Region:Asia

Author(s):Geetanshi

Product Code:KRAB1682

Pages:91

Published On:October 2025

By Type:The market is segmented into various types of dietary supplements, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, functional foods & beverages, sports nutrition, and others. Among these, vitamins and protein supplements are particularly popular due to their perceived health benefits and widespread consumer acceptance. The increasing trend of fitness and wellness has led to a surge in demand for protein supplements, especially among athletes and health-conscious individuals. Functional foods and beverages represent the largest revenue-generating segment, while sports nutrition is the fastest-growing segment .

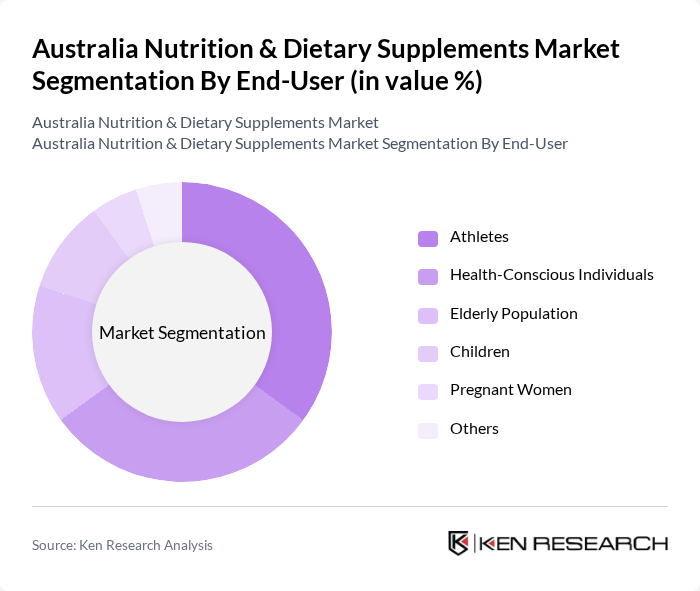

By End-User:The end-user segmentation includes athletes, health-conscious individuals, the elderly population, children, pregnant women, and others. Athletes and health-conscious individuals represent the largest segments, driven by the increasing focus on fitness and nutrition. The elderly population is also a significant segment, as they seek supplements to support their health and well-being. The trend toward personalized nutrition is especially pronounced among millennials, Gen Z, and seniors .

The Australia Nutrition & Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blackmores Limited, Swisse Wellness Pty Ltd, Herbalife Nutrition Ltd, Nature's Way, GNC Holdings, Inc., Vitaco Health Group Limited, BioCeuticals, Metagenics Australia Pty Ltd, Australian NaturalCare, Nature's Own, Ethical Nutrients, Bioglan, Cenovis, Thompson's Nutrition, Nutra-Life contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia nutrition and dietary supplements market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for innovative, high-quality products is expected to grow. Additionally, the integration of digital health solutions will likely enhance consumer engagement and product personalization, creating new avenues for market expansion. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Functional Foods & Beverages Sports Nutrition Others |

| By End-User | Athletes Health-Conscious Individuals Elderly Population Children Pregnant Women Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies Direct Sales Others |

| By Formulation | Tablets Capsules Powders Liquids Gummies Chewables Others |

| By Price Range | Economy Mid-Range Premium Luxury |

| By Brand Type | National Brands Private Labels Generic Brands |

| By Packaging Type | Bottles Blister Packs Pouches Jars Sachets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Dietary Supplements | 120 | Store Managers, Category Buyers |

| Consumer Preferences in Nutrition | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Market Trends in Herbal Supplements | 80 | Herbal Product Distributors, Retail Buyers |

| Impact of Regulatory Changes | 60 | Regulatory Affairs Specialists, Compliance Officers |

| Trends in Sports Nutrition Products | 100 | Sports Nutritionists, Gym Owners |

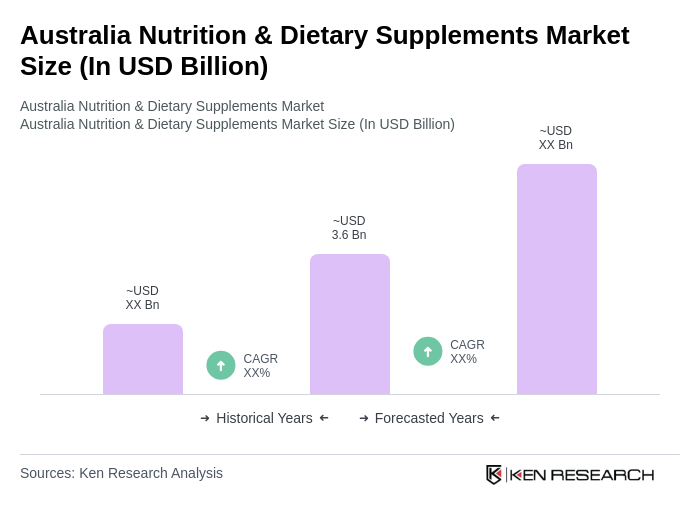

The Australia Nutrition & Dietary Supplements Market is valued at approximately USD 3.6 billion, reflecting significant growth driven by increased health awareness, preventive healthcare trends, and the rising popularity of fitness and wellness regimes among consumers.