Region:Middle East

Author(s):Dev

Product Code:KRAB7393

Pages:85

Published On:October 2025

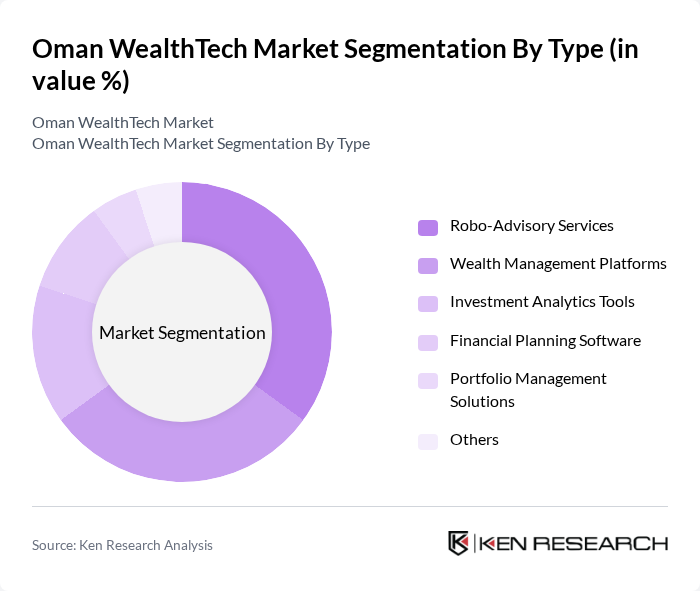

By Type:The WealthTech market can be segmented into various types, including Robo-Advisory Services, Wealth Management Platforms, Investment Analytics Tools, Financial Planning Software, Portfolio Management Solutions, and Others. Each of these sub-segments plays a crucial role in catering to the diverse needs of investors, with Robo-Advisory Services currently leading the market due to their accessibility and cost-effectiveness. Wealth Management Platforms are also gaining traction as they offer comprehensive solutions for high-net-worth individuals.

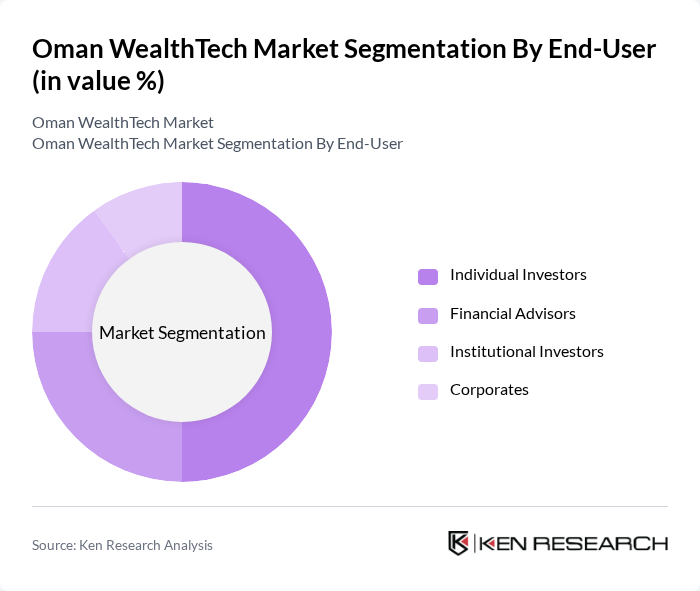

By End-User:The end-user segmentation includes Individual Investors, Financial Advisors, Institutional Investors, and Corporates. Individual Investors dominate the market as they increasingly seek digital solutions for personal finance management and investment. Financial Advisors are also significant users of WealthTech solutions, leveraging technology to enhance their service offerings and improve client engagement.

The Oman WealthTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Investment Authority, Bank Muscat, Dhofar Insurance Company, Muscat Capital, Alizz Islamic Bank, Oman Arab Bank, National Bank of Oman, Oman Insurance Company, Al Madina Investment, Oman Investment and Finance Company, Al Izz Islamic Bank, Muscat Securities Market, Oman National Investments Development Company, Bank Dhofar, Oman Oil Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman WealthTech market appears promising, driven by technological advancements and increasing consumer demand for personalized financial services. As digital banking continues to expand, WealthTech firms are likely to leverage artificial intelligence and machine learning to enhance customer experiences. Additionally, the growing trend towards sustainable investing will encourage firms to develop products that align with socially responsible values, further attracting a diverse client base seeking innovative investment solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisory Services Wealth Management Platforms Investment Analytics Tools Financial Planning Software Portfolio Management Solutions Others |

| By End-User | Individual Investors Financial Advisors Institutional Investors Corporates |

| By Distribution Channel | Direct Sales Online Platforms Financial Institutions Partnerships with Fintech Firms |

| By Investment Type | Equity Investments Fixed Income Investments Alternative Investments Mutual Funds |

| By Customer Segment | High Net-Worth Individuals (HNWIs) Mass Affluent Retail Investors |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) |

| By Geographic Reach | Local Market Regional Market International Market |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Investment Management Platforms | 100 | Wealth Managers, Financial Advisors |

| Robo-Advisory Services | 80 | Fintech Entrepreneurs, Product Managers |

| Financial Planning Tools | 70 | Financial Planners, Compliance Officers |

| WealthTech User Experience | 90 | End-users, Retail Investors |

| Regulatory Impact Assessment | 60 | Regulatory Experts, Policy Makers |

The Oman WealthTech market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a rising affluent population seeking personalized investment solutions.