Region:Middle East

Author(s):Shubham

Product Code:KRAD3601

Pages:88

Published On:November 2025

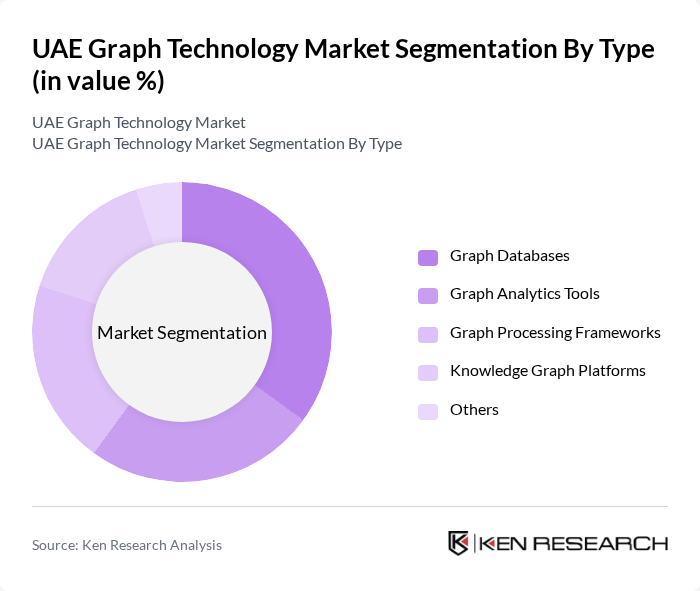

By Type:The market is segmented into various types, including Graph Databases, Graph Analytics Tools, Graph Processing Frameworks, Knowledge Graph Platforms, and Others. Each of these sub-segments plays a crucial role in the overall market dynamics, catering to different business needs and technological advancements. Graph Databases are widely adopted for their ability to efficiently store and query complex relationships, while Graph Analytics Tools and Knowledge Graph Platforms are increasingly used for advanced analytics, AI, and semantic search applications .

The Graph Databases sub-segment is currently dominating the market due to the increasing need for efficient data storage and retrieval solutions. Organizations are increasingly adopting graph databases to manage complex relationships within their data, which is essential for applications such as social networks, fraud detection, and recommendation systems. The growing trend of data-driven decision-making and the integration of AI across industries is further propelling the demand for graph databases, making them a critical component of the overall graph technology landscape .

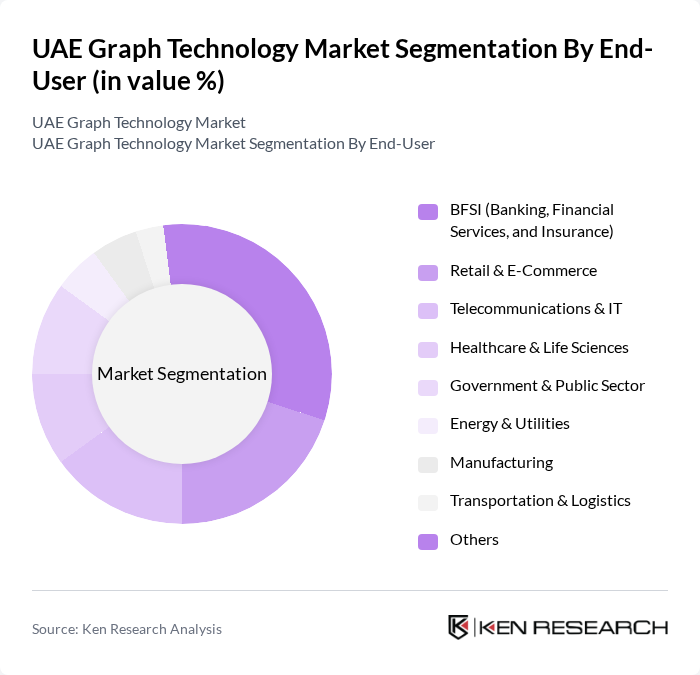

By End-User:The market is segmented by end-user into BFSI (Banking, Financial Services, and Insurance), Retail & E-Commerce, Telecommunications & IT, Healthcare & Life Sciences, Government & Public Sector, Energy & Utilities, Manufacturing, Transportation & Logistics, and Others. Each end-user segment has unique requirements and applications for graph technology. BFSI leverages graph technology for fraud detection and risk analytics; Retail & E-Commerce uses it for recommendation engines and customer analytics; Telecommunications & IT apply graph solutions for network optimization and customer experience management; Healthcare & Life Sciences utilize graph databases for patient data integration and drug discovery; Government & Public Sector focus on smart city and citizen services; while other segments use graph technology for supply chain, asset management, and operational efficiency .

