Region:Middle East

Author(s):Rebecca

Product Code:KRAC1103

Pages:90

Published On:October 2025

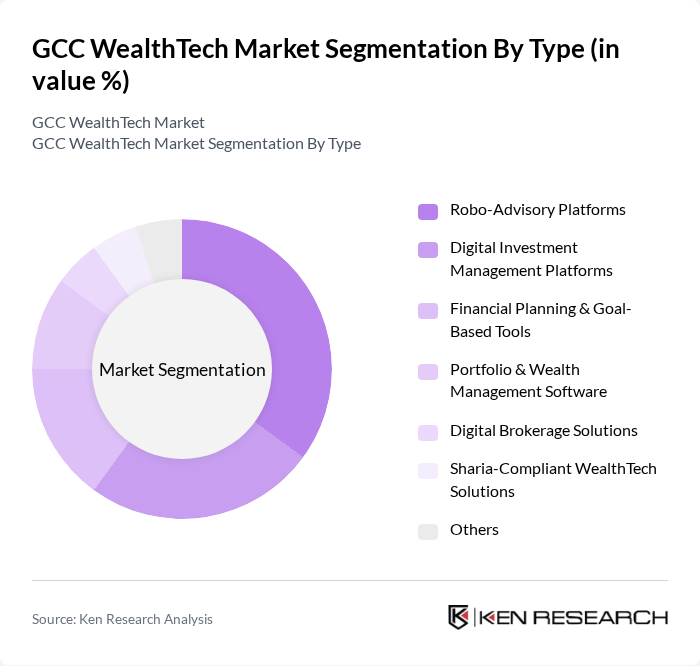

By Type:The WealthTech market can be segmented into various types, including Robo-Advisory Platforms, Digital Investment Management Platforms, Financial Planning & Goal-Based Tools, Portfolio & Wealth Management Software, Digital Brokerage Solutions, Sharia-Compliant WealthTech Solutions, and Others. Each of these segments caters to different consumer needs and preferences, with Robo-Advisory Platforms currently leading the market due to their accessibility, cost-effectiveness, and appeal to tech-savvy investors seeking automated, user-friendly solutions. The rise of AI-powered and Sharia-compliant platforms is also notable, reflecting evolving investor preferences and regulatory requirements .

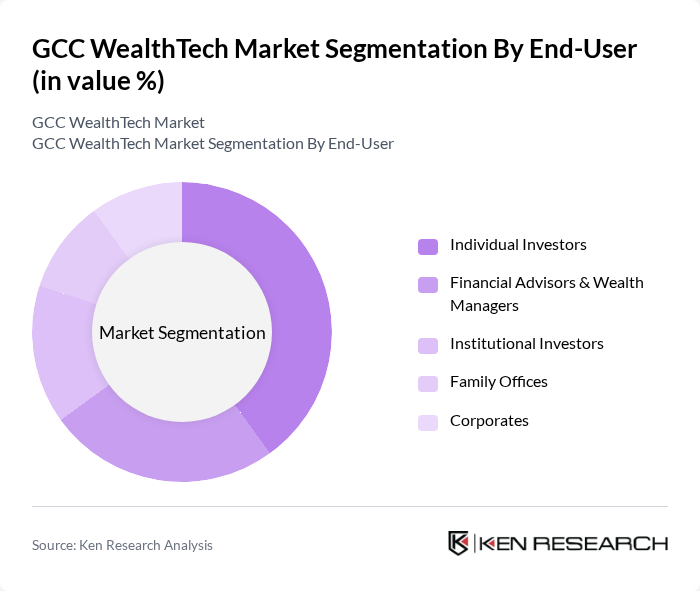

By End-User:The WealthTech market serves various end-users, including Individual Investors, Financial Advisors & Wealth Managers, Institutional Investors, Family Offices, and Corporates. Individual Investors are the largest segment, driven by the increasing number of retail investors and millennials seeking accessible investment options and personalized financial advice through digital platforms. Family Offices are also a significant segment due to the region’s high concentration of wealth and growing interest in sophisticated digital solutions .

The GCC WealthTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Souqalmal.com, Sarwa, Wahed Invest, Al Rajhi Capital, Emirates NBD, Abu Dhabi Commercial Bank (ADCB), FinaMaze, Zand, Nomo Bank, StashAway, InvestSky, MENA Financial Group, Baraka, Qardus, Fintech Galaxy contribute to innovation, geographic expansion, and service delivery in this space.

The GCC WealthTech market is poised for substantial growth, driven by technological advancements and evolving consumer preferences. As digital banking and investment platforms become more prevalent, firms that prioritize user experience and leverage AI for personalized services will thrive. Additionally, the increasing focus on sustainable investments will shape product offerings, aligning with global trends. The regulatory environment will continue to evolve, fostering innovation while ensuring consumer protection, ultimately enhancing market stability and growth potential in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Robo-Advisory Platforms Digital Investment Management Platforms Financial Planning & Goal-Based Tools Portfolio & Wealth Management Software Digital Brokerage Solutions Sharia-Compliant WealthTech Solutions Others |

| By End-User | Individual Investors Financial Advisors & Wealth Managers Institutional Investors Family Offices Corporates |

| By Distribution Channel | Direct-to-Consumer (D2C) Platforms Online Marketplaces Partnerships with Financial Institutions White-Label Solutions Others |

| By Service Model | Subscription-Based Services Commission-Based Services Fee-Only Advisory Services Hybrid (Human + Digital) Advisory |

| By Investment Type | Equities Fixed Income Real Estate Commodities Alternative Investments Others |

| By Customer Segment | High Net-Worth Individuals (HNWIs) Mass Affluent Retail Investors Ultra High Net-Worth Individuals (UHNWIs) |

| By Geographic Focus | Saudi Arabia United Arab Emirates Qatar Kuwait Bahrain Oman International Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Robo-Advisory Services | 120 | Wealth Managers, Financial Advisors |

| Investment Platforms | 110 | Investment Analysts, Portfolio Managers |

| Financial Planning Tools | 100 | Financial Planners, Tax Advisors |

| Blockchain in Wealth Management | 90 | Technology Officers, Compliance Managers |

| Regulatory Impact on WealthTech | 110 | Regulatory Affairs Specialists, Legal Advisors |

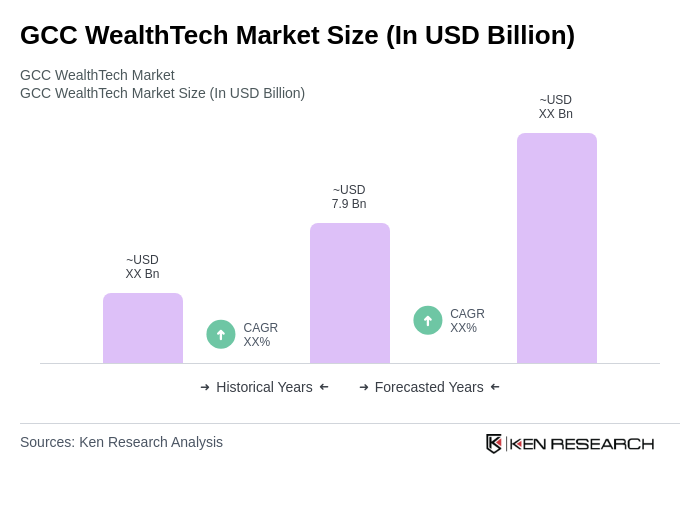

The GCC WealthTech market is valued at approximately USD 7.9 billion, driven by the increasing adoption of digital financial services and a growing number of high-net-worth individuals (HNWIs) seeking personalized investment solutions.