Region:Asia

Author(s):Geetanshi

Product Code:KRAA4260

Pages:92

Published On:January 2026

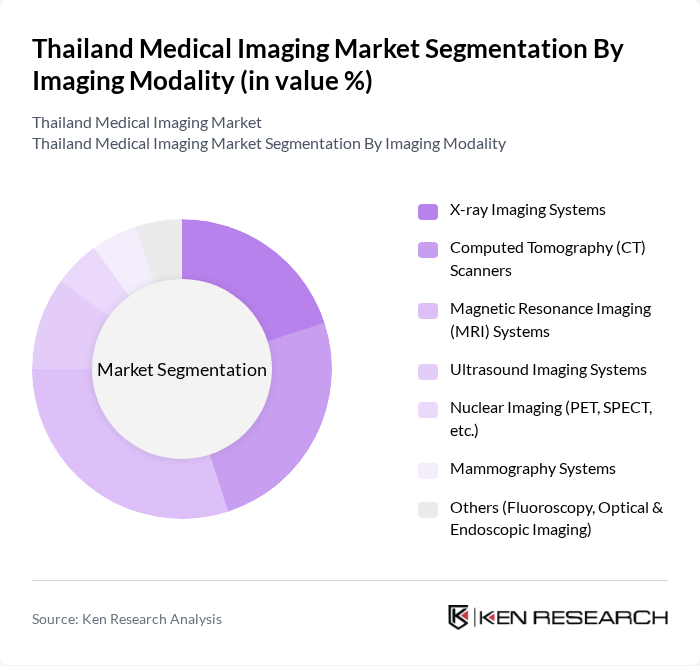

By Imaging Modality:The imaging modality segment includes various technologies used for medical imaging. The subsegments are X-ray Imaging Systems, Computed Tomography (CT) Scanners, Magnetic Resonance Imaging (MRI) Systems, Ultrasound Imaging Systems, Nuclear Imaging (PET, SPECT, etc.), Mammography Systems, and Others (Fluoroscopy, Optical & Endoscopic Imaging). In Thailand, CT scan and X-ray based products together account for the largest revenue share among diagnostic imaging modalities, reflecting their widespread use in emergency care, trauma, chest, and musculoskeletal imaging, while MRI and ultrasound continue to grow with increasing adoption in neurology, oncology, and obstetrics. MRI Systems represent a high-value subsegment due to their non-invasive nature and high-resolution imaging capabilities, although X-ray and CT remain the highest-volume modalities used across the country.

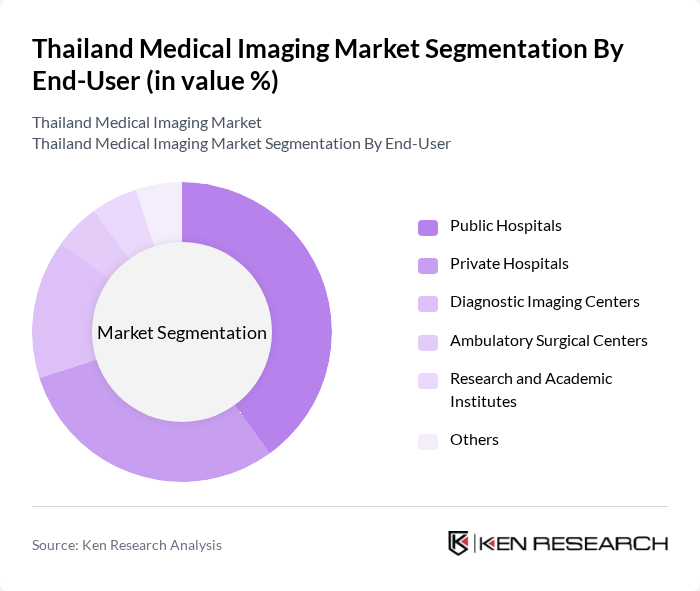

By End-User:The end-user segment encompasses various healthcare facilities utilizing medical imaging services. This includes Public Hospitals, Private Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Research and Academic Institutes, and Others. Public Hospitals are the leading subsegment by volume, supported by universal coverage schemes and government funding that enable widespread deployment of X-ray, CT, ultrasound, and basic MRI systems across provincial and district hospitals, while private hospitals and standalone diagnostic centers capture a significant share of higher-end imaging demand from insured and international patients.

