Region:North America

Author(s):Geetanshi

Product Code:KRAD4768

Pages:84

Published On:December 2025

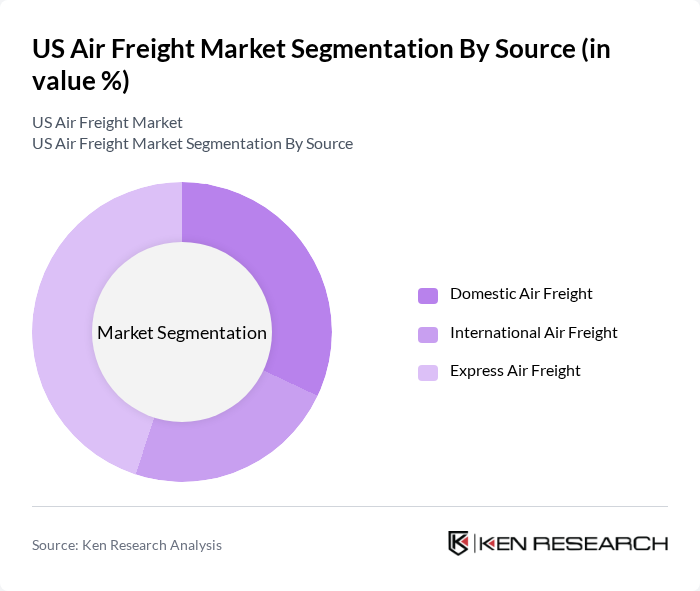

By Source:The air freight market can be segmented based on the source of the cargo. The primary subsegments include domestic air freight, international air freight, and express air freight. Among these, the express air freight subsegment dominates the market due to the increasing demand for fast delivery services, particularly driven by e-commerce growth. Consumers and businesses increasingly opt for express shipping to meet tight delivery windows, supported by innovations in last-mile delivery and integrated logistics platforms. The convenience, speed, and reliability of express services are key factors driving its growth.

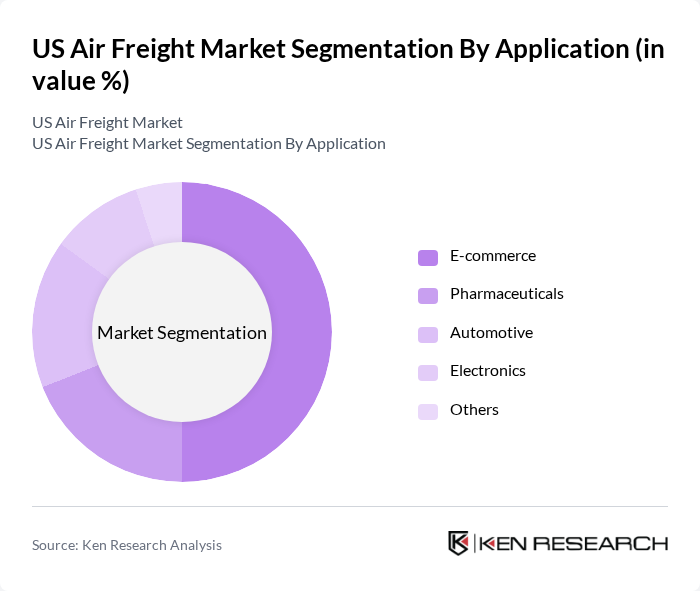

By Application:The air freight market is also segmented by application, including e-commerce, pharmaceuticals, automotive, electronics, and others. The e-commerce subsegment leads the market, propelled by rapid online retail growth and consumer demand for expedited shipping. Pharmaceuticals represent a significant share due to the critical need for temperature-controlled, time-sensitive shipments. Automotive and electronics sectors contribute notably, driven by just-in-time manufacturing and high-value components requiring secure, fast transport. Advancements in cold chain logistics and digital supply chain management further support these segments.

The US Air Freight Market is characterized by a dynamic mix of regional and international players. Leading participants such as United Parcel Service (UPS), FedEx Corporation, Atlas Air Worldwide Holdings, American Airlines Group (Cargo Division), Delta Air Lines (Cargo Division), Southwest Airlines (Cargo Division), DHL Express (US Operations), XPO Logistics, C.H. Robinson Worldwide, Expeditors International, Kuehne + Nagel (North America), DB Schenker (USA), CEVA Logistics, Forward Air Corporation, ABX Air (ArcBest subsidiary) contribute to innovation, geographic expansion, and service delivery in this space.

The US air freight market is poised for significant transformation as it adapts to evolving consumer demands and technological advancements. With the anticipated growth in e-commerce and global trade, air freight volumes are expected to rise sharply. Companies will increasingly leverage technology to enhance efficiency and reduce costs. However, challenges such as rising fuel prices and regulatory compliance will require strategic planning. Overall, the market is likely to experience robust growth, driven by innovation and increased demand for rapid delivery services.

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Perishable Goods Air Freight | 120 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceuticals Air Cargo | 95 | Operations Directors, Compliance Officers |

| Electronics and High-Value Goods | 90 | Product Managers, Freight Forwarding Specialists |

| Automotive Parts Logistics | 70 | Procurement Managers, Warehouse Supervisors |

| E-commerce Fulfillment Strategies | 110 | eCommerce Operations Managers, Logistics Analysts |

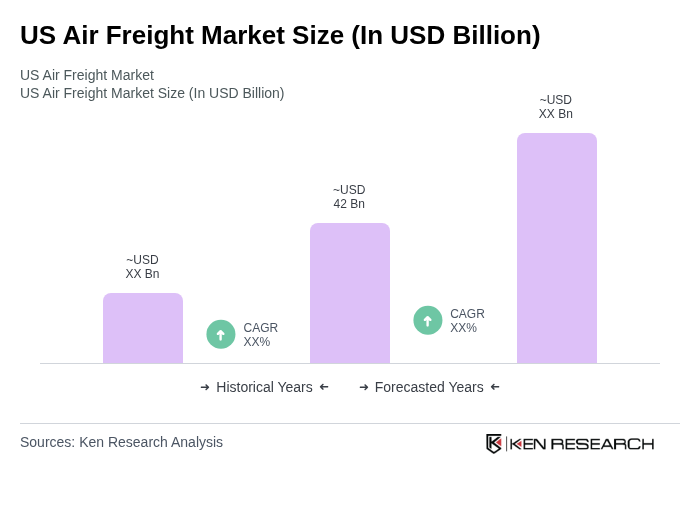

The US Air Freight Market is valued at approximately USD 42 billion, driven by increasing e-commerce demand and the need for rapid transportation of perishable goods, pharmaceuticals, and high-value electronics.