Japan Medical Imaging Market Overview

- The Japan Medical Imaging Market is valued at USD 1.8 billion, based on a five-year historical analysis of equipment and modality-based revenues reported for Japan. This growth is primarily driven by advancements in imaging technologies, increasing prevalence of chronic and lifestyle-related diseases, and a growing aging population that demands more diagnostic imaging services. The market is also supported by government and payer initiatives aimed at enhancing healthcare infrastructure, expanding cancer and cardiovascular screening programs, and promoting early disease detection through imaging.

- Tokyo, Osaka, and Yokohama are the dominant cities in the Japan Medical Imaging Market due to their advanced healthcare facilities, high concentration of hospitals and diagnostic centers, and significant investments in medical technology. These cities are also located within the broader Kanto and Kansai regions that host leading academic medical centers and imaging vendors, which further strengthens their market position and facilitates access to cutting-edge imaging solutions, including AI-enabled CT, MRI, and PET-CT, for healthcare providers.

- In 2023, the Japanese government implemented updated reimbursement and approval pathways that accelerate the clinical use of AI and advanced imaging technologies in hospitals to improve diagnostic accuracy and patient outcomes, building on earlier regulatory reforms under the Pharmaceuticals and Medical Devices Act overseen by the Ministry of Health, Labour and Welfare (MHLW). In particular, the Pharmaceuticals and Medical Devices Act (Act No. 145 of 1960, as amended by MHLW and the Pharmaceuticals and Medical Devices Agency) sets binding requirements for marketing authorization, quality, and safety of CT, MRI, X-ray, nuclear medicine, and related software, including AI-enabled imaging systems. This framework requires healthcare facilities and vendors to use approved digital imaging systems that comply with performance, post?marketing surveillance, and traceability standards, thereby supporting nationwide adoption of modern and AI-supported medical imaging.

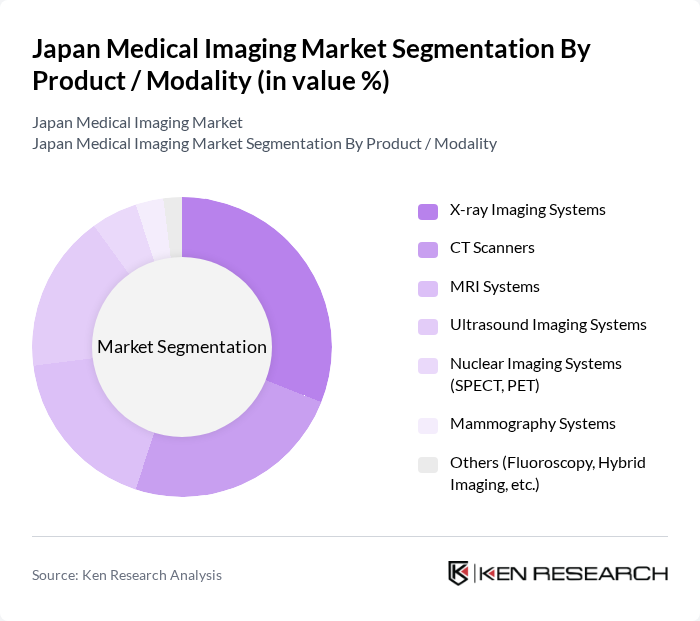

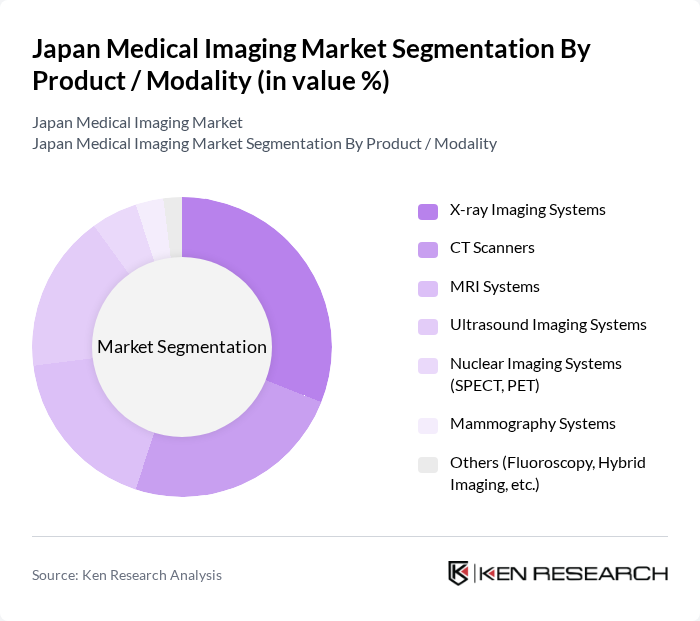

Japan Medical Imaging Market Segmentation

By Product / Modality:The market is segmented into various imaging modalities, each serving distinct diagnostic needs. The primary modalities include X-ray Imaging Systems, CT Scanners, MRI Systems, Ultrasound Imaging Systems, Nuclear Imaging Systems (SPECT, PET), Mammography Systems, and Others (Fluoroscopy, Hybrid Imaging, etc.). In the overall diagnostic imaging services mix in Japan, X?ray accounts for the largest share of modality revenues, with X?ray retaining around one?third of diagnostic imaging services market value, followed by CT and ultrasound. High-field MRI systems, however, remain a critical growth segment due to their non-invasive nature and superior imaging capabilities, particularly in oncology and neurology, and their increasing use in advanced neuro, musculoskeletal, and prostate imaging.

