Region:Middle East

Author(s):Shubham

Product Code:KRAB7115

Pages:89

Published On:October 2025

By Type:The market is segmented into various types, including Freight Transportation, Warehousing Services, Last-Mile Delivery, Supply Chain Management, Project Logistics, Cold Chain Logistics, and Others. Among these, Freight Transportation is the leading sub-segment due to the increasing demand for efficient transportation solutions to support the booming construction sector.

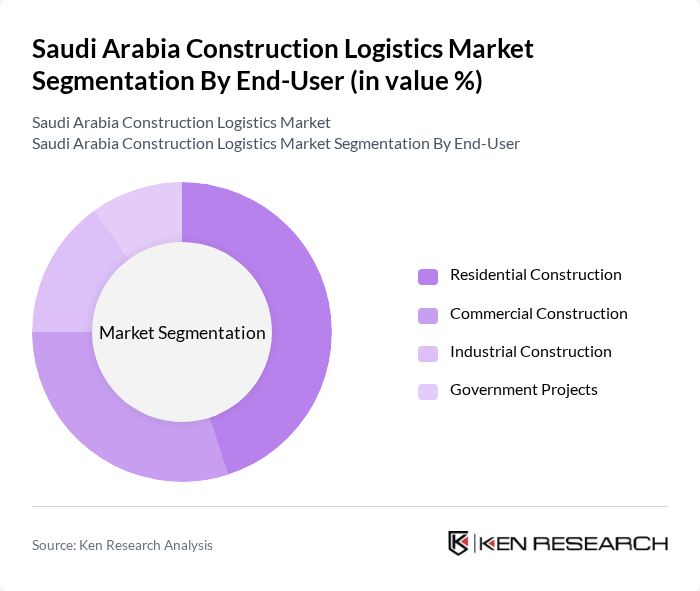

By End-User:The end-user segmentation includes Residential Construction, Commercial Construction, Industrial Construction, and Government Projects. The Residential Construction segment is currently the most significant contributor, driven by the increasing population and demand for housing in urban areas.

The Saudi Arabia Construction Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Logistics Services, Bahri Logistics, Agility Logistics, DHL Supply Chain, Aramex, Al-Futtaim Logistics, Kuehne + Nagel, DB Schenker, CEVA Logistics, Gulf Agency Company (GAC), Mena Logistics, Al-Muhaidib Group, Al-Jazira Transport, United Parcel Service (UPS), FedEx contribute to innovation, geographic expansion, and service delivery in this space.

The future of the construction logistics market in Saudi Arabia appears promising, driven by ongoing infrastructure investments and urbanization trends. As the government continues to prioritize mega projects, logistics providers will need to adapt to evolving demands. The integration of advanced technologies, such as automation and digital supply chain solutions, will enhance efficiency. Furthermore, the focus on sustainability will shape logistics practices, encouraging companies to adopt eco-friendly solutions to meet regulatory requirements and consumer expectations in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Transportation Warehousing Services Last-Mile Delivery Supply Chain Management Project Logistics Cold Chain Logistics Others |

| By End-User | Residential Construction Commercial Construction Industrial Construction Government Projects |

| By Service Type | Transportation Services Logistics Management Freight Forwarding Customs Brokerage |

| By Delivery Mode | Road Transport Rail Transport Air Transport Sea Transport |

| By Packaging Type | Bulk Packaging Unit Packaging Custom Packaging |

| By Geographic Coverage | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Subsidies for Logistics Companies Tax Incentives Infrastructure Development Grants Regulatory Support for Foreign Investment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Logistics | 100 | Project Managers, Logistics Coordinators |

| Commercial Building Supply Chain | 80 | Operations Managers, Procurement Specialists |

| Infrastructure Project Logistics | 70 | Site Managers, Construction Supervisors |

| Heavy Equipment Transportation | 60 | Fleet Managers, Logistics Analysts |

| Material Handling in Construction | 90 | Warehouse Managers, Supply Chain Directors |

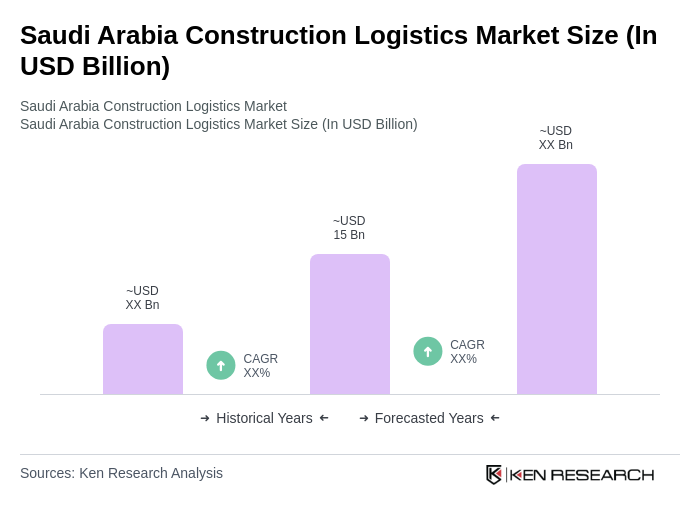

The Saudi Arabia Construction Logistics Market is valued at approximately USD 15 billion, driven by rapid urbanization, government investments in infrastructure, and the Vision 2030 initiative aimed at diversifying the economy and enhancing the logistics sector.