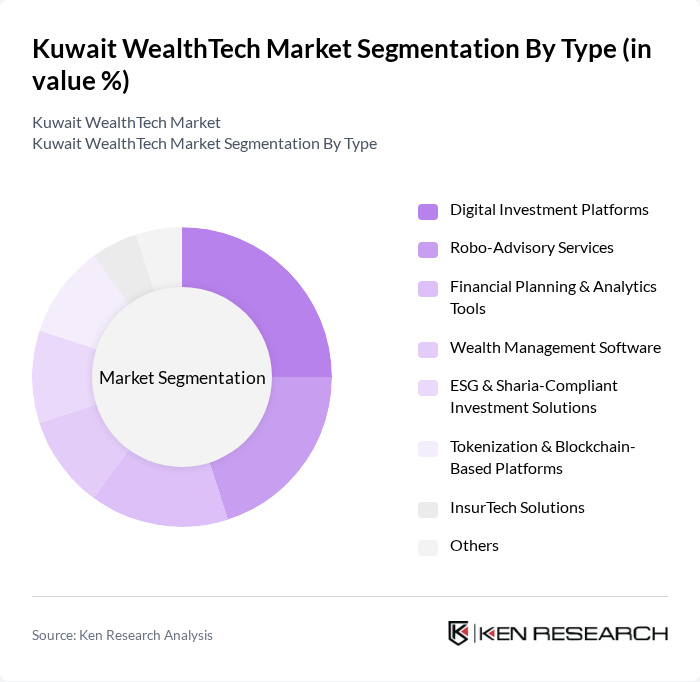

By Type:The WealthTech market is segmented into Digital Investment Platforms, Robo-Advisory Services, Financial Planning & Analytics Tools, Wealth Management Software, ESG & Sharia-Compliant Investment Solutions, Tokenization & Blockchain-Based Platforms, InsurTech Solutions, and Others. Digital investment platforms and robo-advisory services are gaining traction due to their accessibility and personalized offerings, while ESG and Sharia-compliant solutions address the unique preferences of Kuwaiti investors. Tokenization and blockchain-based platforms are emerging, particularly in real estate and Sukuk investments, and InsurTech solutions are expanding as insurers digitize sales and claims processes.

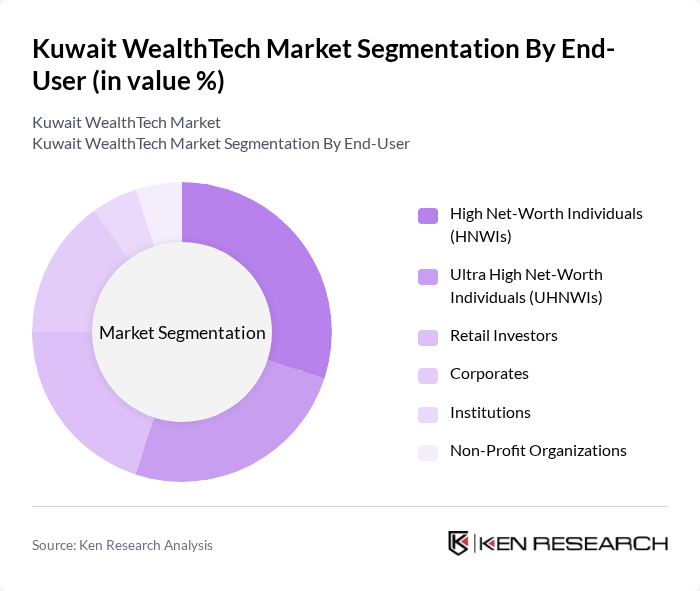

By End-User:The end-user segmentation includes High Net-Worth Individuals (HNWIs), Ultra High Net-Worth Individuals (UHNWIs), Retail Investors, Corporates, Institutions, and Non-Profit Organizations. HNWIs and UHNWIs drive demand for personalized and Sharia-compliant investment solutions, while retail investors increasingly adopt digital platforms for convenience and lower fees. Corporates and institutions utilize analytics tools and wealth management software for portfolio optimization, and non-profit organizations leverage digital platforms for transparent asset management.

The Kuwait WealthTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as KFH Capital, Boubyan Bank, Al Ahli Bank of Kuwait, Gulf Bank, National Bank of Kuwait, Warba Bank, Kuwait Finance House, Al Mal Investment Company, Al-Dar Investment Company, Global Investment House, Al-Ahli United Bank, Noor Financial Investment Company, KAMCO Invest, Kuwait Financial Centre (Markaz), Al-Waseet Financial Business Company contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait WealthTech market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital adoption continues to rise, firms will increasingly leverage AI and machine learning to enhance service delivery and customer engagement. Additionally, the growing interest in sustainable investments will shape product offerings, aligning with global trends. Collaboration between WealthTech firms and traditional financial institutions will also foster innovation, creating a more integrated financial ecosystem that meets diverse consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Investment Platforms Robo-Advisory Services Financial Planning & Analytics Tools Wealth Management Software ESG & Sharia-Compliant Investment Solutions Tokenization & Blockchain-Based Platforms InsurTech Solutions Others |

| By End-User | High Net-Worth Individuals (HNWIs) Ultra High Net-Worth Individuals (UHNWIs) Retail Investors Corporates Institutions Non-Profit Organizations |

| By Investment Strategy | Growth Investing Value Investing Income Investing Alternative Investments Others |

| By Asset Class | Equities Fixed Income Real Estate Commodities Alternatives Others |

| By Service Channel | Direct Sales Online Platforms Financial Advisors Wealth Management Firms Others |

| By Client Demographics | Age Group (Millennials, Gen X, Baby Boomers) Gender Income Level Geographic Location Others |

| By Regulatory Compliance | Sharia-Compliant Wealth Management International Compliance Standards Local Regulatory Requirements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Investor Insights | 150 | Individual Investors, Financial Advisors |

| WealthTech Service Providers | 100 | Fintech Founders, Product Managers |

| Institutional Investment Strategies | 80 | Portfolio Managers, Institutional Investors |

| Regulatory Impact Assessment | 60 | Compliance Officers, Regulatory Analysts |

| Technology Adoption Trends | 90 | IT Managers, Digital Transformation Leads |

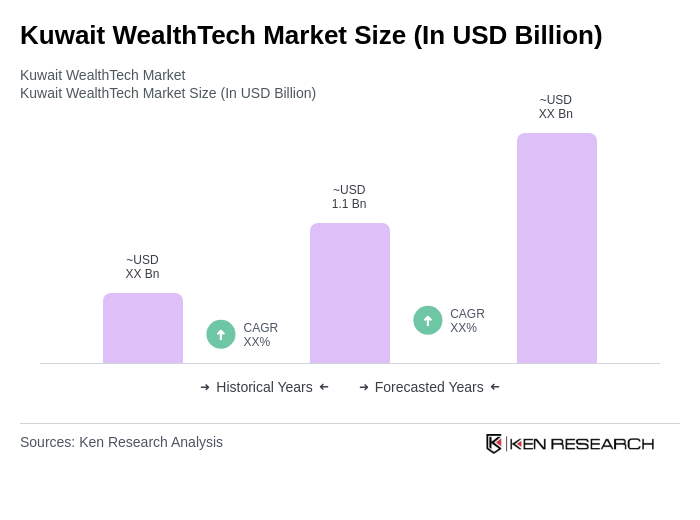

The Kuwait WealthTech market is valued at approximately USD 1.1 billion, driven by the increasing adoption of digital financial services and a growing number of high-net-worth individuals seeking innovative investment solutions.