Region:Europe

Author(s):Shubham

Product Code:KRAB1191

Pages:82

Published On:October 2025

By Type:The market is segmented into various types of dietary supplements, including vitamins, minerals, herbal/botanical supplements, protein and amino acid supplements, omega fatty acids, probiotics, multivitamins, and others such as enzymes and antioxidants. Among these,vitamins and minerals are the most populardue to their essential role in daily nutrition and health maintenance. The increasing awareness of nutritional deficiencies and the benefits of supplementation has led to a surge in demand for these products. The vitamin segment holds the highest market share, reflecting consumer preference for immune and general health support .

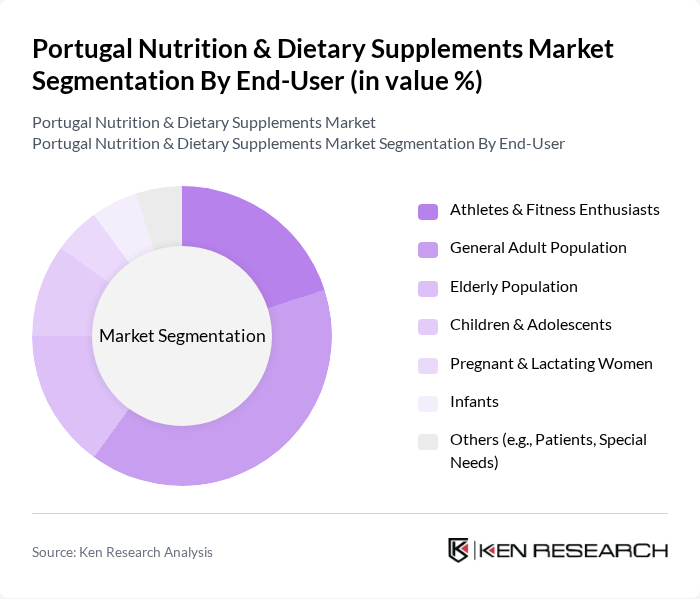

By End-User:The end-user segmentation includes athletes and fitness enthusiasts, the general adult population, the elderly population, children and adolescents, pregnant and lactating women, infants, and others such as patients with special needs. Thegeneral adult population represents the largest segment, driven by a growing focus on health and wellness, as well as preventive healthcare measures. This demographic is increasingly turning to dietary supplements to enhance their overall health and well-being .

The Portugal Nutrition & Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gold Nutrition (Nutri4Life, S.A.), Biocol Labs, Pharma Nord Portugal, Nutricia Portugal (Danone Group), Nestlé Portugal, S.A., Herbalife Nutrition Ltd., Amway Corporation, Glanbia Performance Nutrition, DSM Nutritional Products, GNC Holdings, Inc., Nature's Bounty Co., Solgar Inc., USANA Health Sciences, Inc., Swisse Wellness Pty Ltd., NOW Foods contribute to innovation, geographic expansion, and service delivery in this space .

The future of the nutrition and dietary supplements market in Portugal appears promising, driven by increasing health awareness and a growing preference for preventive healthcare. As consumers continue to seek personalized and plant-based options, companies are likely to innovate and expand their product offerings. Additionally, the integration of technology in supplement formulation and marketing will enhance consumer engagement, making it easier for brands to connect with their target audience and address their specific health needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal/Botanical Supplements Protein and Amino Acid Supplements Omega Fatty Acids Probiotics Multivitamins Others (e.g., Enzymes, Antioxidants) |

| By End-User | Athletes & Fitness Enthusiasts General Adult Population Elderly Population Children & Adolescents Pregnant & Lactating Women Infants Others (e.g., Patients, Special Needs) |

| By Distribution Channel | Pharmacies Health Food Stores Supermarkets/Hypermarkets Online Retail/E-commerce Direct Sales Others (e.g., Specialty Stores) |

| By Formulation | Tablets Capsules Powders Liquids/Soft Gels Gummies Others (e.g., Effervescent, Sprays) |

| By Price Range | Economy Mid-Range Premium Luxury |

| By Brand Type | National Brands Private Labels International Brands Generic Brands |

| By Consumer Demographics | Age Group Gender Income Level Lifestyle Choices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Dietary Supplements | 150 | Store Managers, Sales Representatives |

| Consumer Preferences in Nutrition | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Market Trends in Herbal Supplements | 100 | Herbal Product Distributors, Retail Buyers |

| Regulatory Impact on Supplement Sales | 80 | Regulatory Affairs Specialists, Compliance Officers |

| Trends in Vitamin and Mineral Consumption | 110 | Nutritionists, Health Coaches |

The Portugal Nutrition & Dietary Supplements Market is valued at approximately USD 705 million, reflecting a significant growth trend driven by increased health consciousness and preventive healthcare measures among consumers.