Region:Asia

Author(s):Rebecca

Product Code:KRAE3381

Pages:84

Published On:February 2026

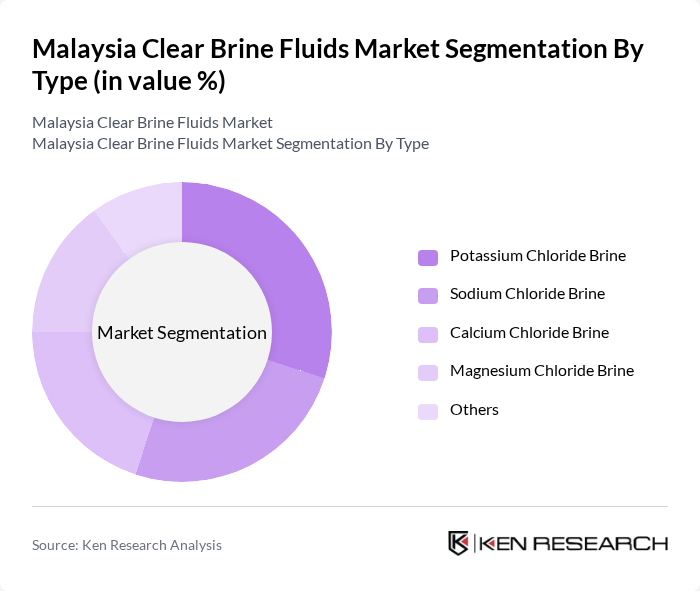

By Type:The clear brine fluids market can be segmented into various types, including Potassium Chloride Brine, Sodium Chloride Brine, Calcium Chloride Brine, Magnesium Chloride Brine, and Others. Each type serves specific applications and industries, with varying properties that cater to different operational needs.

The Potassium Chloride Brine segment is currently dominating the market due to its effectiveness in high-density applications, particularly in the oil and gas sector. Its ability to maintain stability under high temperatures and pressures makes it a preferred choice for drilling fluids. Additionally, the increasing focus on environmentally friendly solutions has led to a rise in the adoption of potassium chloride brine, as it is less harmful to the environment compared to other types.

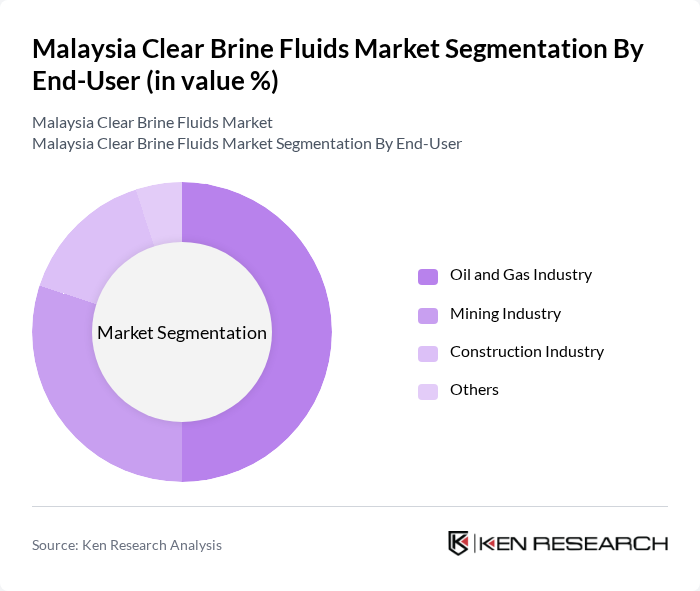

By End-User:The market can also be segmented based on end-users, which include the Oil and Gas Industry, Mining Industry, Construction Industry, and Others. Each end-user category has distinct requirements and applications for clear brine fluids, influencing the overall market dynamics.

The Oil and Gas Industry is the leading end-user of clear brine fluids, accounting for a significant portion of the market. This dominance is attributed to the extensive use of brine fluids in drilling and completion processes, where they are essential for maintaining wellbore stability and preventing formation damage. The ongoing exploration and production activities in Malaysia's offshore oil fields further bolster the demand for clear brine fluids in this sector.

The Malaysia Clear Brine Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton, Schlumberger, Baker Hughes, Weatherford International, Newpark Resources, Chemours Company, Albemarle Corporation, Tetra Technologies, Superior Energy Services, DOW Chemical Company, AECOM, National Oilwell Varco, Ecolab, FMC Technologies, Scomi Group Berhad contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysian clear brine fluids market appears promising, driven by ongoing investments in oil and gas exploration and advancements in drilling technologies. As companies increasingly focus on sustainable practices, the demand for biodegradable brine fluids is expected to rise. Additionally, the integration of digital technologies and AI in fluid management will enhance operational efficiency, allowing for better resource allocation and risk management, ultimately supporting market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Potassium Chloride Brine Sodium Chloride Brine Calcium Chloride Brine Magnesium Chloride Brine Others |

| By End-User | Oil and Gas Industry Mining Industry Construction Industry Others |

| By Application | Drilling Fluids Completion Fluids Workover Fluids Others |

| By Region | Peninsular Malaysia East Malaysia Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Product Formulation | Standard Formulations Customized Formulations Others |

| By Pricing Model | Fixed Pricing Variable Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Exploration Companies | 100 | Drilling Engineers, Project Managers |

| Chemical Manufacturers of Brine Fluids | 80 | Product Development Managers, Sales Directors |

| Service Providers in Fluid Management | 70 | Operations Managers, Technical Sales Representatives |

| Regulatory Bodies and Industry Associations | 50 | Policy Analysts, Compliance Officers |

| Research Institutions and Universities | 60 | Academic Researchers, Industry Consultants |

The Malaysia Clear Brine Fluids Market is valued at approximately USD 150 million, driven by demand from the oil and gas industry, as well as mining and construction sectors requiring effective fluid solutions for various applications.