The BFSI sector is the leading end-user of graph technology, driven by the need for advanced analytics, fraud detection, and regulatory compliance. Financial institutions are increasingly leveraging graph technology to analyze complex relationships and transactions, enabling them to identify suspicious activities, enhance customer experiences, and meet stringent data protection requirements. The growing emphasis on digital transformation and data security in the BFSI sector further supports the adoption of graph technology solutions .

The UAE Graph Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, Microsoft Corporation, Neo4j, Inc., Amazon Web Services, Inc., IBM Corporation, TigerGraph, Inc., DataStax, Inc., ArangoDB GmbH, SAP SE, TIBCO Software Inc., Ontotext AD (GraphDB), Redis Ltd., Couchbase, Inc., Franz Inc. (AllegroGraph), Memgraph Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE graph technology market appears promising, driven by ongoing advancements in data analytics and AI. As organizations increasingly recognize the value of real-time data processing, the adoption of graph databases is expected to rise significantly. Furthermore, collaboration between tech companies and academic institutions will likely foster innovation, leading to the development of more sophisticated graph solutions tailored to specific industry needs, enhancing overall market growth and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Graph Databases Graph Analytics Tools Graph Processing Frameworks Knowledge Graph Platforms Others |

| By End-User | BFSI (Banking, Financial Services, and Insurance) Retail & E-Commerce Telecommunications & IT Healthcare & Life Sciences Government & Public Sector Energy & Utilities Manufacturing Transportation & Logistics Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Others |

| By Application | Fraud Detection & Anti-Money Laundering Network & IT Operations Analytics Recommendation Engines Social Network Analysis Supply Chain & Logistics Optimization Knowledge Management & Search Customer 360 & Personalization Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Umm Al Quwain Others |

| By Industry Vertical | BFSI Retail & E-Commerce Telecommunications & IT Healthcare & Life Sciences Government & Public Sector Energy & Utilities Manufacturing Transportation & Logistics Others |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Graph Technology Adoption | 100 | IT Directors, Data Analysts |

| Healthcare Data Management Solutions | 70 | Healthcare IT Managers, Data Scientists |

| Telecommunications Network Optimization | 60 | Network Engineers, Operations Managers |

| Retail Customer Insights and Analytics | 80 | Marketing Managers, Business Analysts |

| Government Data Integration Projects | 50 | Policy Makers, IT Project Managers |

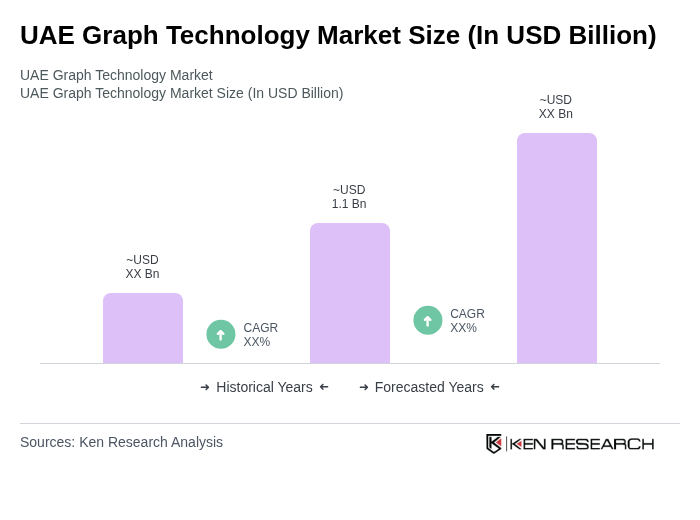

The UAE Graph Technology Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the increasing adoption of advanced data analytics, artificial intelligence, and efficient data management solutions across various sectors.