Region:Middle East

Author(s):Shubham

Product Code:KRAA4734

Pages:86

Published On:September 2025

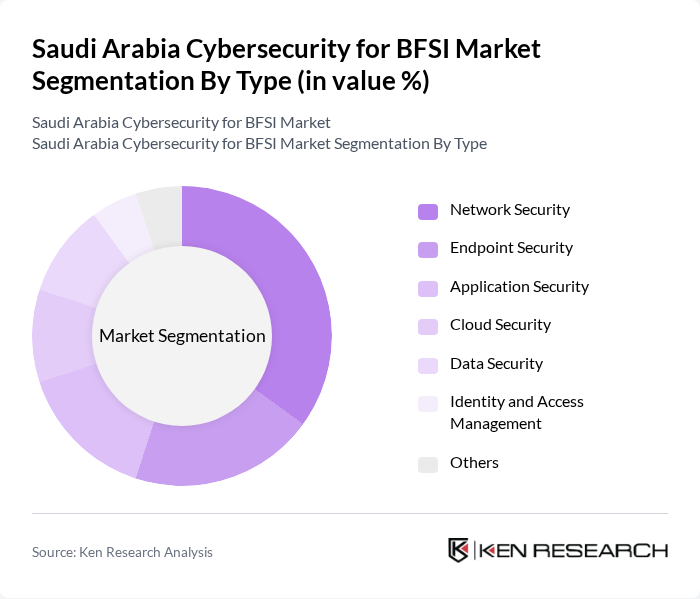

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Cloud Security, Data Security, Identity and Access Management, and Others. Among these, Network Security is the most dominant segment due to the increasing need to protect sensitive financial data from unauthorized access and cyberattacks. Organizations are investing heavily in firewalls, intrusion detection systems, and secure network architectures to safeguard their operations.

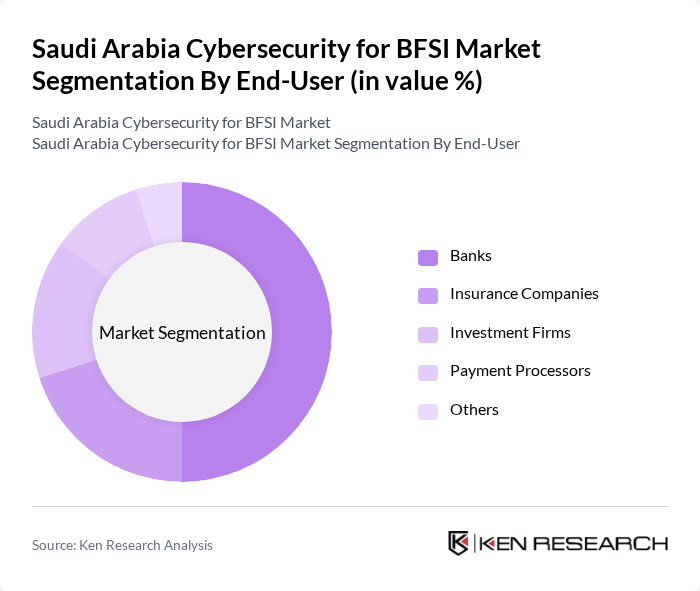

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Processors, and Others. Banks represent the largest segment, driven by the need for robust security measures to protect customer data and comply with regulatory requirements. The increasing digitization of banking services has heightened the focus on cybersecurity, leading to significant investments in protective technologies.

The Saudi Arabia Cybersecurity for BFSI Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Solutions, CyberX, DarkMatter, Secureworks, IBM Security, Cisco Systems, Fortinet, Check Point Software Technologies, Palo Alto Networks, Trend Micro, McAfee, FireEye, RSA Security, Kaspersky Lab, Symantec contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia cybersecurity market for BFSI is poised for significant evolution, driven by technological advancements and increasing regulatory pressures. As organizations embrace AI and machine learning for threat detection, the demand for innovative cybersecurity solutions will rise. Additionally, the growing emphasis on data privacy and protection will further compel financial institutions to enhance their cybersecurity frameworks, ensuring compliance and safeguarding customer information in an increasingly digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Processors Others |

| By Component | Solutions Services |

| By Deployment Mode | On-Premises Cloud-Based |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Industry Vertical | Retail Healthcare Government Telecommunications |

| By Policy Support | Subsidies Tax Exemptions Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Cybersecurity Strategies | 100 | IT Security Managers, Risk Assessment Officers |

| Insurance Industry Cyber Threat Management | 80 | Compliance Officers, Cybersecurity Analysts |

| Investment Firms' Data Protection Measures | 70 | Data Protection Officers, IT Directors |

| Fintech Innovations in Cybersecurity | 60 | Product Managers, CTOs |

| Regulatory Compliance in BFSI Cybersecurity | 90 | Legal Advisors, Regulatory Affairs Managers |

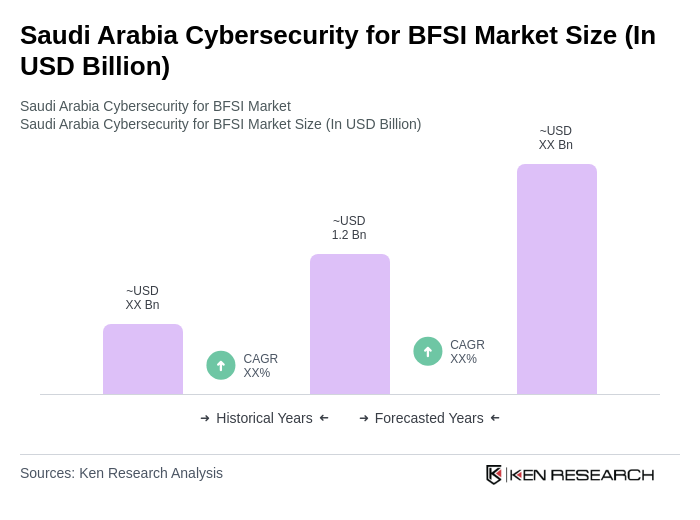

The Saudi Arabia Cybersecurity for BFSI Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing cyber threats, regulatory compliance, and the digital transformation of the banking, financial services, and insurance sectors.