Region:Asia

Author(s):Rebecca

Product Code:KRAA7080

Pages:81

Published On:January 2026

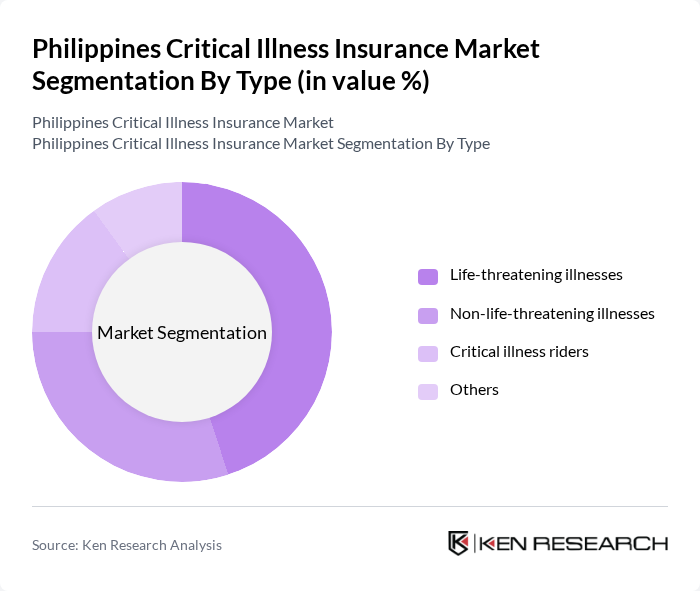

By Type:The market can be segmented into various types of critical illness insurance products, including life-threatening illnesses, non-life-threatening illnesses, critical illness riders, and others. Each of these segments caters to different consumer needs and preferences, influencing their market share and growth potential.

The life-threatening illnesses segment dominates the market due to the increasing prevalence of severe health conditions such as cancer, heart disease, and stroke. Consumers are more inclined to invest in insurance products that provide substantial financial support in the event of a critical diagnosis. This trend is further fueled by rising healthcare costs and the desire for comprehensive coverage, leading to a significant market share for this segment.

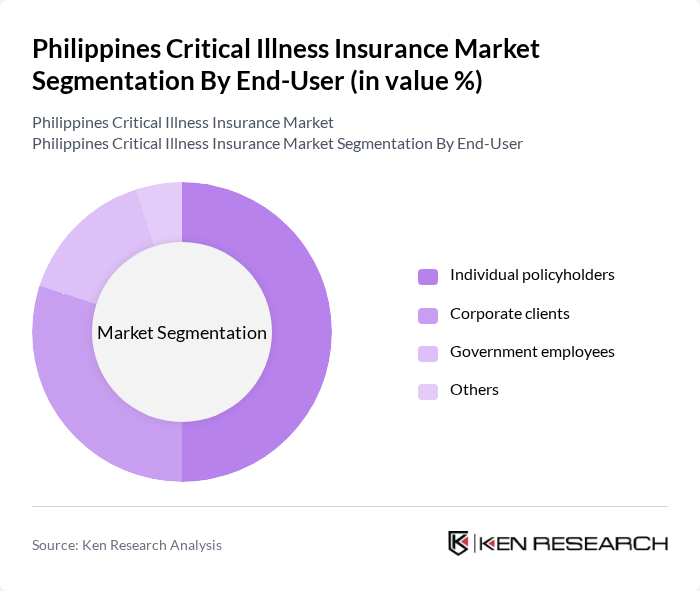

By End-User:The critical illness insurance market can also be segmented by end-users, including individual policyholders, corporate clients, government employees, and others. Each segment reflects different purchasing behaviors and insurance needs, impacting overall market dynamics.

Individual policyholders represent the largest segment in the market, driven by the increasing awareness of health risks and the need for personal financial security. As more individuals recognize the importance of safeguarding their health and finances, the demand for critical illness insurance among this demographic continues to grow, solidifying its market leadership.

The Philippines Critical Illness Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sun Life Financial, Philam Life, Manulife Philippines, BPI-Philam Life Assurance Corporation, FWD Life Insurance Corporation, Pru Life UK, AXA Philippines, Generali Pilipinas, EastWest Ageas Life Insurance, Insular Life Assurance Company, Cocolife, Standard Insurance, Malayan Insurance, Union Bank of the Philippines, Allianz PNB Life Insurance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the critical illness insurance market in the Philippines appears promising, driven by increasing health awareness and technological advancements. As digital platforms gain traction, insurers are likely to enhance customer engagement through online services and personalized offerings. Additionally, the integration of wellness programs into insurance products is expected to attract health-conscious consumers, fostering a proactive approach to health management. These trends will likely reshape the market landscape, encouraging innovation and improved service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Life-threatening illnesses Non-life-threatening illnesses Critical illness riders Others |

| By End-User | Individual policyholders Corporate clients Government employees Others |

| By Age Group | Young adults (18-30) Middle-aged adults (31-50) Seniors (51 and above) Others |

| By Coverage Amount | Low coverage (up to PHP 1 million) Medium coverage (PHP 1 million - PHP 5 million) High coverage (above PHP 5 million) Others |

| By Payment Mode | Annual payment Semi-annual payment Monthly payment Others |

| By Distribution Channel | Direct sales Brokers Online platforms Others |

| By Policy Duration | Short-term policies (1-5 years) Long-term policies (5+ years) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Policyholders | 120 | Policyholders aged 30-50, diverse income levels |

| Insurance Agents | 100 | Agents with 3+ years of experience in critical illness insurance |

| Healthcare Professionals | 80 | Doctors and healthcare providers involved in critical illness treatment |

| Financial Advisors | 70 | Advisors specializing in insurance and financial planning |

| Insurance Company Executives | 60 | Executives from companies offering critical illness insurance products |

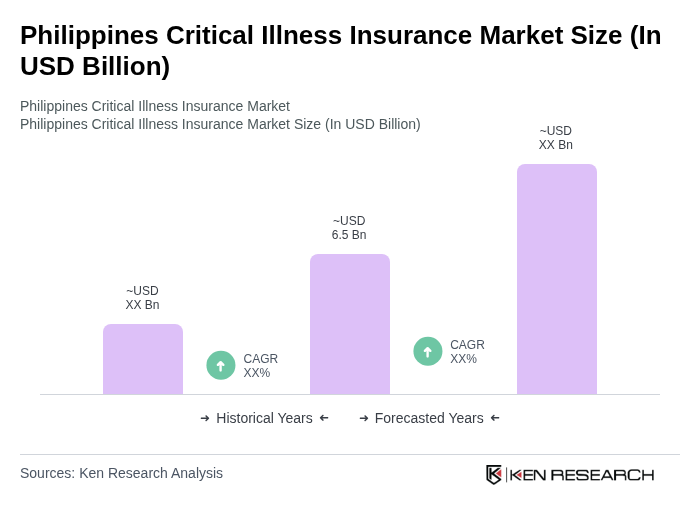

The Philippines Critical Illness Insurance Market is valued at approximately USD 6.5 billion, reflecting significant growth driven by rising healthcare costs, increased awareness of critical illnesses, and a growing middle class seeking financial protection against health-related risks.