Region:Middle East

Author(s):Rebecca

Product Code:KRAE3459

Pages:92

Published On:February 2026

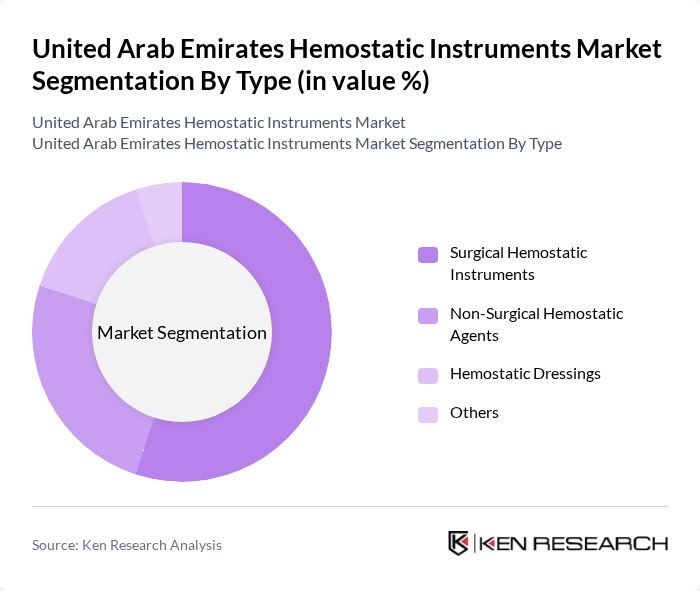

By Type:The market can be segmented into various types, including Surgical Hemostatic Instruments, Non-Surgical Hemostatic Agents, Hemostatic Dressings, and Others. Among these, Surgical Hemostatic Instruments are the most dominant due to their essential role in surgical procedures, where effective bleeding control is critical. The increasing number of surgeries performed annually contributes to the high demand for these instruments. Non-Surgical Hemostatic Agents and Hemostatic Dressings are also gaining traction, particularly in emergency care and trauma situations.

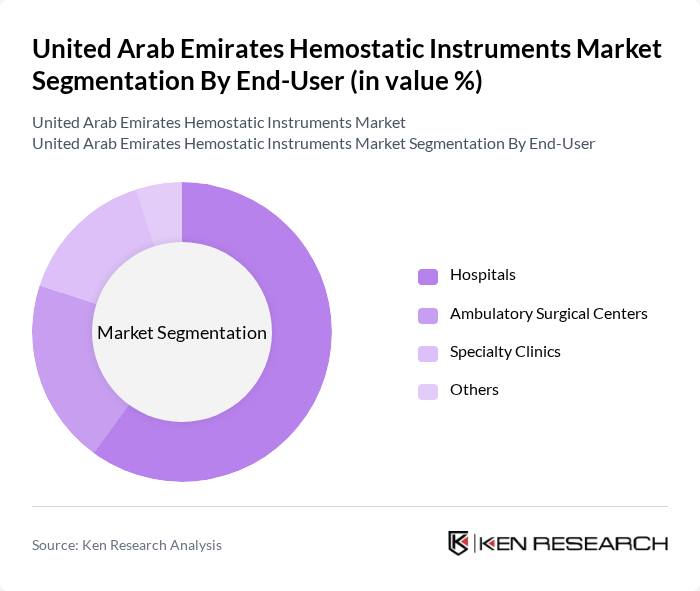

By End-User:The end-user segmentation includes Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others. Hospitals are the leading end-users, driven by the high volume of surgical procedures performed in these facilities. Ambulatory Surgical Centers are also witnessing growth due to the trend towards outpatient surgeries, which require effective hemostatic solutions. Specialty Clinics are increasingly adopting advanced hemostatic instruments to cater to specific surgical needs.

The United Arab Emirates Hemostatic Instruments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Johnson & Johnson, B. Braun Melsungen AG, Ethicon (a subsidiary of Johnson & Johnson), Stryker Corporation, Terumo Corporation, C.R. Bard, Inc., 3M Company, Baxter International Inc., Hemostasis, Inc., Z-Medica, LLC, Cohera Medical, Inc., Integra LifeSciences, Acelity L.P. Inc., Medline Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hemostatic instruments market in the UAE appears promising, driven by ongoing advancements in medical technology and an increasing focus on patient safety. As healthcare infrastructure expands, the demand for innovative hemostatic solutions is expected to rise. Additionally, the integration of artificial intelligence in surgical procedures will enhance precision and outcomes. These trends indicate a robust growth trajectory for the market, with significant opportunities for stakeholders to innovate and collaborate.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Hemostatic Instruments Non-Surgical Hemostatic Agents Hemostatic Dressings Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Others |

| By Application | General Surgery Orthopedic Surgery Cardiovascular Surgery Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Others |

| By Material Type | Synthetic Materials Natural Materials Composite Materials Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Product Lifecycle Stage | New Products Growth Stage Products Mature Products Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Surgery Departments | 100 | Surgeons, Surgical Nurses |

| Emergency Medical Services | 80 | Paramedics, Emergency Room Physicians |

| Orthopedic Surgery Units | 70 | Orthopedic Surgeons, Surgical Assistants |

| Cardiovascular Surgery Teams | 60 | Cardiothoracic Surgeons, Anesthesiologists |

| Medical Device Distributors | 90 | Sales Managers, Product Specialists |

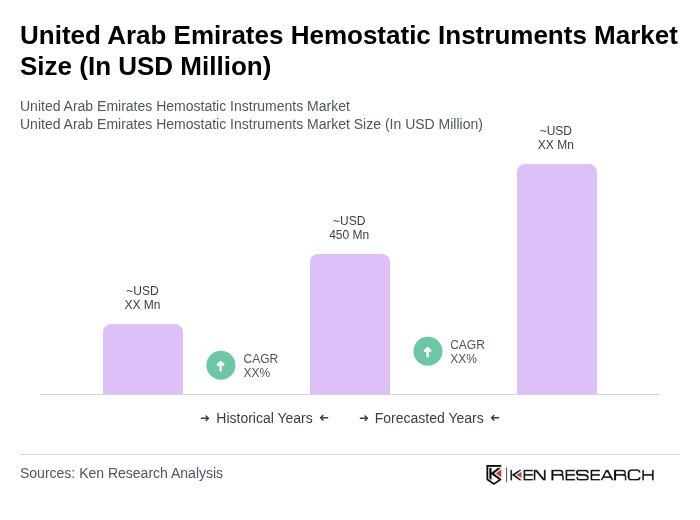

The United Arab Emirates Hemostatic Instruments Market is valued at approximately USD 450 million, reflecting a significant growth driven by the increasing number of surgical procedures and advancements in medical technology aimed at improving patient safety and bleeding control.