Region:Middle East

Author(s):Shubham

Product Code:KRAD3061

Pages:96

Published On:January 2026

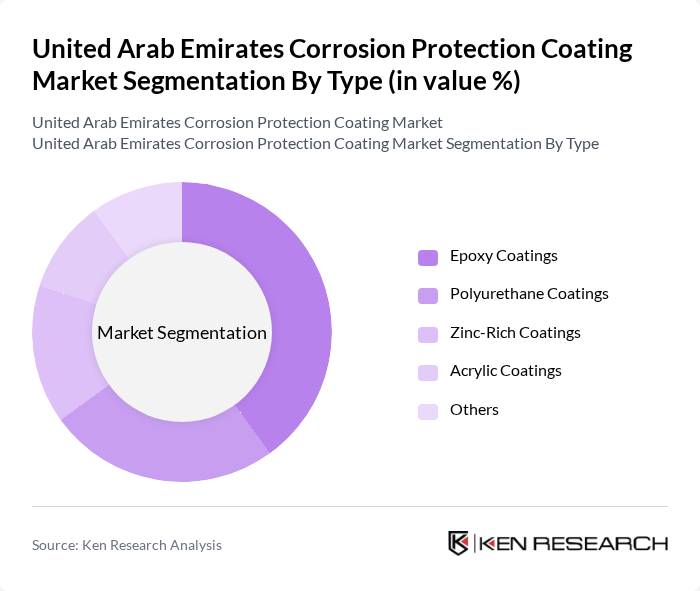

By Type:The market is segmented into various types of coatings, including Epoxy Coatings, Polyurethane Coatings, Zinc-Rich Coatings, Acrylic Coatings, and Others. Among these, Epoxy Coatings dominate the market due to their excellent adhesion, chemical resistance, and durability, making them ideal for harsh environments. The increasing use of epoxy coatings in industrial applications and infrastructure projects is a significant driver of their market share.

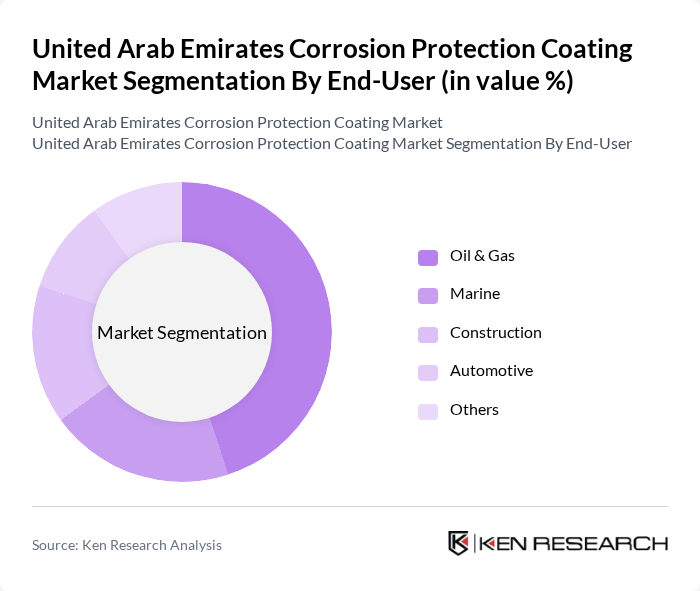

By End-User:The end-user segmentation includes Oil & Gas, Marine, Construction, Automotive, and Others. The Oil & Gas sector is the leading end-user, driven by the need for corrosion protection in pipelines, storage tanks, and offshore platforms. The high investment in oil and gas infrastructure in the UAE, coupled with stringent safety regulations, significantly boosts the demand for protective coatings in this sector.

The United Arab Emirates Corrosion Protection Coating Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jotun Group, PPG Industries, AkzoNobel, Sherwin-Williams, Hempel A/S, BASF SE, RPM International Inc., Carboline Company, Tnemec Company, Inc., International Paint Ltd., Sika AG, DuPont, Henkel AG & Co. KGaA, Valspar Corporation, Covestro AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the corrosion protection coating market in the UAE appears promising, driven by ongoing infrastructure projects and a strong focus on sustainability. As the government continues to prioritize eco-friendly initiatives, the demand for innovative and sustainable coating solutions is expected to rise. Additionally, the integration of digital technologies in coating applications will enhance efficiency and performance, positioning the UAE as a leader in advanced coating solutions in the region and beyond.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Coatings Polyurethane Coatings Zinc-Rich Coatings Acrylic Coatings Others |

| By End-User | Oil & Gas Marine Construction Automotive Others |

| By Application | Industrial Equipment Infrastructure Transportation Power Generation Others |

| By Formulation | Solvent-Based Coatings Water-Based Coatings Powder Coatings Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Technology | Conventional Coating Technologies Advanced Coating Technologies Smart Coating Technologies Others |

| By Market Segment | Commercial Sector Residential Sector Industrial Sector Government Sector Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Coating Applications | 100 | Project Engineers, Maintenance Managers |

| Construction Industry Corrosion Protection | 80 | Site Managers, Quality Control Inspectors |

| Marine Coating Solutions | 70 | Fleet Managers, Marine Engineers |

| Infrastructure Maintenance Coatings | 90 | Facility Managers, Asset Management Directors |

| Automotive Coating Applications | 60 | Production Managers, R&D Specialists |

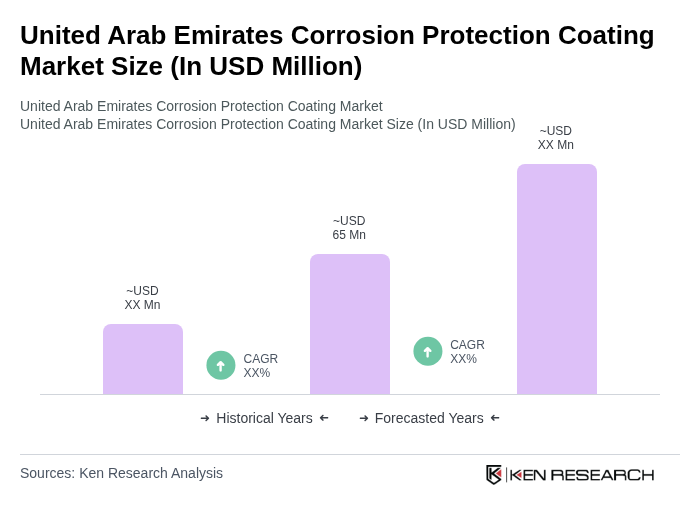

The United Arab Emirates Corrosion Protection Coating Market is valued at approximately USD 65 million, driven by the increasing demand for protective coatings across various industries, including oil and gas, construction, and marine sectors.