Region:Asia

Author(s):Geetanshi

Product Code:KRAB5190

Pages:81

Published On:October 2025

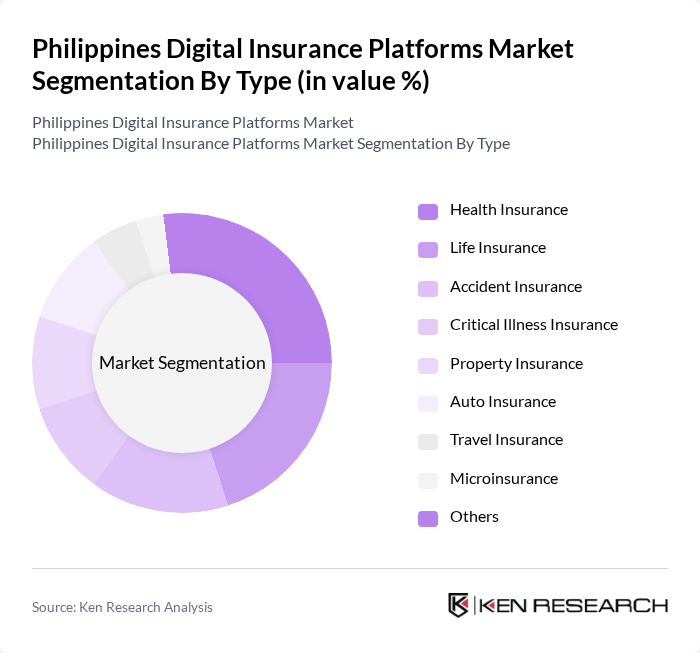

By Type:The market is segmented into Health Insurance, Life Insurance, Accident Insurance, Critical Illness Insurance, Property Insurance, Auto Insurance, Travel Insurance, Microinsurance, and Others. These segments address a broad spectrum of consumer needs, reflecting the diversity of insurance products available through digital channels. Health and life insurance remain the most prominent segments, driven by rising healthcare costs and increased awareness of financial protection. Microinsurance is gaining traction among underserved populations, while property and auto insurance are supported by urban growth and rising asset ownership .

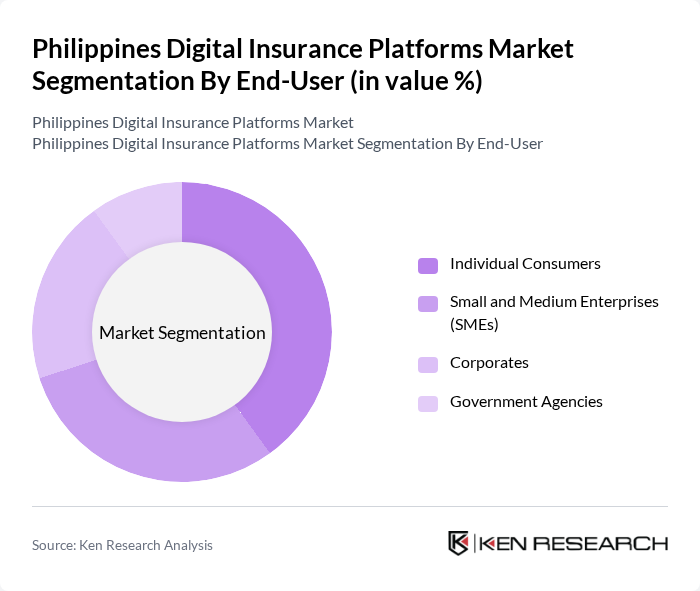

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Government Agencies. Individual consumers represent the largest segment, driven by increased financial literacy and digital access. SMEs and corporates are adopting digital insurance to manage business risks and employee benefits, while government agencies leverage digital platforms to expand public insurance coverage and streamline administrative processes .

The Philippines Digital Insurance Platforms Market features a dynamic mix of regional and international players. Leading participants such as Sun Life Financial, AXA Philippines, BPI AIA Life Assurance Corporation, FWD Life Insurance Corporation, Manulife Philippines, Insular Life Assurance Company, Ltd. (InLife), EastWest Ageas Life Insurance Corporation, Cocolife (United Coconut Planters Life Assurance Corporation), Allianz PNB Life Insurance, Inc., Generali Life Assurance Philippines, Inc., Tokio Marine Life Insurance Philippines, Inc., Pru Life UK, UnionDigital Bank (UnionBank of the Philippines), Standard Insurance Co., Inc., Igloo (Igloo Philippines/Igloo InsureTech), and PhilHealth (Philippine Health Insurance Corporation) drive innovation, geographic expansion, and service delivery. The market is witnessing increased collaboration with fintech providers and the integration of AI-based platforms to enhance customer experience and operational efficiency .

The future of the digital insurance market in the Philippines appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, more Filipinos are likely to embrace digital solutions for their insurance needs. Additionally, the integration of artificial intelligence and big data analytics will enhance risk assessment and customer service, making insurance products more accessible and tailored to individual needs. This trend is expected to foster greater competition and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Health Insurance Life Insurance Accident Insurance Critical Illness Insurance Property Insurance Auto Insurance Travel Insurance Microinsurance Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Government Agencies |

| By Distribution Channel | Direct Sales Online Platforms Insurance Brokers Agents |

| By Payment Method | Credit/Debit Cards Mobile Wallets Bank Transfers Cash Payments |

| By Customer Segment | Millennials Gen Z Baby Boomers Families |

| By Coverage Type | Comprehensive Coverage Basic Coverage Customizable Plans |

| By Policy Duration | Short-term Policies Long-term Policies Pay-as-you-go Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Digital Platforms | 60 | Product Managers, Marketing Directors |

| Life Insurance Digital Solutions | 50 | Sales Executives, Customer Experience Managers |

| Property Insurance Online Services | 40 | Underwriters, Risk Assessment Analysts |

| Consumer Awareness and Adoption | 70 | General Consumers, Financial Advisors |

| Regulatory Impact on Digital Insurance | 40 | Compliance Officers, Legal Advisors |

The Philippines Digital Insurance Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies, increased internet penetration, and heightened consumer awareness regarding insurance products and services.