Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4044

Pages:89

Published On:December 2025

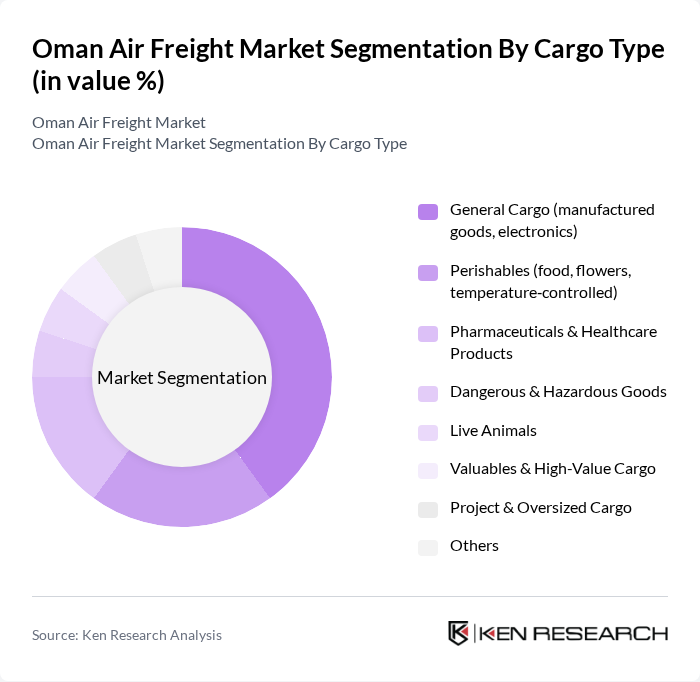

By Cargo Type:The air freight market is segmented into various cargo types, including General Cargo, Perishables, Pharmaceuticals & Healthcare Products, Dangerous & Hazardous Goods, Live Animals, Valuables & High-Value Cargo, Project & Oversized Cargo, and Others. Among these, General Cargo is the leading segment due to the high volume of manufactured goods and electronics being transported. The increasing demand for quick delivery of consumer products and industrial supplies drives this segment's growth.

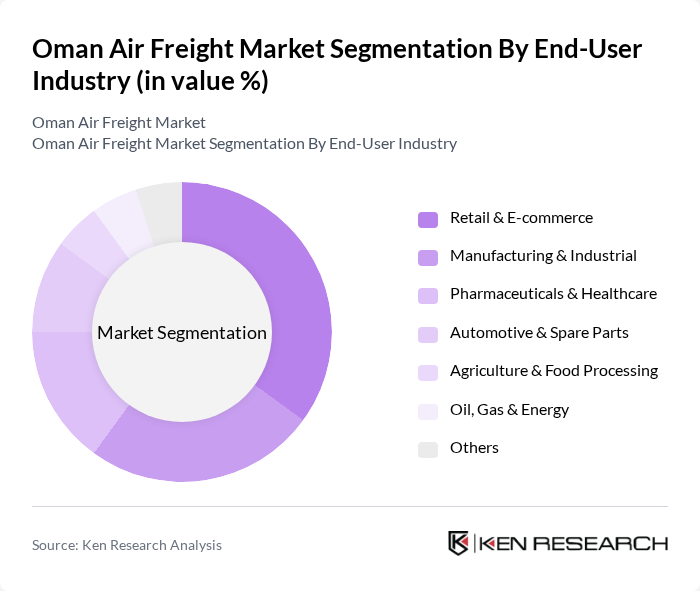

By End-User Industry:The air freight market is also segmented by end-user industries, including Retail & E-commerce, Manufacturing & Industrial, Pharmaceuticals & Healthcare, Automotive & Spare Parts, Agriculture & Food Processing, Oil, Gas & Energy, and Others. The Retail & E-commerce segment is currently the dominant force, driven by the surge in online shopping and the need for rapid delivery services. This trend has led to increased demand for air freight solutions to meet consumer expectations for quick shipping.

The Oman Air Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Air Cargo, Oman Airports Management Company (cargo operations), ASYAD Group (including Asyad Express), SalamAir Cargo, DHL Express / DHL Aviation, Aramex, Emirates SkyCargo, Qatar Airways Cargo, Etihad Cargo, Turkish Cargo, Saudia Cargo, FedEx Express, UPS Airlines / UPS Supply Chain Solutions, Cargolux Airlines International, Singapore Airlines Cargo contribute to innovation, geographic expansion, and service delivery in this space.

The Oman air freight market is poised for significant growth, driven by the increasing demand for e-commerce and ongoing infrastructure enhancements. As logistics hubs expand and technological advancements streamline operations, the sector is expected to adapt to evolving consumer needs. Additionally, sustainability initiatives are likely to gain traction, influencing operational practices. The combination of these factors will create a dynamic environment, fostering innovation and competitiveness in the air freight industry throughout the coming years.

| Segment | Sub-Segments |

|---|---|

| By Cargo Type | General Cargo (manufactured goods, electronics) Perishables (food, flowers, temperature?controlled) Pharmaceuticals & Healthcare Products Dangerous & Hazardous Goods Live Animals Valuables & High-Value Cargo Project & Oversized Cargo Others |

| By End-User Industry | Retail & E-commerce Manufacturing & Industrial Pharmaceuticals & Healthcare Automotive & Spare Parts Agriculture & Food Processing Oil, Gas & Energy Others |

| By Corridor / Destination | Intra-GCC & Middle East Asia–Pacific (including India & China) Europe Africa Rest of World |

| By Service Type | Scheduled Airline Freight Services Express & Courier / Integrator Services Air Freight Forwarding & Consolidation Charter & Project Cargo Services Others |

| By Carrier Type | Belly-Hold Cargo (Passenger Aircraft) Dedicated Freighter Aircraft Integrator / Express Network Aircraft Others |

| By Shipment Size | Small Parcels & Documents (< 45 kg) Medium Shipments (45–300 kg) Large & Bulk Shipments (> 300 kg) Project & Oversized Loads |

| By Delivery Speed | Express / Time-Definite Standard Economy / Deferred |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Air Freight | 100 | Logistics Managers, Compliance Officers |

| Electronics and High-Value Goods | 80 | Supply Chain Directors, Operations Managers |

| Perishable Goods Transportation | 70 | Cold Chain Managers, Quality Assurance Heads |

| Textile and Apparel Shipping | 60 | Procurement Officers, Logistics Coordinators |

| General Cargo Operations | 90 | Air Freight Managers, Customs Brokers |

The Oman Air Freight Market is valued at approximately USD 1.0 billion, driven by increasing demand for air cargo services due to e-commerce growth, global trade, and the need for faster delivery of goods.