Region:Europe

Author(s):Geetanshi

Product Code:KRAA6641

Pages:84

Published On:September 2025

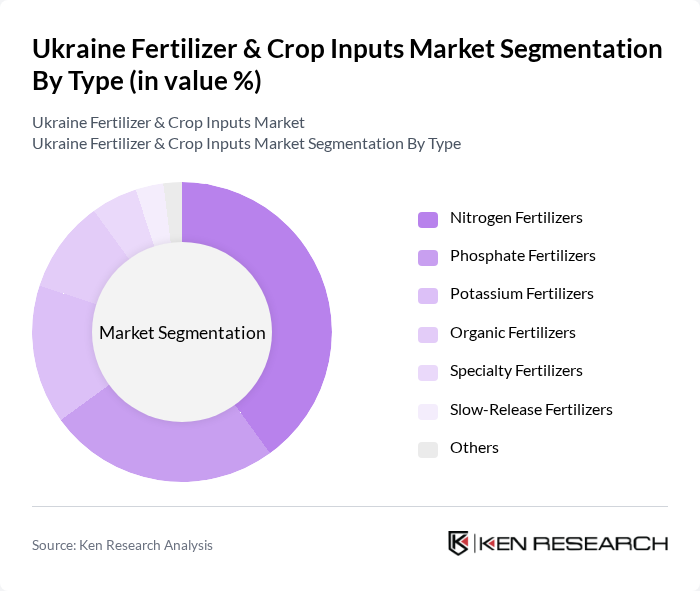

By Type:The market is segmented into various types of fertilizers, including nitrogen, phosphate, potassium, organic, specialty, slow-release, and others. Among these, nitrogen fertilizers are the most widely used due to their essential role in promoting plant growth and increasing crop yields. The demand for nitrogen fertilizers is driven by their effectiveness in enhancing soil fertility and supporting high agricultural productivity. Phosphate and potassium fertilizers also hold significant market shares, particularly in regions with specific soil nutrient deficiencies.

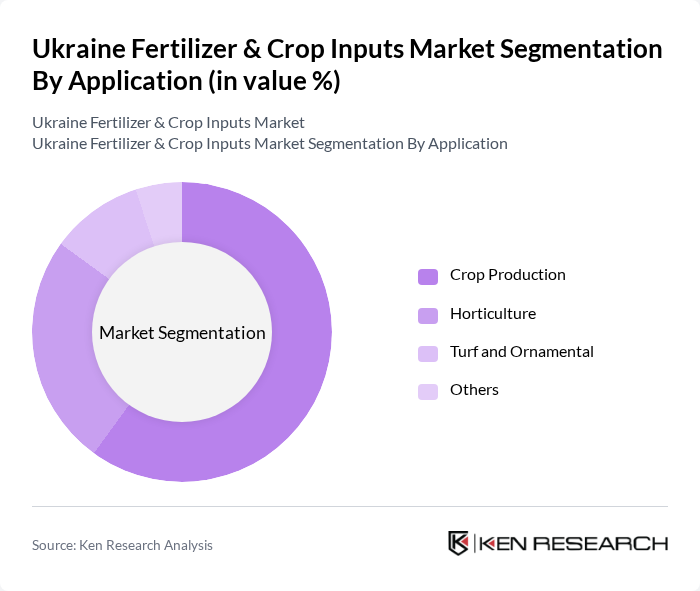

By Application:The application segment includes crop production, horticulture, turf and ornamental, and others. Crop production is the leading application area, driven by the need for increased food production to meet the demands of a growing population. The horticulture segment is also gaining traction as consumers increasingly seek high-quality fruits and vegetables. The turf and ornamental segment, while smaller, is supported by the rising interest in landscaping and gardening.

The Ukraine Fertilizer & Crop Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as OJSC "Ukrainian Chemical Products", PJSC "Azot", LLC "Ukrainian Fertilizers", PJSC "Stirol", LLC "AgroChem", PJSC "DniproAzot", LLC "Ukrainian Agrochemicals", PJSC "Severodonetsk Azot", LLC "Fertility Ukraine", OJSC "Ukrainian Potash", LLC "Agro-Resource", PJSC "Krymchem", LLC "AgroChemistry", PJSC "Ukrainian Phosphates", LLC "Green Fertilizers" contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Ukraine fertilizer and crop inputs market appears cautiously optimistic, driven by technological advancements and a growing emphasis on sustainable practices. As farmers increasingly adopt precision agriculture and bio-based fertilizers, the market is likely to witness a shift towards environmentally friendly solutions. Additionally, government initiatives aimed at enhancing agricultural productivity and food security will play a crucial role in shaping the market landscape, fostering resilience amid ongoing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogen Fertilizers Phosphate Fertilizers Potassium Fertilizers Organic Fertilizers Specialty Fertilizers Slow-Release Fertilizers Others |

| By Application | Crop Production Horticulture Turf and Ornamental Others |

| By End-User | Farmers Agricultural Cooperatives Government Agencies Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors |

| By Region | Central Ukraine Eastern Ukraine Western Ukraine Southern Ukraine |

| By Price Range | Low Price Mid Price High Price |

| By Packaging Type | Bulk Packaging Bagged Packaging Liquid Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retailers | 100 | Store Managers, Sales Representatives |

| Crop Input Distributors | 80 | Distribution Managers, Logistics Coordinators |

| Farmers (Cereal Crops) | 150 | Farm Owners, Agronomists |

| Government Agricultural Officials | 50 | Policy Makers, Agricultural Advisors |

| Research Institutions | 40 | Agricultural Researchers, Extension Officers |

The Ukraine Fertilizer & Crop Inputs Market is valued at approximately USD 2.5 billion, reflecting a significant growth driven by the increasing demand for agricultural productivity and sustainable farming practices.