Region:Asia

Author(s):Geetanshi

Product Code:KRAA4263

Pages:94

Published On:January 2026

By Modality:The medical imaging market can be segmented into various modalities, each serving specific diagnostic needs. The primary modalities include X-ray Systems, Computed Tomography (CT), Magnetic Resonance Imaging (MRI), Ultrasound Systems, Nuclear Imaging (PET, SPECT), Mammography Systems, and Others (Fluoroscopy, Optical and Hybrid Imaging). X-ray Systems remain a foundational modality due to their critical role in general radiography, emergency care, and orthopaedics, while CT and MRI have expanded rapidly for oncologic, neurologic, and cardiovascular imaging. Ultrasound is widely used in obstetrics, cardiology, and point-of-care applications, and nuclear imaging (PET, SPECT) and hybrid PET-CT systems are increasingly used for oncology staging and therapy planning. The adoption of digital and AI-assisted imaging workflows is strengthening utilization across these modalities in both hospital and outpatient settings.

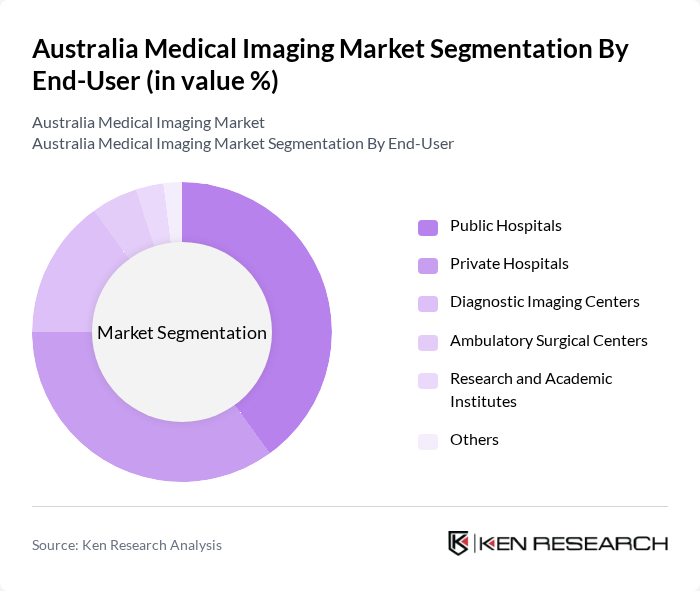

By End-User:The end-user segmentation of the medical imaging market includes Public Hospitals, Private Hospitals, Diagnostic Imaging Centers, Ambulatory Surgical Centers, Research and Academic Institutes, and Others. Public and Private Hospitals are the leading end-users, as they require extensive imaging services for emergency care, inpatient diagnostics, surgical planning, and oncology pathways, supported by Medicare-funded imaging services. Independent Diagnostic Imaging Centers account for a significant and growing share of imaging activity in metropolitan and regional areas, reflecting outpatient referrals and increasing patient preference for dedicated imaging facilities. Ambulatory Surgical Centers and specialist clinics are expanding use of ultrasound, CT, and interventional imaging for day procedures, while Research and Academic Institutes drive adoption of advanced and hybrid imaging systems through clinical trials and translational research partnerships.

The Australia Medical Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems, Fujifilm Healthcare, Hitachi Medical Systems (Fujifilm Healthcare), Agfa HealthCare, Carestream Health, Hologic, Inc., Mindray Medical International, Varian Medical Systems (Siemens Healthineers), Samsung Medison (Samsung Electronics), Bracco Imaging, Neusoft Medical Systems, I-MED Radiology Network, and Sonic Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the medical imaging market in Australia appears promising, driven by ongoing technological advancements and a growing focus on patient-centered care. The integration of artificial intelligence in imaging analysis is expected to enhance diagnostic accuracy and efficiency. Additionally, the expansion of telemedicine and remote diagnostics will likely increase access to imaging services, particularly in rural areas, fostering a more inclusive healthcare environment and improving patient outcomes.

| Segment | Sub-Segments |

|---|---|

| By Modality | X-ray Systems Computed Tomography (CT) Magnetic Resonance Imaging (MRI) Ultrasound Systems Nuclear Imaging (PET, SPECT) Mammography Systems Others (Fluoroscopy, Optical and Hybrid Imaging) |

| By End-User | Public Hospitals Private Hospitals Diagnostic Imaging Centers Ambulatory Surgical Centers Research and Academic Institutes Others |

| By Clinical Application | Oncology Cardiology Neurology Orthopedics and Musculoskeletal Obstetrics and Gynecology Gastroenterology Others |

| By Technology | Digital Imaging (DR, CR) Analog Imaging Hybrid Imaging (PET-CT, SPECT-CT, PET-MRI) AI-Enabled and Advanced Imaging Solutions |

| By Region | New South Wales Victoria Queensland Western Australia South Australia Tasmania Australian Capital Territory and Northern Territory |

| By Funding / Ownership Model | Publicly Funded Facilities Privately Owned Facilities Public-Private Partnerships (PPP) Others |

| By Procurement / Deployment Model | Capital Purchase Leasing and Managed Equipment Services Pay-per-Use / Outcome-Based Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Technologists |

| Private Imaging Clinics | 80 | Clinic Owners, Operations Managers |

| Medical Device Manufacturers | 60 | Product Managers, Sales Directors |

| Healthcare Administrators | 90 | Chief Financial Officers, Procurement Officers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Australia Medical Imaging Market is valued at approximately USD 0.75 billion, reflecting a five-year historical analysis. This growth is driven by advancements in imaging technologies and an increasing prevalence of chronic diseases.