Region:Middle East

Author(s):Rebecca

Product Code:KRAB7387

Pages:92

Published On:October 2025

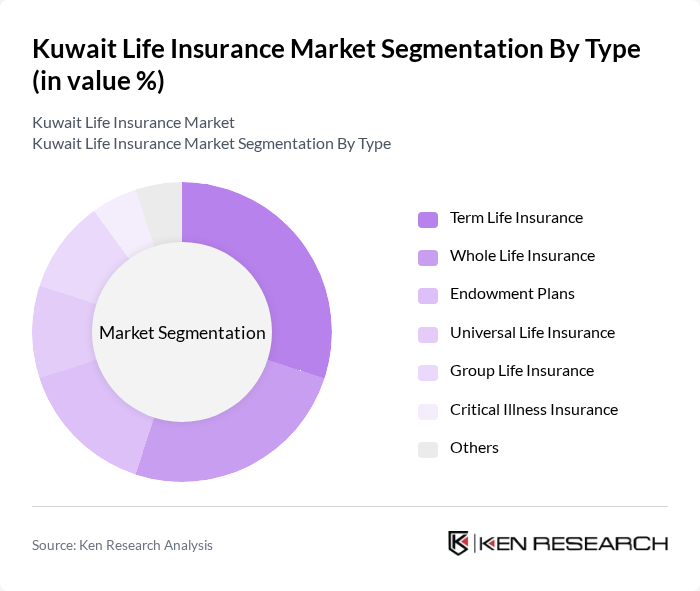

By Type:The life insurance market can be segmented into various types, including Term Life Insurance, Whole Life Insurance, Endowment Plans, Universal Life Insurance, Group Life Insurance, Critical Illness Insurance, and Others. Among these, Term Life Insurance is gaining traction due to its affordability and straightforward nature, appealing to a broad demographic. Whole Life Insurance, on the other hand, is favored for its savings component, attracting individuals looking for long-term financial security.

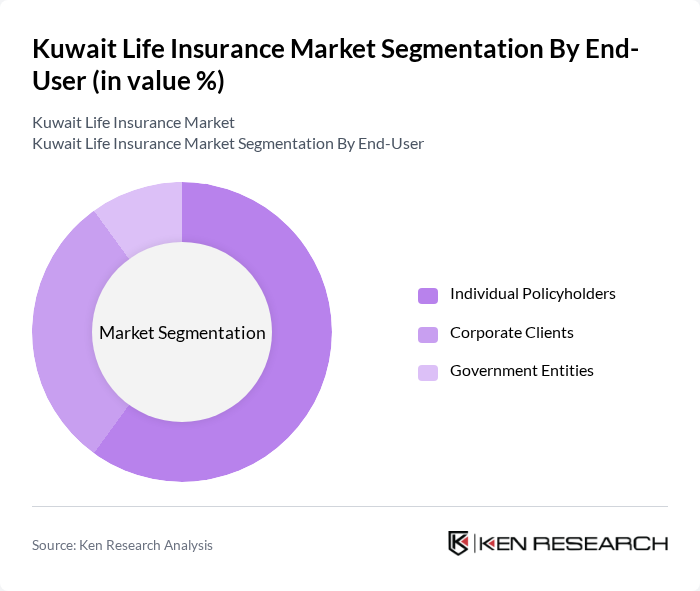

By End-User:The end-user segmentation includes Individual Policyholders, Corporate Clients, and Government Entities. Individual policyholders dominate the market, driven by a growing awareness of personal financial planning and the need for family protection. Corporate clients are increasingly purchasing group life insurance policies to provide benefits to their employees, while government entities are also engaging in insurance products to cover public sector employees.

The Kuwait Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Insurance Company, Gulf Insurance Group, Al Ahli United Bank, Warba Insurance Company, National Life & General Insurance Company, Takaful International Company, Al Sagr Cooperative Insurance Company, Kuwait Reinsurance Company, MetLife Alico, AXA Gulf, Zurich Insurance Group, Al-Masraf Insurance Company, Al-Ahli Insurance Company, Al-Jazeera Takaful Insurance Company, Al-Mawashi Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait life insurance market appears promising, driven by technological advancements and evolving consumer preferences. The integration of digital platforms for policy management is expected to enhance customer engagement and streamline operations. Additionally, the growing focus on health and wellness insurance products aligns with global trends, catering to an increasingly health-conscious population. As these trends continue to evolve, they will likely reshape the market landscape, fostering innovation and attracting new customers.

| Segment | Sub-Segments |

|---|---|

| By Type | Term Life Insurance Whole Life Insurance Endowment Plans Universal Life Insurance Group Life Insurance Critical Illness Insurance Others |

| By End-User | Individual Policyholders Corporate Clients Government Entities |

| By Distribution Channel | Direct Sales Brokers and Agents Online Platforms Banks and Financial Institutions |

| By Premium Payment Mode | Annual Payment Semi-Annual Payment Monthly Payment |

| By Customer Demographics | Age Group (Under 30, 30-50, 50+) Gender Income Level |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Policy Features | Riders and Add-Ons Investment Component Flexibility in Premium Payments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Life Insurance Policies | 150 | Policyholders, Financial Advisors |

| Group Life Insurance Plans | 100 | HR Managers, Corporate Insurance Brokers |

| Retirement and Pension Products | 80 | Financial Planners, Retirement Fund Managers |

| Health and Life Insurance Bundles | 70 | Insurance Agents, Customer Service Representatives |

| Insurance Market Trends and Insights | 90 | Market Analysts, Industry Experts |

The Kuwait Life Insurance Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased awareness of financial security, a rising expatriate population, and higher disposable incomes among Kuwaiti citizens.