Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1060

Pages:84

Published On:October 2025

By Type:The corporate banking market can be segmented into various types, includingcorporate loans, trade finance, treasury and cash management, investment banking services, Islamic banking products, foreign exchange services, supply chain finance, project finance, syndicated loans, and others. Each segment addresses the diverse financing, liquidity, and risk management needs of businesses, with digital and Sharia-compliant solutions gaining prominence as part of the sector’s modernization and inclusion agenda .

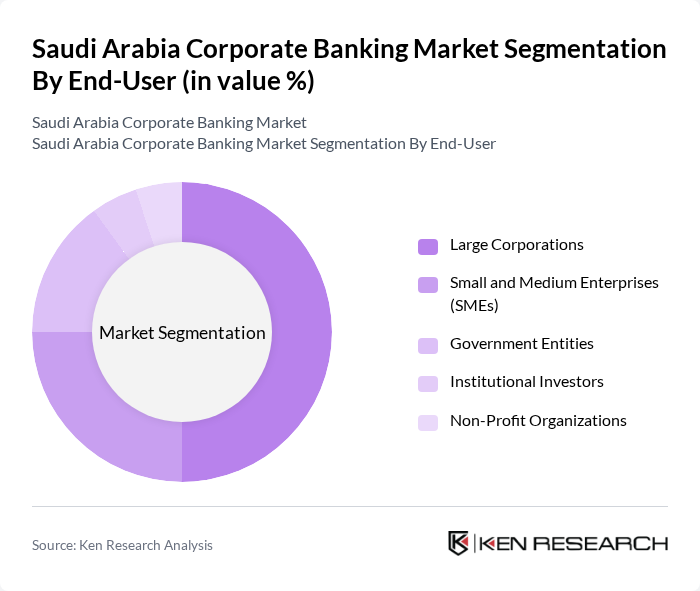

By End-User:The end-users of corporate banking services includelarge corporations, small and medium enterprises (SMEs), government entities, institutional investors, and non-profit organizations. Large corporations and government entities are the primary drivers of demand, particularly in infrastructure, energy, and public sector projects, while SMEs increasingly access tailored digital and Sharia-compliant banking solutions .

The Saudi Arabia Corporate Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi National Bank (SNB), Al Rajhi Bank, Riyad Bank, Banque Saudi Fransi, Arab National Bank, The Saudi British Bank (SABB), Alinma Bank, Bank Aljazira, Saudi Investment Bank, Gulf International Bank (GIB), Emirates NBD Saudi Arabia, Qatar National Bank (QNB) Saudi Arabia, Abu Dhabi Commercial Bank (ADCB) Saudi Arabia, HSBC Saudi Arabia, and NCB Capital contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi corporate banking market is poised for significant transformation, driven by ongoing economic diversification and technological advancements. As banks increasingly adopt AI and machine learning, operational efficiencies will improve, enhancing customer service. Additionally, the rise of sustainable financing will align with global trends, attracting environmentally conscious investments. The focus on customer-centric banking will further reshape service offerings, ensuring that banks remain competitive and responsive to the evolving needs of corporate clients in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Corporate Loans Trade Finance Treasury and Cash Management Investment Banking Services Islamic Banking Products Foreign Exchange Services Supply Chain Finance Project Finance Syndicated Loans Others |

| By End-User | Large Corporations Small and Medium Enterprises (SMEs) Government Entities Institutional Investors Non-Profit Organizations |

| By Industry Sector | Oil and Gas Construction Manufacturing Retail Telecommunications Healthcare Transportation and Logistics Utilities and Energy Others |

| By Service Channel | Direct Banking Online Banking Mobile Banking Relationship Managers Corporate Banking Portals |

| By Financing Type | Secured Financing Unsecured Financing Structured Financing Islamic Financing |

| By Geographical Presence | Central Region Eastern Region Western Region Southern Region Northern Region |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Programs Public-Private Partnerships |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Banking Services | 120 | Corporate Banking Managers, Relationship Managers |

| SME Financing Solutions | 60 | SME Owners, Financial Advisors |

| Trade Finance Products | 50 | Trade Finance Specialists, Export Managers |

| Digital Banking Adoption | 70 | IT Managers, Digital Transformation Officers |

| Risk Management Practices | 40 | Risk Managers, Compliance Officers |

The Saudi Arabia Corporate Banking Market is valued at approximately USD 33 billion, driven by increasing demand for corporate loans, trade finance, and investment banking services, particularly under the Vision 2030 initiative aimed at economic diversification.