Region:Asia

Author(s):Geetanshi

Product Code:KRAA4261

Pages:93

Published On:January 2026

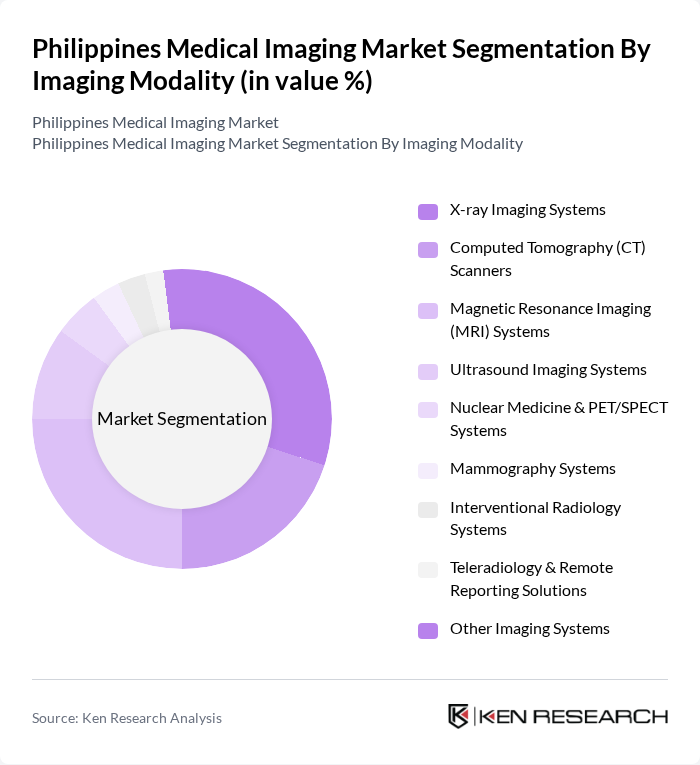

By Imaging Modality:The imaging modality segment includes various technologies used for medical imaging, each serving specific diagnostic purposes. The subsegments include X-ray Imaging Systems, Computed Tomography (CT) Scanners, Magnetic Resonance Imaging (MRI) Systems, Ultrasound Imaging Systems, Nuclear Medicine & PET/SPECT Systems, Mammography Systems, Interventional Radiology Systems, Teleradiology & Remote Reporting Solutions, and Other Imaging Systems. Among these, X-ray Imaging Systems and Ultrasound Imaging Systems are particularly prominent due to their essential role in first-line diagnostics, broad availability across primary and secondary facilities, and relatively lower cost compared with advanced modalities, while CT and MRI volumes are concentrated in larger hospitals and referral centers.

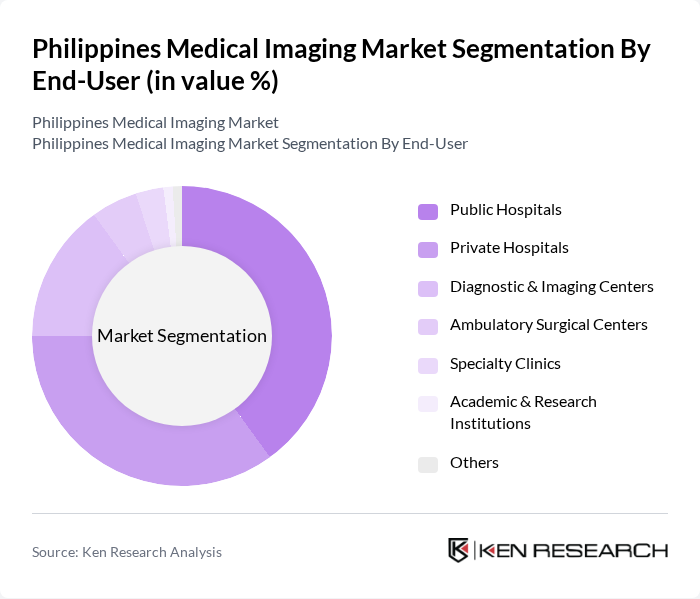

By End-User:The end-user segment encompasses various healthcare facilities that utilize medical imaging services. This includes Public Hospitals, Private Hospitals, Diagnostic & Imaging Centers, Ambulatory Surgical Centers, Specialty Clinics, Academic & Research Institutions, and Others. Public and Private Hospitals dominate this segment due to their extensive patient base, broad clinical case mix, emergency and inpatient demand, and the critical role of imaging in diagnosis, treatment planning, and monitoring across specialties such as oncology, cardiology, neurology, and trauma care, while independent diagnostic and imaging centers play a significant role in outpatient and self-pay imaging, especially in urban areas.

