Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7331

Pages:83

Published On:October 2025

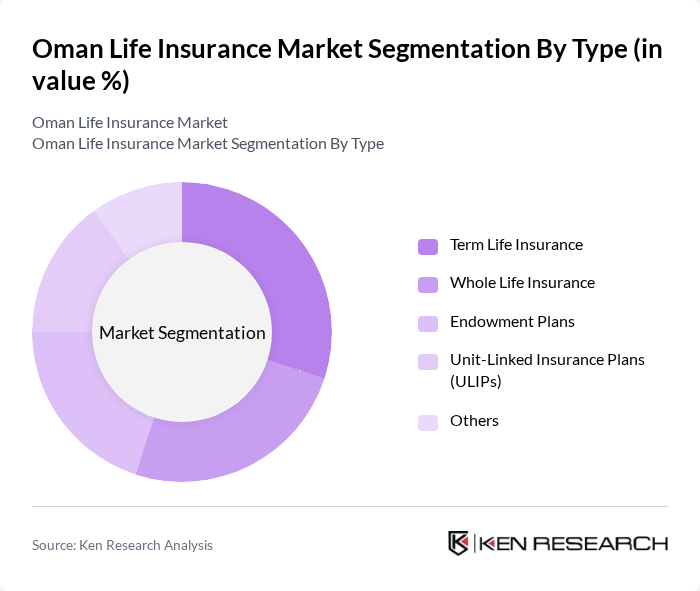

By Type:The life insurance market can be segmented into various types, including Term Life Insurance, Whole Life Insurance, Endowment Plans, Unit-Linked Insurance Plans (ULIPs), and Others. Each of these segments caters to different consumer needs and preferences, with specific features and benefits that appeal to various demographics.

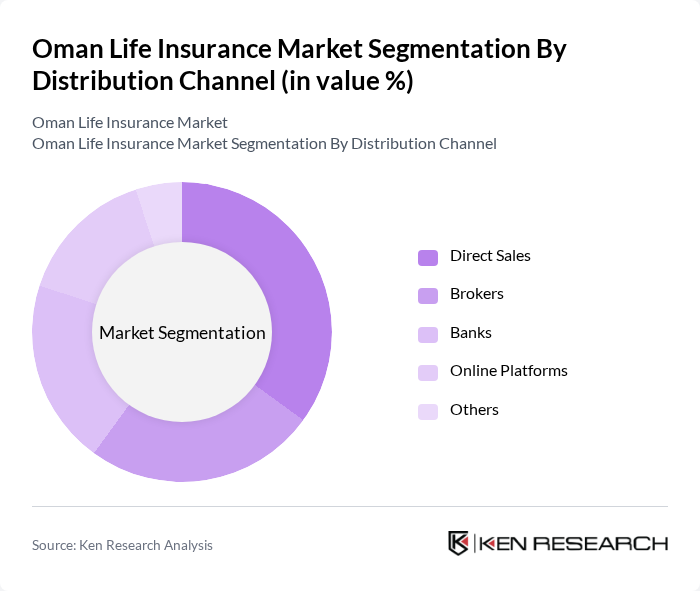

By Distribution Channel:The distribution channels for life insurance products include Direct Sales, Brokers, Banks, Online Platforms, and Others. Each channel plays a crucial role in reaching different customer segments and enhancing accessibility to insurance products.

The Oman Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Insurance Company S.A.O.G., Dhofar Insurance Company S.A.O.G., Muscat Insurance Company S.A.O.G., Al Ahlia Insurance Company S.A.O.G., National Life & General Insurance Company S.A.O.G., Oman United Insurance Company S.A.O.G., Takaful Oman Insurance S.A.O.G., Al Madina Takaful, Oman Reinsurance Company S.A.O.G., Muscat Capital LLC, Al Izz Islamic Bank, Bank Muscat, Oman Arab Bank, HSBC Oman, Bank Dhofar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman life insurance market appears promising, driven by increasing digitalization and a growing emphasis on customer-centric services. As technology continues to reshape the industry, insurers are expected to adopt advanced analytics and artificial intelligence to enhance product offerings and streamline operations. Additionally, the focus on health-linked insurance products is likely to expand, catering to the evolving needs of consumers seeking comprehensive coverage that aligns with their lifestyle choices.

| Segment | Sub-Segments |

|---|---|

| By Type | Term Life Insurance Whole Life Insurance Endowment Plans Unit-Linked Insurance Plans (ULIPs) Others |

| By Distribution Channel | Direct Sales Brokers Banks Online Platforms Others |

| By Customer Segment | Individual Customers Corporate Clients Government Entities Non-Profit Organizations |

| By Policy Term | Short-Term Policies Long-Term Policies |

| By Premium Payment Mode | Single Premium Regular Premium Limited Premium |

| By Age Group | Under 30 Years 50 Years Above 50 Years |

| By Coverage Amount | Low Coverage Medium Coverage High Coverage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Life Insurance Policies | 150 | Policyholders, Financial Advisors |

| Group Life Insurance Plans | 100 | HR Managers, Corporate Insurance Buyers |

| Insurance Agents and Brokers | 80 | Insurance Agents, Sales Managers |

| Regulatory Impact Assessment | 60 | Regulatory Officials, Compliance Officers |

| Consumer Behavior Insights | 120 | General Public, Policyholders |

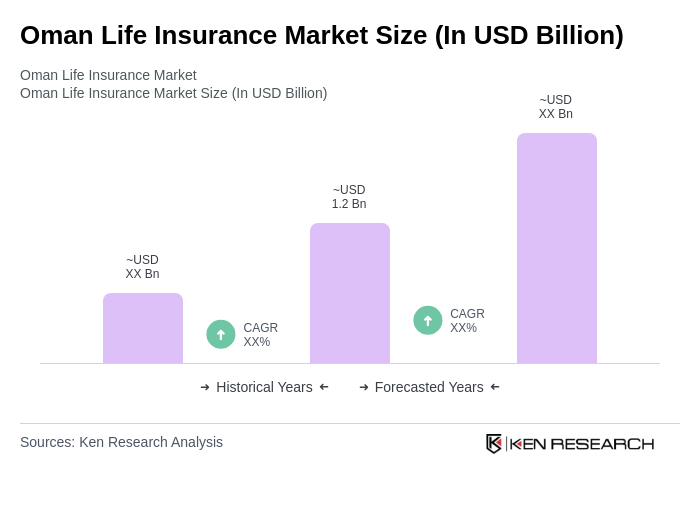

The Oman Life Insurance Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased awareness of financial security, rising disposable incomes, and a growing population seeking protection for their families and assets.