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Clinics, Academic Institutes and Research Organizations, and Others. Hospitals dominate the market as they are the primary providers of medical imaging services, equipped with comprehensive modality portfolios and staffed by specialized radiologists and technologists. Large university and tertiary hospitals in major metropolitan areas lead early adoption of AI-assisted imaging protocols, hybrid PET?CT and PET?MRI systems, and advanced PACS/RIS integration, while independent diagnostic imaging centers are gradually increasing their share by offering high-throughput, cost-efficient scanning services.

Japan Medical Imaging Market Competitive Landscape

The Japan Medical Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Hitachi, Ltd. (Hitachi Healthcare / Hitachi Medical), Siemens Healthineers Japan, GE Healthcare Japan Corporation, Philips Japan, Ltd. (Koninklijke Philips N.V.), Shimadzu Corporation, Hologic, Inc., Agfa-Gevaert Group, Carestream Health, Inc., Mindray Medical International Limited, Samsung Medison Co., Ltd., Koning Corporation, EIZO Corporation, Other Emerging Domestic Players contribute to innovation, geographic expansion, and service delivery in this space.

Japan Medical Imaging Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as diabetes and cardiovascular conditions is a significant growth driver for the medical imaging market in Japan. In future, approximately 10 million people are expected to be diagnosed with diabetes, leading to increased imaging needs for monitoring and diagnosis. The healthcare expenditure related to chronic diseases is projected to reach ¥40 trillion, emphasizing the demand for advanced imaging technologies to support early detection and management.

- Technological Advancements in Imaging Modalities:Continuous innovations in imaging technologies, such as MRI and CT scans, are propelling market growth. In future, the Japanese market is expected to see a 15% increase in the adoption of AI-integrated imaging systems, enhancing diagnostic accuracy. The introduction of high-resolution imaging and 3D visualization techniques is projected to improve patient outcomes, with an estimated 20% reduction in diagnostic errors, further driving demand for these advanced modalities.

- Rising Geriatric Population:Japan's aging population is a critical factor influencing the medical imaging market. In future, over 30% of the population will be aged 65 and older, leading to a higher incidence of age-related diseases requiring imaging services. The government’s healthcare budget for elderly care is expected to exceed ¥20 trillion, highlighting the need for efficient imaging solutions to cater to this demographic's healthcare requirements, thus driving market growth.

Market Challenges

- High Cost of Advanced Imaging Equipment:The substantial investment required for advanced imaging equipment poses a significant challenge for healthcare providers in Japan. The average cost of MRI machines can exceed ¥100 million, making it difficult for smaller facilities to acquire such technology. This financial barrier limits access to cutting-edge imaging services, particularly in rural areas, where healthcare budgets are constrained, impacting overall market growth.

- Shortage of Skilled Professionals:The medical imaging sector faces a critical shortage of trained professionals, which hampers service delivery. In future, it is estimated that Japan will need an additional 15,000 radiologists to meet the growing demand for imaging services. This shortage is exacerbated by an aging workforce, with nearly 40% of current radiologists expected to retire within the next decade, creating a significant gap in expertise and impacting patient care.

Japan Medical Imaging Market Future Outlook

The future of the medical imaging market in Japan appears promising, driven by technological advancements and demographic shifts. The integration of AI and machine learning into imaging technologies is expected to enhance diagnostic capabilities significantly. Additionally, the increasing focus on value-based healthcare will likely lead to more efficient imaging practices. As healthcare infrastructure continues to evolve, the demand for innovative imaging solutions will grow, ensuring that the market remains dynamic and responsive to patient needs.

Market Opportunities

- Expansion of Telemedicine Services:The rise of telemedicine presents a unique opportunity for the medical imaging market. In future, telemedicine consultations are projected to increase by 25%, allowing for remote imaging interpretations. This shift can enhance access to imaging services, particularly in underserved areas, and improve patient engagement, ultimately driving market growth and innovation in imaging technologies.

- Development of Portable Imaging Devices:The demand for portable imaging devices is on the rise, particularly in emergency and rural healthcare settings. In future, the market for portable ultrasound devices is expected to grow by 30%, driven by their ease of use and accessibility. This trend will facilitate timely diagnostics and improve patient outcomes, creating significant opportunities for manufacturers and healthcare providers alike.