Region:Global

Author(s):Shubham

Product Code:KRAA2730

Pages:98

Published On:August 2025

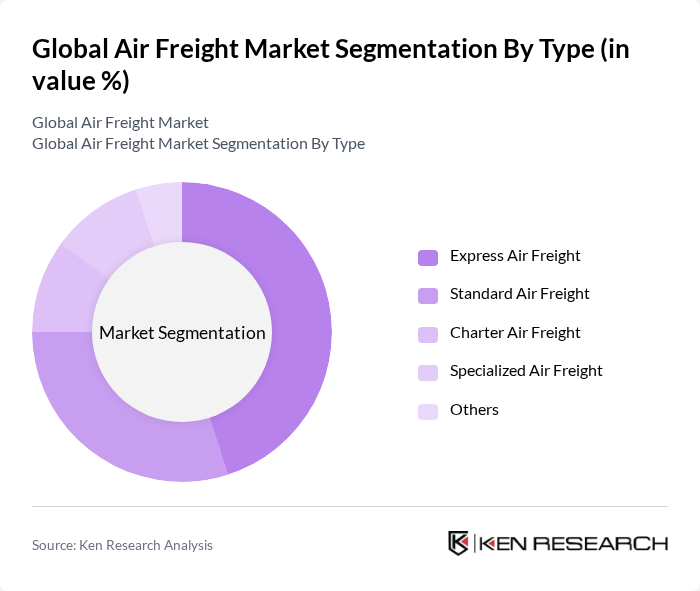

By Type:The air freight market is segmented into Express Air Freight, Standard Air Freight, Charter Air Freight, Specialized Air Freight, and Others.Express Air Freightremains the dominant segment, fueled by the surge in e-commerce and the increasing need for rapid, reliable delivery in high-value sectors. Businesses are prioritizing speed and reliability to meet customer expectations, driving the adoption of express services.

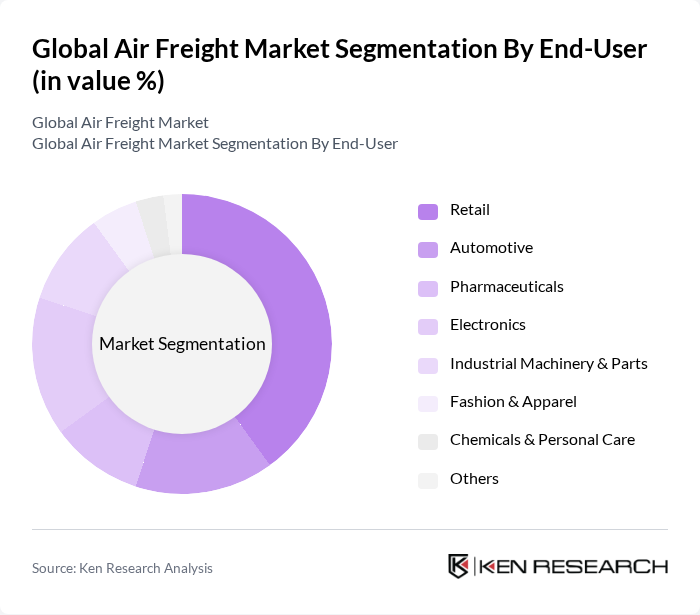

By End-User:The end-user segmentation includes Retail, Automotive, Pharmaceuticals, Electronics, Industrial Machinery & Parts, Fashion & Apparel, Chemicals & Personal Care, and Others. TheRetail segmentleads the market, driven by the explosive growth in e-commerce and online shopping. Retailers are increasingly using air freight to ensure timely delivery and enhance customer satisfaction, a trend that is expected to persist as digital sales channels expand.

The Global Air Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL International GmbH, FedEx Corporation, United Parcel Service, Inc. (UPS), Kuehne + Nagel International AG, DB Schenker, C.H. Robinson Worldwide, Inc., Expeditors International of Washington, Inc., Nippon Express Co., Ltd., XPO Logistics, Inc., CEVA Logistics, DSV A/S, Agility Logistics, Sinotrans Limited, Toll Group, Emirates SkyCargo, Qatar Airways Cargo, Cathay Pacific Cargo, Turkish Cargo, Lufthansa Cargo AG, Korean Air Cargo, Singapore Airlines Cargo, Air France-KLM Cargo, ANA Cargo, China Airlines Cargo, Atlas Air Worldwide Holdings, Inc., Cargolux Airlines International S.A., EVA Air Cargo, Saudia Cargo, AirBridgeCargo Airlines, MASkargo (Malaysia Airlines Cargo) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the air freight market appears promising, driven by ongoing advancements in technology and a growing emphasis on sustainability. As companies increasingly adopt digital solutions, the efficiency of air freight operations is expected to improve significantly. Furthermore, the rising demand for environmentally friendly logistics practices will likely lead to the development of greener air freight options. These trends indicate a transformative period for the industry, with enhanced service offerings and operational efficiencies on the horizon.

| Segment | Sub-Segments |

|---|---|

| By Type | Express Air Freight Standard Air Freight Charter Air Freight Specialized Air Freight Others |

| By End-User | Retail Automotive Pharmaceuticals Electronics Industrial Machinery & Parts Fashion & Apparel Chemicals & Personal Care Others |

| By Service Type | Door-to-Door Service Port-to-Port Service Airport-to-Airport Service Customs Clearance & Documentation Warehousing & Distribution Others |

| By Cargo Type | General Cargo Perishable Goods Dangerous Goods Oversized Cargo Time-sensitive Shipments Others |

| By Distribution Mode | Direct Distribution Indirect Distribution Third-Party Logistics (3PL) Freight Forwarders Others |

| By Pricing Model | Flat Rate Pricing Variable Rate Pricing Contractual Pricing Spot Pricing Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| International Air Freight Operations | 100 | Airline Operations Managers, Freight Forwarding Executives |

| Regional Air Cargo Trends | 60 | Logistics Analysts, Regional Sales Managers |

| Perishable Goods Transportation | 40 | Cold Chain Managers, Supply Chain Coordinators |

| Pharmaceutical Air Freight Services | 40 | Pharma Logistics Managers, Compliance Officers |

| E-commerce Air Freight Solutions | 50 | E-commerce Logistics Managers, Operations Directors |

The Global Air Freight Market is valued at approximately USD 320 billion, reflecting significant growth driven by e-commerce expansion, demand for fast shipping, and globalization of supply chains.