Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7735

Pages:90

Published On:October 2025

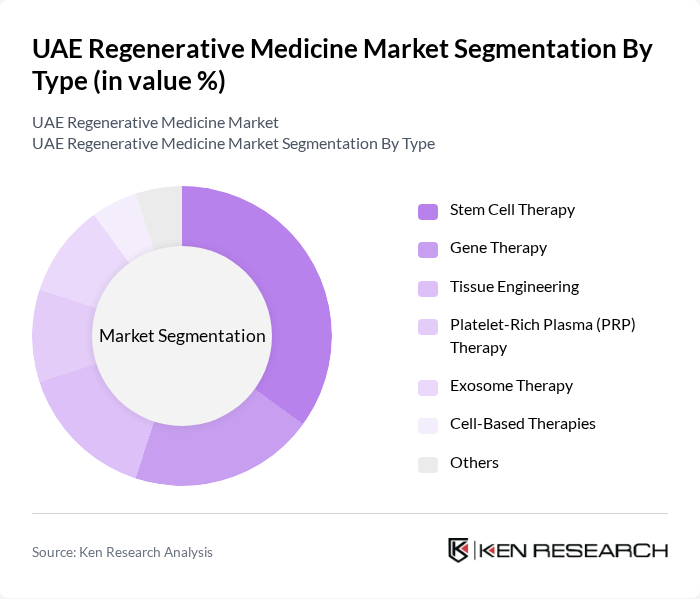

By Type:The regenerative medicine market can be segmented into various types, including Stem Cell Therapy, Gene Therapy, Tissue Engineering, Platelet-Rich Plasma (PRP) Therapy, Exosome Therapy, Cell-Based Therapies, and Others. Among these, Stem Cell Therapy is currently the leading sub-segment due to its wide application in treating various diseases and injuries, coupled with increasing research and clinical trials supporting its efficacy.

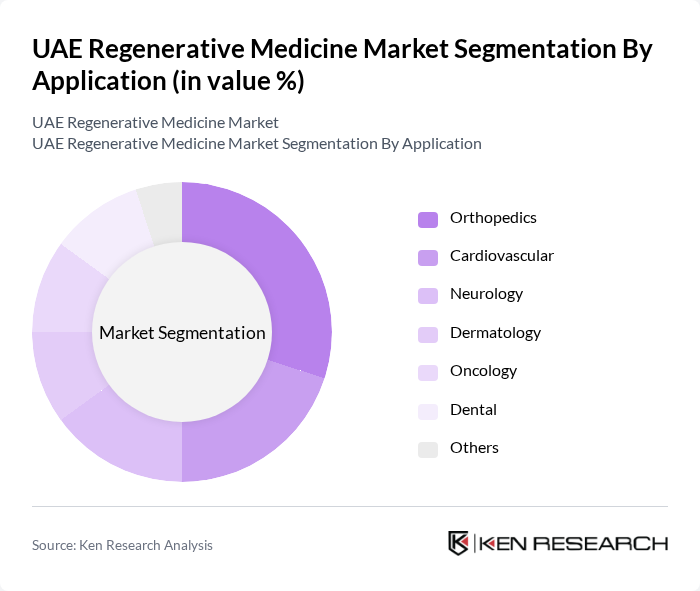

By Application:The applications of regenerative medicine include Orthopedics, Cardiovascular, Neurology, Dermatology, Oncology, Dental, and Others. Orthopedics is the dominant application area, driven by the increasing incidence of musculoskeletal disorders and the growing demand for minimally invasive treatment options that regenerative therapies provide.

The UAE Regenerative Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Stem Cells Center, Dubai Health Authority, Al Jalila Foundation, Emirates Stem Cell Center, Medcare Hospitals, Cleveland Clinic Abu Dhabi, Burjeel Hospital, American Hospital Dubai, Sheikh Khalifa Medical City, University of Sharjah, Dubai Science Park, Abu Dhabi University, Gulf Medical University, Mediclinic City Hospital, Aster DM Healthcare contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE regenerative medicine market appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in treatment protocols is expected to enhance patient outcomes and streamline processes. Additionally, the growing focus on personalized medicine will likely lead to tailored therapies that cater to individual patient needs, further propelling market growth. As regulatory frameworks evolve, the market is poised for significant expansion, attracting more investments and innovations.

| Segment | Sub-Segments |

|---|---|

| By Type | Stem Cell Therapy Gene Therapy Tissue Engineering Platelet-Rich Plasma (PRP) Therapy Exosome Therapy Cell-Based Therapies Others |

| By Application | Orthopedics Cardiovascular Neurology Dermatology Oncology Dental Others |

| By End-User | Hospitals Research Institutions Clinics Academic Institutions Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah Others |

| By Patient Demographics | Age Group (Pediatric, Adult, Geriatric) Gender (Male, Female) Socioeconomic Status (Low, Middle, High) |

| By Treatment Duration | Short-term Treatments Long-term Treatments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Stem Cell Therapy Providers | 100 | Clinical Directors, Medical Researchers |

| Tissue Engineering Specialists | 80 | Biotechnology Experts, Lab Managers |

| Regenerative Medicine Patients | 120 | Patients, Caregivers, Health Advocates |

| Healthcare Policy Makers | 60 | Government Officials, Health Economists |

| Investors in Biotech Startups | 50 | Venture Capitalists, Angel Investors |

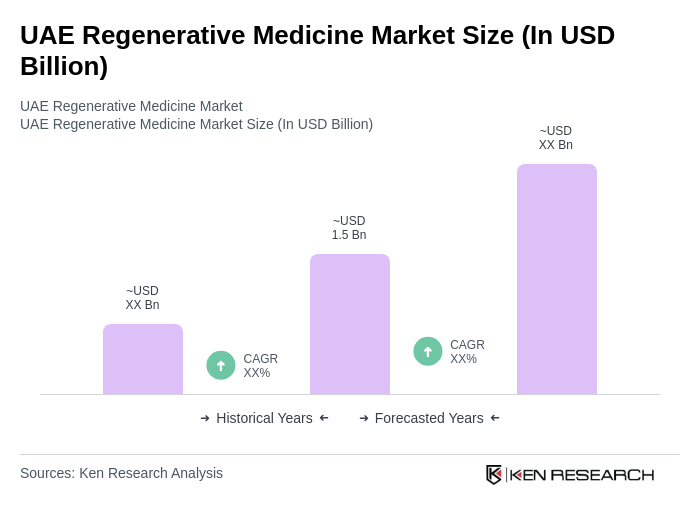

The UAE Regenerative Medicine Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by advancements in biotechnology, increasing chronic disease prevalence, and rising healthcare investments.