Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8197

Pages:98

Published On:December 2025

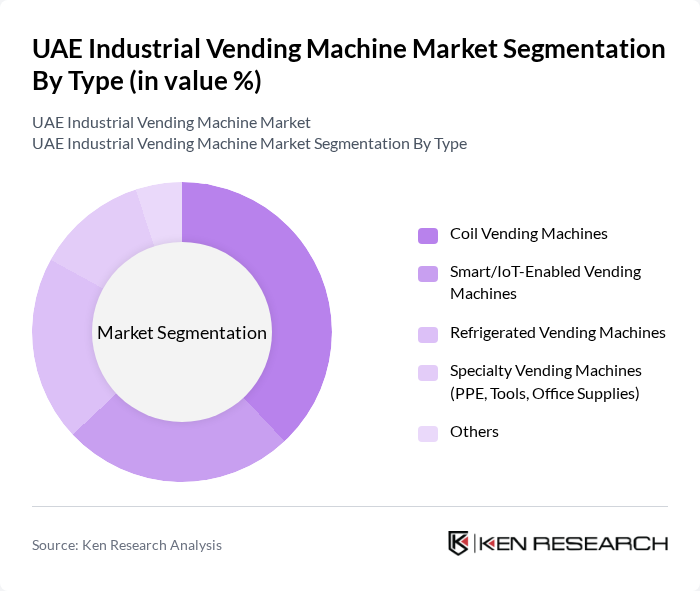

By Type:The market is segmented into various types of vending machines, including Coil Vending Machines, Carousel Vending Machines, Cabinet Vending Machines, and Others. Among these, Coil Vending Machines are leading due to their versatility and ability to dispense a wide range of products, making them popular in industrial settings. Carousel Vending Machines are also gaining traction for their efficient space utilization and high product visibility. The demand for Cabinet Vending Machines is growing as they provide secure storage for valuable tools and equipment.

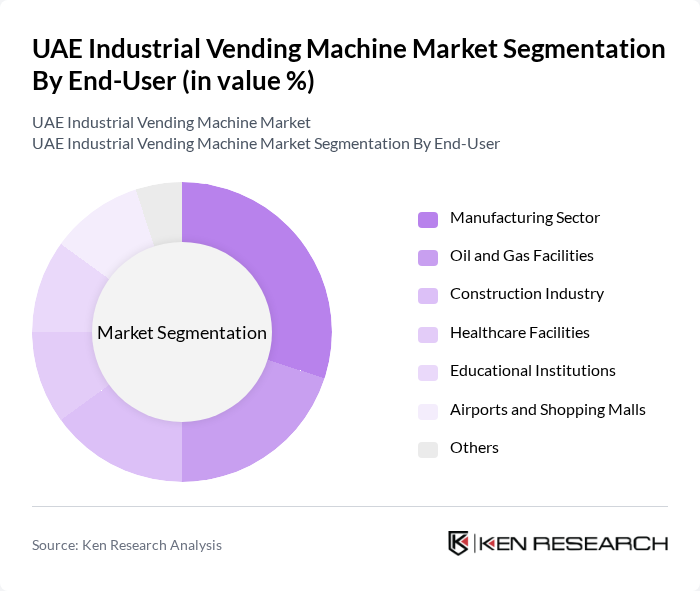

By End-User:The end-user segmentation includes the Manufacturing Sector, Oil & Gas Industry, Construction Industry, Aerospace Sector, and Others. The Manufacturing Sector is the dominant end-user, driven by the need for quick access to tools and parts, which enhances productivity and reduces operational delays. The Oil & Gas Industry follows closely, as companies seek to improve safety and efficiency in remote locations. The Construction Industry is also a significant user, requiring immediate access to equipment and safety gear on-site.

The UAE Industrial Vending Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Harbi Group, Al Futtaim Group, Emaar Properties, Majid Al Futtaim, Lulu Hypermarket, Carrefour UAE, Spinneys, Ace Hardware UAE, Bin Dasmal Group, Azadea Group, Plug and Play Tech Center (UAE Operations), Tradekey UAE, Etisalat Digital (IoT Solutions Provider), du (Emirates Integrated Telecommunications Company), Honeywell UAE (Automation & Controls) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE industrial vending machine market appears promising, driven by technological advancements and a growing emphasis on automation. As businesses increasingly recognize the benefits of vending solutions, particularly in terms of efficiency and cost savings, adoption rates are expected to rise. Furthermore, the integration of cashless payment systems and smart technologies will enhance user experience, making vending machines more attractive to a broader range of industries, including healthcare and education.

| Segment | Sub-Segments |

|---|---|

| By Type | Coil Vending Machines Carousel Vending Machines Cabinet Vending Machines Others |

| By End-User | Manufacturing Sector Oil & Gas Industry Construction Industry Aerospace Sector Others |

| By Product Category | Personal Protective Equipment (PPE) MRO Tools (Maintenance, Repair & Operations) Others |

| By Payment Method | Cash Payments Card Payments Mobile Payments Contactless Payments Others |

| By Location | Manufacturing Facilities Industrial Zones Oil & Gas Operations Construction Sites Others |

| By Machine Size | Small Vending Machines Medium Vending Machines Large Vending Machines Custom Size Vending Machines Others |

| By Service Type | Full-Service Vending Self-Service Vending Maintenance and Support Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Office Vending Solutions | 65 | Facility Managers, Office Administrators |

| Healthcare Facility Vending Machines | 52 | Procurement Officers, Hospital Administrators |

| Educational Institution Vending Services | 48 | Campus Managers, Student Services Coordinators |

| Retail Sector Vending Operations | 58 | Store Managers, Retail Operations Directors |

| Public Space Vending Installations | 42 | City Planners, Public Facility Managers |

The UAE Industrial Vending Machine Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by the increasing demand for automated solutions across various industries, enhancing operational efficiency and reducing downtime.