Region:Middle East

Author(s):Dev

Product Code:KRAB7238

Pages:88

Published On:October 2025

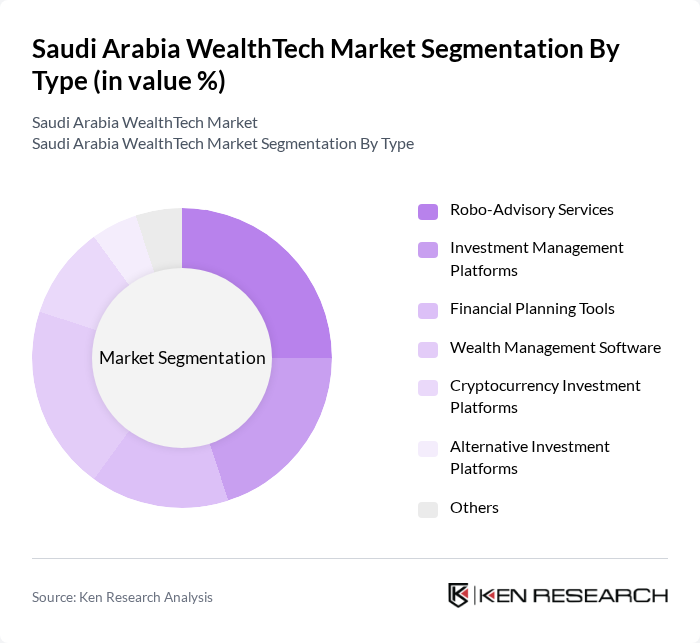

By Type:The WealthTech market can be segmented into various types, including Robo-Advisory Services, Investment Management Platforms, Financial Planning Tools, Wealth Management Software, Cryptocurrency Investment Platforms, Alternative Investment Platforms, and Others. Each of these segments caters to different consumer needs and preferences, with a notable trend towards digital solutions that enhance user experience and accessibility.

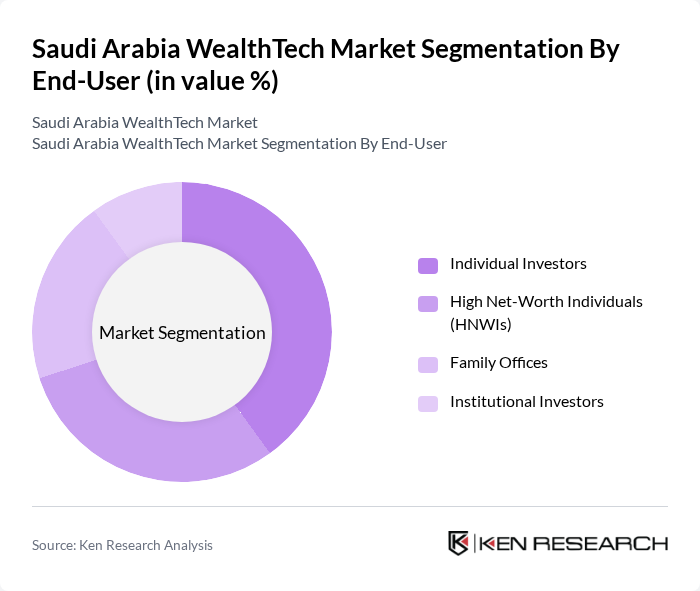

By End-User:The end-user segmentation includes Individual Investors, High Net-Worth Individuals (HNWIs), Family Offices, and Institutional Investors. Each group has distinct investment goals and risk appetites, influencing their choice of WealthTech solutions. The increasing number of HNWIs in Saudi Arabia is driving demand for tailored investment services.

The Saudi Arabia WealthTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Rajhi Bank, NCB Capital, Riyad Capital, Samba Capital, Alinma Investment, Jadwa Investment, Emirates NBD, STC Pay, Fawry, Wealthsimple, Sarwa Capital, Mena Capital, SEDCO Capital, Alkhabeer Capital, Amlak Finance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the WealthTech market in Saudi Arabia appears promising, driven by technological advancements and a supportive regulatory environment. As digital banking services expand, more consumers will seek innovative investment solutions tailored to their needs. Additionally, the increasing interest in sustainable investments will likely shape product offerings, encouraging WealthTech firms to integrate ESG factors into their strategies. Overall, the market is poised for significant growth as it adapts to evolving consumer preferences and technological innovations.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisory Services Investment Management Platforms Financial Planning Tools Wealth Management Software Cryptocurrency Investment Platforms Alternative Investment Platforms Others |

| By End-User | Individual Investors High Net-Worth Individuals (HNWIs) Family Offices Institutional Investors |

| By Investment Strategy | Active Management Passive Management Tactical Asset Allocation Strategic Asset Allocation |

| By Distribution Channel | Direct-to-Consumer Financial Advisors Online Platforms Mobile Applications |

| By Service Model | Subscription-Based Services Commission-Based Services Fee-Only Services |

| By Customer Segment | Millennials Gen X Baby Boomers |

| By Policy Support | Government Grants Tax Incentives Regulatory Sandboxes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Robo-Advisory Services | 100 | Wealth Managers, Financial Advisors |

| Digital Investment Platforms | 80 | Fintech Entrepreneurs, Product Managers |

| Wealth Management Software | 70 | IT Managers, Software Developers |

| Consumer Investment Behavior | 90 | Retail Investors, Financial Literacy Advocates |

| Regulatory Impact on WealthTech | 60 | Compliance Officers, Regulatory Analysts |

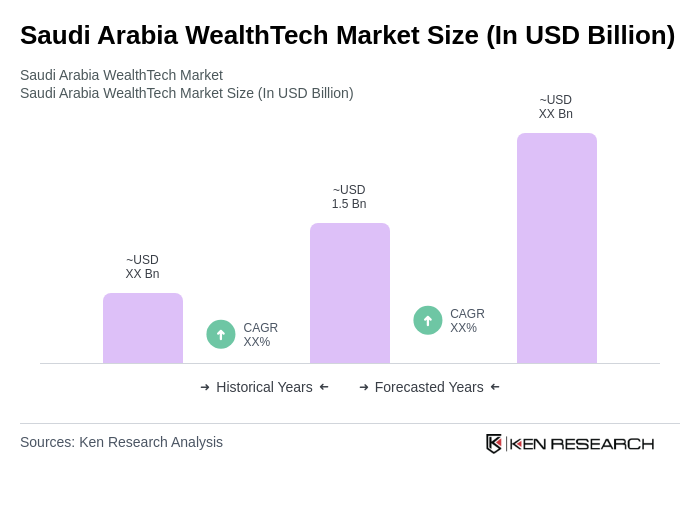

The Saudi Arabia WealthTech market is valued at approximately USD 1.5 billion, driven by the increasing adoption of digital financial services and a growing affluent population, alongside government initiatives supporting fintech innovation as part of Vision 2030.