The Thailand Medical Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems Corporation, Fujifilm Healthcare, Hitachi Medical Systems (Fujifilm Healthcare after integration), Agfa HealthCare, Carestream Health, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Hologic, Inc., Samsung Medison Co., Ltd., Varian Medical Systems, Inc. (A Siemens Healthineers Company), Neusoft Medical Systems Co., Ltd., Esaote S.p.A., Leading Thai Hospital & Teleradiology Networks (e.g., Bumrungrad International Hospital, Bangkok Hospital Group, Samitivej Hospital, Vejthani Hospital) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical imaging market in Thailand appears promising, driven by ongoing technological innovations and increasing healthcare investments. The integration of artificial intelligence in imaging analysis is expected to enhance diagnostic accuracy and efficiency. Additionally, the expansion of telemedicine services will facilitate remote diagnostics, making imaging services more accessible. As healthcare policies continue to evolve, the focus on preventive care will further stimulate demand for advanced imaging solutions, ensuring sustained market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Imaging Modality | X-ray Imaging Systems Computed Tomography (CT) Scanners Magnetic Resonance Imaging (MRI) Systems Ultrasound Imaging Systems Nuclear Imaging (PET, SPECT, etc.) Mammography Systems Others (Fluoroscopy, Optical & Endoscopic Imaging) |

| By End-User | Public Hospitals Private Hospitals Diagnostic Imaging Centers Ambulatory Surgical Centers Research and Academic Institutes Others |

| By Region | Bangkok Metropolitan Region Central Thailand (Excl. Bangkok) Northern Thailand Northeastern (Isan) Thailand Southern Thailand Others |

| By Technology | Digital Imaging Analog Imaging Hybrid Imaging Others |

| By Clinical Application | Radiology / General Imaging Oncology Cardiology Neurology Orthopedics & Musculoskeletal Obstetrics & Gynecology Others |

| By Investment Source | Public Funding (Government & Public Hospitals) Private Investments (Private Hospitals & Chains) International Aid & Development Programs Others |

| By Policy Support Mechanism | Government Subsidies Tax Incentives Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Directors |

| Private Imaging Clinics | 90 | Clinic Owners, Technologists |

| Healthcare Administrators | 70 | Chief Financial Officers, Procurement Managers |

| Patient Experience Surveys | 140 | Patients who have undergone imaging procedures |

| Medical Equipment Suppliers | 60 | Sales Representatives, Product Managers |

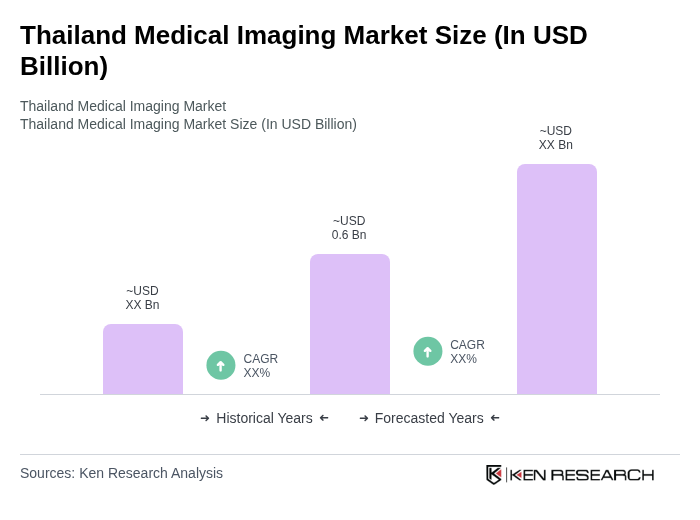

The Thailand Medical Imaging Market is valued at approximately USD 0.6 billion, reflecting a historical analysis of diagnostic imaging device revenues and related medical imaging services in the country.