Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3772

Pages:100

Published On:October 2025

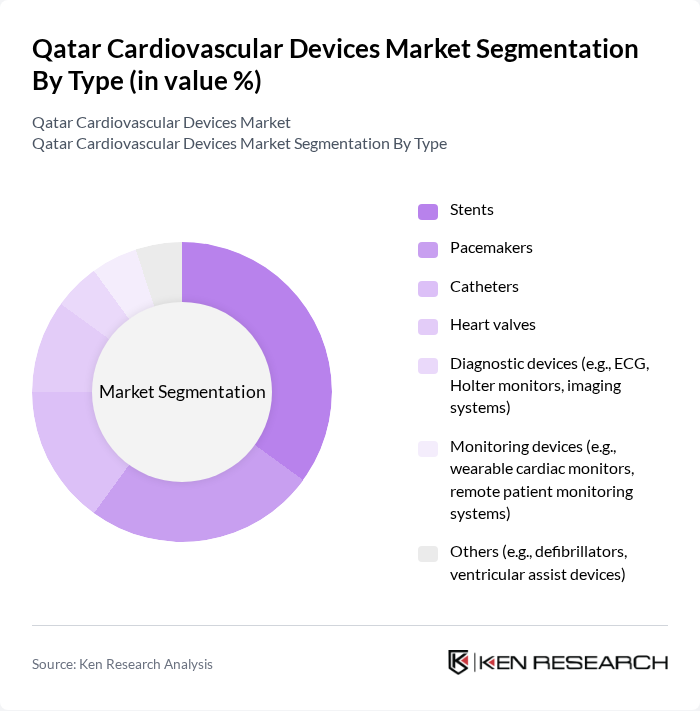

By Type:The segmentation by type includes various categories of cardiovascular devices that cater to different medical needs. The subsegments are Stents, Pacemakers, Catheters, Heart Valves, Diagnostic Devices (e.g., ECG, Holter monitors, imaging systems), Monitoring Devices (e.g., wearable cardiac monitors, remote patient monitoring systems), and Others (e.g., defibrillators, ventricular assist devices). Among these, stents and pacemakers are the most prominent due to their critical role in treating coronary artery diseases and arrhythmias, respectively. The market is also witnessing increased adoption of remote monitoring and wearable cardiac devices, reflecting the growing emphasis on preventive care and outpatient management .

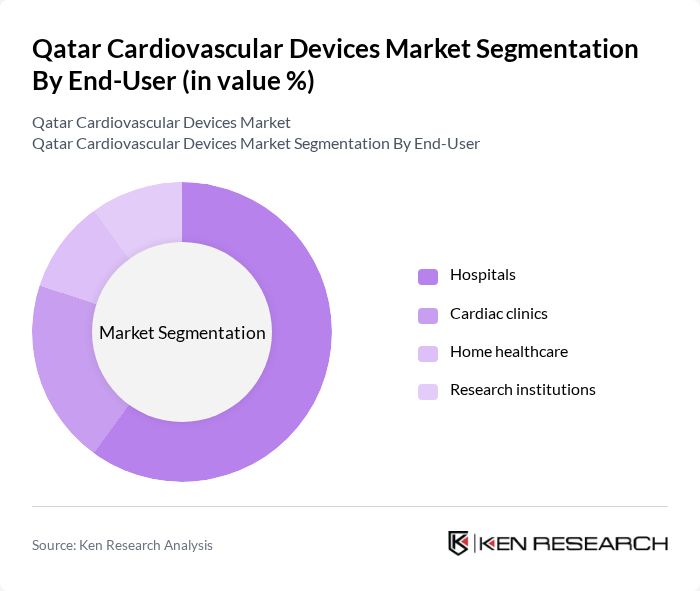

By End-User:The end-user segmentation includes Hospitals, Cardiac Clinics, Home Healthcare, and Research Institutions. Hospitals dominate this segment due to their advanced infrastructure and high procedure volumes, which necessitate the use of various cardiovascular devices. The increasing adoption of telemedicine and remote monitoring is also contributing to the growth of home healthcare, making it a significant segment in the market. Research institutions are expanding their role through clinical trials and device innovation, further diversifying end-user demand .

The Qatar Cardiovascular Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Boston Scientific, Abbott Laboratories, Johnson & Johnson, Siemens Healthineers, Philips Healthcare, Edwards Lifesciences, Biotronik, Terumo Corporation, B. Braun Melsungen AG, Stryker Corporation, Cook Medical, LivaNova, Cardiovascular Systems, Inc. (CSI), AtriCure, Inc., SCHILLER, Bionet Co., Ltd., Beurer GmbH, MEDEL INTERNATIONAL SRL contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Qatar cardiovascular devices market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the population ages and the prevalence of cardiovascular diseases rises, the demand for innovative devices is expected to grow. Additionally, the integration of telemedicine and digital health solutions will likely enhance patient monitoring and treatment adherence, further propelling market expansion. The focus on personalized medicine and preventive healthcare will also shape the future landscape of cardiovascular care in Qatar.

| Segment | Sub-Segments |

|---|---|

| By Type | Stents Pacemakers Catheters Heart valves Diagnostic devices (e.g., ECG, Holter monitors, imaging systems) Monitoring devices (e.g., wearable cardiac monitors, remote patient monitoring systems) Others (e.g., defibrillators, ventricular assist devices) |

| By End-User | Hospitals (dominant segment due to advanced infrastructure and high procedure volumes) Cardiac clinics Home healthcare (growing with telemedicine and remote monitoring adoption) Research institutions |

| By Application | Coronary artery disease (largest application segment globally and in Qatar) Heart failure Arrhythmia Congenital heart defects |

| By Distribution Channel | Direct sales (common for high-value devices and OEM partnerships) Distributors (key for broad market reach, especially for consumables and accessories) Online sales (emerging channel for monitoring devices and consumables) |

| By Component | Hardware (devices, implants, disposables) Software (AI analytics, remote monitoring platforms, EHR integration) Services (installation, training, maintenance, teleconsultation) |

| By Price Range | Low-end devices (basic monitoring, consumables) Mid-range devices (standard implants, diagnostic equipment) High-end devices (advanced implants, robotic systems, AI-enabled diagnostics) |

| By Technology | Traditional devices (conventional stents, pacemakers) Advanced devices (bioabsorbable stents, leadless pacemakers, transcatheter valves) Wearable technology (Holter monitors, patch ECG, remote patient monitoring) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiovascular Device Usage in Hospitals | 120 | Cardiologists, Hospital Administrators |

| Market Insights from Medical Device Distributors | 60 | Sales Managers, Distribution Executives |

| Patient Perspectives on Cardiovascular Treatments | 50 | Patients with Cardiovascular Conditions, Caregivers |

| Regulatory Insights from Health Authorities | 40 | Regulatory Affairs Specialists, Health Policy Makers |

| Technological Adoption in Cardiology | 45 | Biomedical Engineers, Clinical Technologists |

The Qatar Cardiovascular Devices Market is valued at approximately USD 50 million, driven by the increasing prevalence of cardiovascular diseases, advancements in medical technology, and rising healthcare expenditure.