The Philippines Medical Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Siemens Healthineers, GE HealthCare, Canon Medical Systems, Fujifilm Healthcare, Hitachi Healthcare, Carestream Health, Agfa HealthCare, Mindray Medical International, Samsung Medison, Hologic, Inc., Varian Medical Systems, Neusoft Medical Systems, Local and Regional Imaging Service Providers (Key Hospitals & Chains), Emerging Domestic Distributors & System Integrators contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines medical imaging market is poised for transformative growth, driven by technological innovations and increasing healthcare investments. The integration of artificial intelligence in imaging diagnostics is expected to enhance accuracy and efficiency, while the expansion of telemedicine will improve access to imaging services, particularly in underserved areas. As healthcare policies evolve to support public-private partnerships, the market is likely to witness enhanced collaboration, fostering innovation and improving patient care across the nation.

| Segment | Sub-Segments |

|---|---|

| By Imaging Modality | X-ray Imaging Systems Computed Tomography (CT) Scanners Magnetic Resonance Imaging (MRI) Systems Ultrasound Imaging Systems Nuclear Medicine & PET/SPECT Systems Mammography Systems Interventional Radiology Systems Teleradiology & Remote Reporting Solutions Other Imaging Systems |

| By End-User | Public Hospitals Private Hospitals Diagnostic & Imaging Centers Ambulatory Surgical Centers Specialty Clinics Academic & Research Institutions Others |

| By Clinical Application | Oncology Cardiology Neurology Musculoskeletal & Orthopedics Obstetrics & Gynecology Gastroenterology & Abdominal Others |

| By Technology | Digital Imaging Systems Analog / Conventional Imaging Systems Hybrid & Advanced Imaging Systems Portable & Point-of-care Imaging Systems |

| By Region | Metro Manila (NCR) Rest of Luzon Visayas Mindanao |

| By Payer Type | Out-of-Pocket (Self-Pay) Private Health Insurance PhilHealth and Other Public Schemes Corporate & HMO Contracts |

| By Ownership & Operating Model | Hospital-owned In-house Imaging Departments Independent Standalone Imaging Centers Public-Private Partnership (PPP) Facilities Franchise & Network-based Imaging Chains Teleradiology & Outsourced Reporting Hubs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Technologists |

| Private Imaging Centers | 90 | Center Managers, Equipment Buyers |

| Healthcare Policy Makers | 60 | Health Administrators, Policy Analysts |

| Medical Equipment Suppliers | 50 | Sales Representatives, Product Managers |

| Insurance Providers | 40 | Claims Managers, Underwriters |

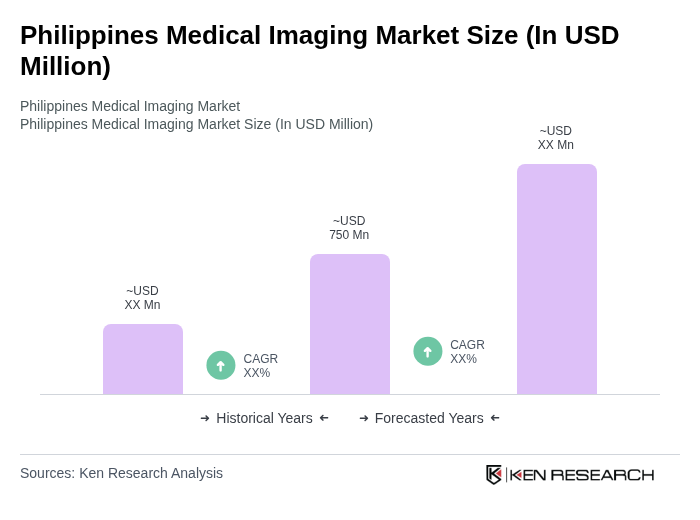

The Philippines Medical Imaging Market is valued at approximately USD 750 million, reflecting the growth of the national imaging services market, which is estimated at around USD 700 million, driven by advancements in technology and increasing healthcare demands.