Region:Europe

Author(s):Rebecca

Product Code:KRAA3331

Pages:84

Published On:September 2025

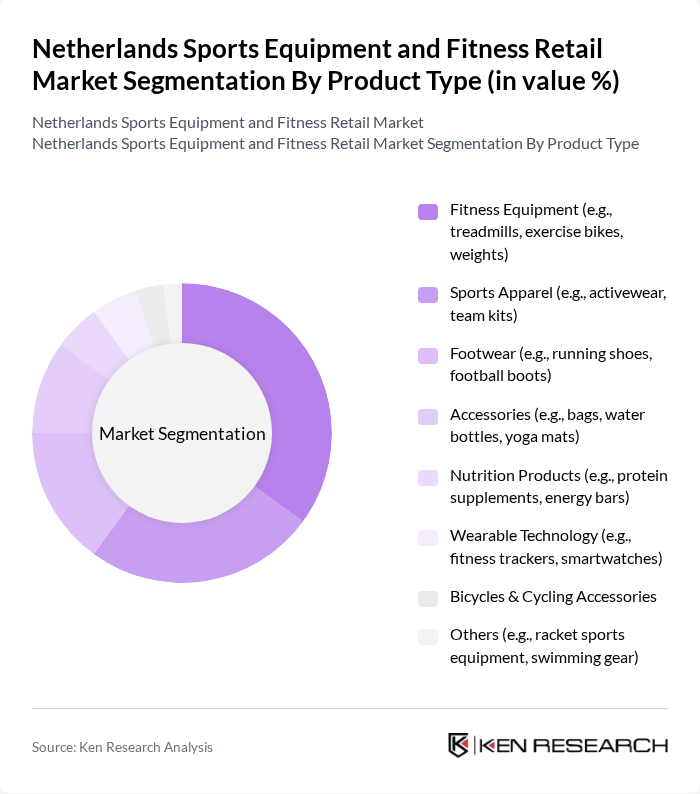

By Product Type:The product type segmentation includes various categories such as fitness equipment, sports apparel, footwear, accessories, nutrition products, wearable technology, bicycles & cycling accessories, and others. Among these, fitness equipment has emerged as the leading sub-segment due to the growing trend of home workouts and gym memberships. The demand for innovative and high-quality fitness equipment has surged, driven by consumers' desire for effective workout solutions.

By End-User:The end-user segmentation encompasses individual consumers, gyms and fitness centers, schools and universities, sports clubs and associations, and corporate wellness programs. Individual consumers represent the largest segment, driven by the increasing focus on personal health and fitness. The rise of fitness influencers and social media has also played a significant role in motivating individuals to invest in sports equipment and fitness-related products.

The Netherlands Sports Equipment and Fitness Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon Nederland, Intersport Nederland, Nike Netherlands B.V., Adidas Benelux B.V., Under Armour Netherlands, ASICS Europe B.V., Puma Benelux B.V., Reebok Netherlands, Sport 2000 Nederland, The Athlete's Foot Netherlands, H&M Sport (H&M Netherlands), Runnersworld Nederland, Fitshop Nederland, MyProtein Netherlands, Body & Fit Netherlands contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands sports equipment and fitness retail market appears promising, driven by ongoing health trends and technological advancements. As consumers increasingly prioritize fitness, the demand for innovative and sustainable products is expected to rise. Additionally, the integration of technology in fitness solutions, such as wearable devices and smart equipment, will likely enhance user experience and engagement, further propelling market growth. Retailers must adapt to these trends to remain competitive and meet evolving consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Fitness Equipment (e.g., treadmills, exercise bikes, weights) Sports Apparel (e.g., activewear, team kits) Footwear (e.g., running shoes, football boots) Accessories (e.g., bags, water bottles, yoga mats) Nutrition Products (e.g., protein supplements, energy bars) Wearable Technology (e.g., fitness trackers, smartwatches) Bicycles & Cycling Accessories Others (e.g., racket sports equipment, swimming gear) |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Universities Sports Clubs and Associations Corporate Wellness Programs |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Focused Customers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Sports Equipment Retailers | 100 | Store Managers, Sales Executives |

| Fitness Center Operators | 80 | Gym Owners, Fitness Directors |

| Consumer Fitness Enthusiasts | 120 | Regular Gym Goers, Home Fitness Users |

| Health and Wellness Influencers | 60 | Fitness Bloggers, Social Media Influencers |

| Sports Equipment Manufacturers | 50 | Product Development Managers, Marketing Executives |

The Netherlands Sports Equipment and Fitness Retail Market is valued at approximately USD 5.5 billion, reflecting a significant growth trend driven by increasing health consciousness, fitness trends, and the expansion of e-commerce platforms.