Region:Middle East

Author(s):Shubham

Product Code:KRAC2248

Pages:98

Published On:October 2025

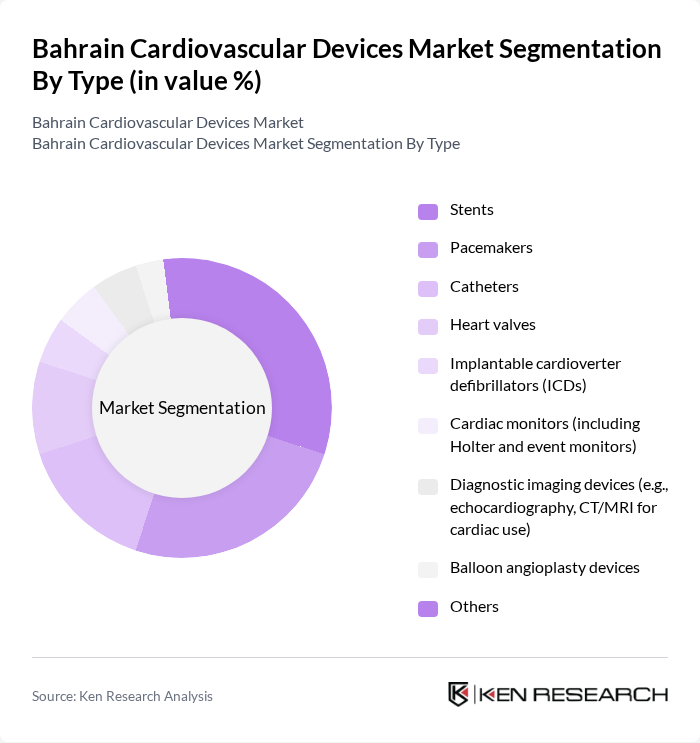

By Type:The market is segmented into various types of cardiovascular devices, including stents, pacemakers, catheters, heart valves, implantable cardioverter defibrillators (ICDs), cardiac monitors, diagnostic imaging devices, balloon angioplasty devices, and others. Among these,stentsandpacemakersare the most widely used due to their critical role in treating coronary artery disease and heart rhythm disorders. The increasing incidence of these conditions, along with the adoption of minimally invasive procedures and real-time monitoring, drives demand for these devices, making them dominant in the market .

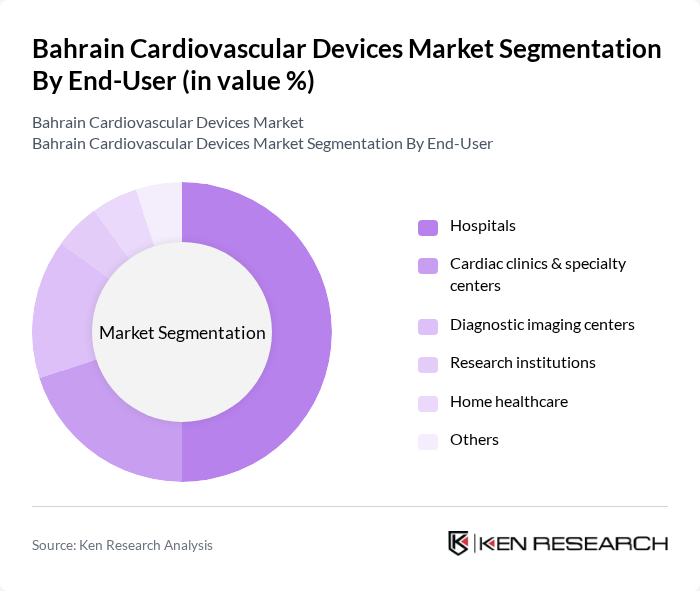

By End-User:The end-user segmentation includes hospitals, cardiac clinics & specialty centers, diagnostic imaging centers, research institutions, home healthcare, and others.Hospitalsare the leading end-users due to their comprehensive facilities and the high volume of cardiovascular procedures performed. The increasing number of patients requiring surgical interventions, the availability of advanced medical technologies, and the expansion of cardiac specialty centers contribute to their dominance in the market. The adoption of remote patient monitoring and telemedicine is also expanding the role of home healthcare in the segment .

The Bahrain Cardiovascular Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Medtronic plc, Boston Scientific Corporation, Johnson & Johnson (Biosense Webster, Cordis), Siemens Healthineers, Philips Healthcare, Edwards Lifesciences Corporation, B. Braun Melsungen AG, Terumo Corporation, Stryker Corporation, GE HealthCare, Cardiac Science Corporation (now part of Zoll Medical), Zoll Medical Corporation, AtriCure, Inc., LivaNova PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Bahrain cardiovascular devices market appears promising, driven by technological advancements and increasing healthcare investments. As the government continues to prioritize healthcare improvements, the integration of telemedicine and digital health solutions is expected to enhance patient monitoring and treatment adherence. Additionally, the growing geriatric population will further fuel demand for innovative cardiovascular solutions, ensuring that healthcare providers can meet the evolving needs of patients effectively and efficiently.

| Segment | Sub-Segments |

|---|---|

| By Type | Stents Pacemakers Catheters Heart valves Implantable cardioverter defibrillators (ICDs) Cardiac monitors (including Holter and event monitors) Diagnostic imaging devices (e.g., echocardiography, CT/MRI for cardiac use) Balloon angioplasty devices Others |

| By End-User | Hospitals Cardiac clinics & specialty centers Diagnostic imaging centers Research institutions Home healthcare Others |

| By Application | Coronary artery disease Heart rhythm disorders (arrhythmias) Heart failure Structural heart disease Others |

| By Distribution Channel | Direct sales Distributors Online sales Tender-based procurement Others |

| By Price Range | Low-end devices Mid-range devices High-end devices |

| By Component | Hardware Software Services |

| By Regulatory Approval Status | NHRA-approved devices Pending approval devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiovascular Device Procurement | 100 | Procurement Managers, Hospital Administrators |

| Cardiologist Insights | 60 | Cardiologists, Interventional Cardiologists |

| Patient Experience with Devices | 50 | Patients, Caregivers |

| Market Trends in Device Usage | 70 | Healthcare Analysts, Medical Device Sales Representatives |

| Regulatory Impact Assessment | 40 | Regulatory Affairs Specialists, Compliance Officers |

The Bahrain Cardiovascular Devices Market is valued at approximately USD 75 million, reflecting a significant growth driven by the rising prevalence of cardiovascular diseases and advancements in medical technology.