Region:Asia

Author(s):Dev

Product Code:KRAC5107

Pages:96

Published On:January 2026

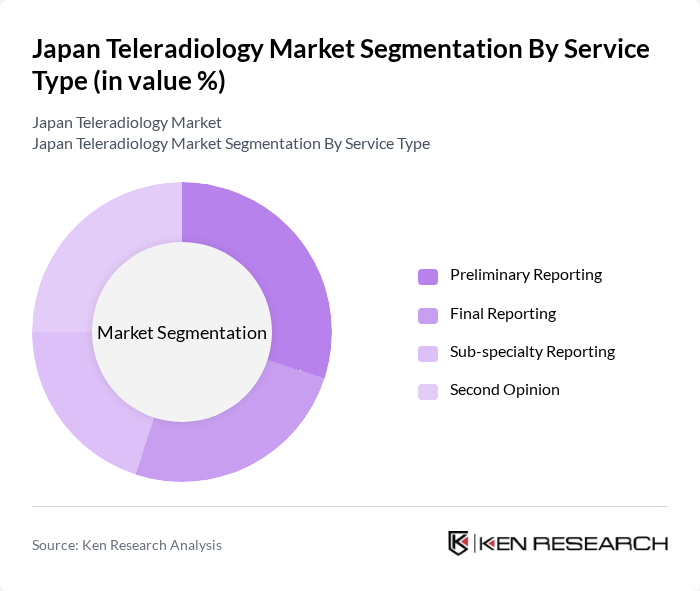

By Service Type:The service type segmentation includes various offerings such as Preliminary Reporting, Final Reporting, Sub-specialty Reporting, and Second Opinion. Each of these services caters to different needs within the healthcare system, with Preliminary Reporting being essential for quick assessments in emergency and out-of-hours settings, while Sub-specialty Reporting addresses complex cases in areas such as neuroradiology, musculoskeletal imaging, oncology, and cardiothoracic imaging where specialist expertise is required.

By Imaging Modality:The imaging modality segmentation encompasses various technologies including X-ray, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound, Nuclear Imaging, and Others. Each modality serves distinct diagnostic purposes, with CT and MRI being particularly favored for their detailed imaging capabilities and high utilization in Japan’s aging population for oncology, cardiovascular, neurological, and orthopedic conditions, while X?ray and ultrasound remain widely used for primary and emergency care diagnostics that are well suited to remote interpretation.

The Japan Teleradiology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fujifilm Holdings Corporation, Canon Medical Systems Corporation, Siemens Healthineers AG, GE HealthCare Technologies Inc., Philips Japan, Ltd. (Koninklijke Philips N.V.), Agfa-Gevaert Group, Hitachi, Ltd. (Healthcare Business), Canon Medical Systems Corporation (formerly Toshiba Medical Systems), Carestream Health, Inc., NTT DATA Corporation, Medica Group / Local Teleradiology Service Providers, Telemedicine Clinic (TMC), Infinitt Healthcare Co., Ltd., EIZO Corporation, Other Emerging Japan-based Teleradiology Providers contribute to innovation, geographic expansion, and service delivery in this space, increasingly focusing on AI-enabled workflow orchestration, cloud-based PACS/RIS integration, and partnerships with hospitals and diagnostic imaging centers to address radiologist shortages and after-hours coverage.

The future of the teleradiology market in Japan appears promising, driven by technological advancements and increasing healthcare demands. As the population ages, the need for efficient diagnostic services will continue to rise. Additionally, the integration of artificial intelligence in radiology is expected to enhance diagnostic accuracy and workflow efficiency. With ongoing government support for telehealth initiatives, the market is poised for significant growth, fostering innovation and improving patient outcomes across the healthcare spectrum.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Preliminary Reporting Final Reporting Sub-specialty Reporting Second Opinion |

| By Imaging Modality | X-ray Computed Tomography (CT) Magnetic Resonance Imaging (MRI) Ultrasound Nuclear Imaging Others |

| By Component | Software and Services Hardware |

| By End User | Hospitals and Clinics Diagnostic Imaging Centers Ambulatory Surgical Centers Others |

| By Deployment Model | Cloud-based On-premise Hybrid |

| By Region | Kanto Region Kansai/Kinki Region Central/Chubu Region Kyushu-Okinawa Region Tohoku Region Chugoku Region Hokkaido Region Shikoku Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Teleradiology Services | 140 | Radiologists, Hospital Administrators |

| Outpatient Imaging Centers | 90 | Imaging Center Managers, IT Directors |

| Telemedicine Platforms | 70 | Telemedicine Coordinators, Healthcare IT Specialists |

| Patient Experience with Teleradiology | 110 | Patients, Caregivers |

| Regulatory Impact on Teleradiology | 50 | Healthcare Policy Experts, Compliance Officers |

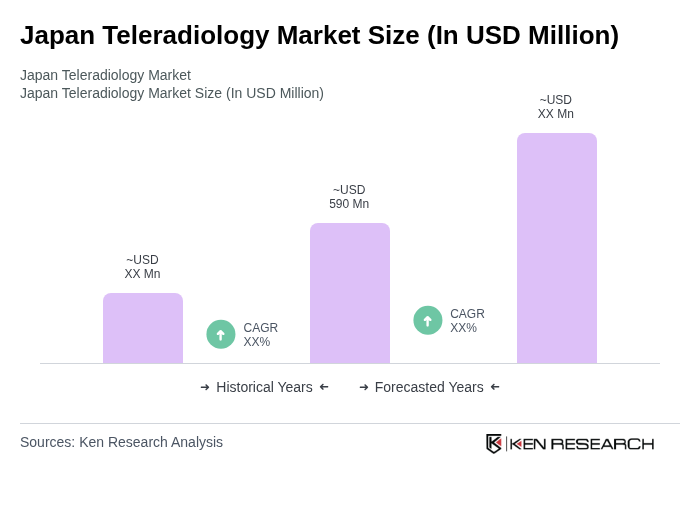

The Japan Teleradiology Market is valued at approximately USD 590 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for remote diagnostic services and advancements in imaging technologies.