Region:Middle East

Author(s):Dev

Product Code:KRAB2154

Pages:91

Published On:October 2025

By Type:The market is segmented into vitamins, minerals, herbal supplements, protein & amino acids, omega fatty acids, probiotics, prebiotics & postbiotics, fibers & specialty carbohydrates, and others. Vitamins and minerals remain the most popular segments, driven by their essential role in maintaining health and preventing deficiencies. Growing consumer awareness of micronutrient importance and the rise of personalized nutrition are fueling increased consumption, while herbal and natural supplements are gaining traction due to preferences for plant-based wellness solutions .

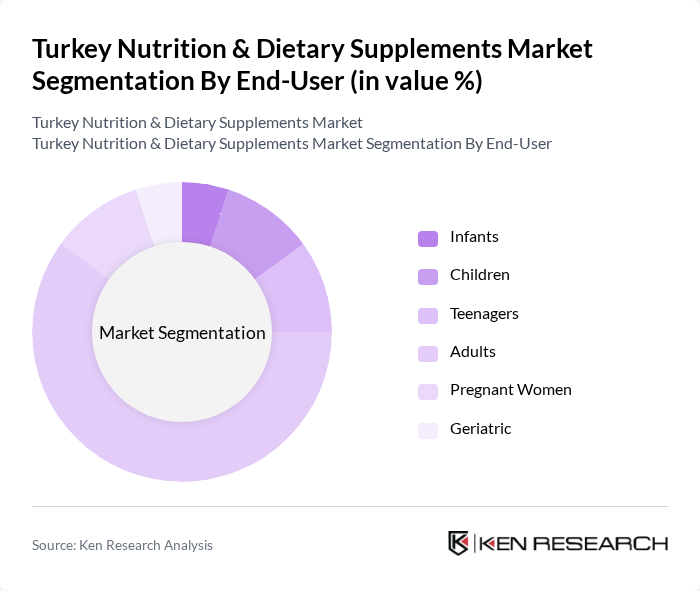

By End-User:The end-user segmentation includes infants, children, teenagers, adults, pregnant women, and geriatric individuals. Adults are the largest segment, reflecting a strong focus on health and wellness and the increasing prevalence of lifestyle-related health conditions. This demographic actively seeks dietary supplements for preventive health and wellness, making it the primary driver of market demand .

The Turkey Nutrition & Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abdi ?brahim ?laç Sanayi ve Ticaret A.?., Orzaks ?laç ve Kimya Sanayi Tic. A.?., Zade Vital (Zade Ya?lar? A.?.), Pharmanatura (pharmanatura.com.tr), Amway Turkey, Herbalife Nutrition Ltd. Turkey, GNC Türkiye (General Nutrition Centers), Solgar Turkey, Mega Lifesciences Turkey, Nature’s Supreme (HSK Biyoteknoloji A.?.), Now Foods Turkey, Nutraxin (B’iota Laboratuvarlar?), Voonka (Orzaks ?laç), New Life Vitamin Turkey, Pharmaton (Boehringer Ingelheim Turkey) contribute to innovation, geographic expansion, and service delivery in this space .

The Turkey Nutrition & Dietary Supplements Market is poised for significant evolution, driven by increasing consumer demand for transparency and quality. As health awareness continues to rise, brands that prioritize organic and natural ingredients are likely to gain a competitive edge. Additionally, the integration of technology in product development, such as personalized nutrition solutions, will cater to the growing consumer preference for tailored health products, enhancing market dynamics in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein & Amino Acids Omega Fatty Acids Probiotics Prebiotics & Postbiotics Fibers & Specialty Carbohydrates Others |

| By End-User | Infants Children Teenagers Adults Pregnant Women Geriatric |

| By Distribution Channel | Pharmacies and Drug Stores Online Retail Supermarkets/Hypermarkets Health Food Stores Others |

| By Formulation | Tablets Capsules Soft gels Powders Gummies Liquids Others |

| By Age Group | Children (0-12 years) Teenagers (13-19 years) Adults (20-64 years) Seniors (65+ years) |

| By Health Benefit / Application | Immune Support Digestive Health Weight Management / Energy Bone & Joint Health General Health Cardiac Health Diabetes Skin / Hair / Nails Brain / Mental Health Prenatal Health Others |

| By Price Range | Low Price Mid Price High Price |

| By Region | Marmara Central Anatolia Aegean Mediterranean Black Sea Eastern Anatolia Southeastern Anatolia |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Dietary Supplement Usage | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Retailer Insights on Supplement Sales | 60 | Store Managers, Product Buyers |

| Healthcare Professional Perspectives | 50 | Nutritionists, General Practitioners |

| Market Trends from Industry Experts | 40 | Market Analysts, Industry Consultants |

| Consumer Attitudes Towards Health Claims | 70 | General Public, Health Advocates |

The Turkey Nutrition & Dietary Supplements Market is valued at approximately USD 1.4 billion, reflecting a significant growth trend driven by increasing health consciousness and a shift towards preventive healthcare among consumers.