Region:Middle East

Author(s):Rebecca

Product Code:KRAE3467

Pages:86

Published On:February 2026

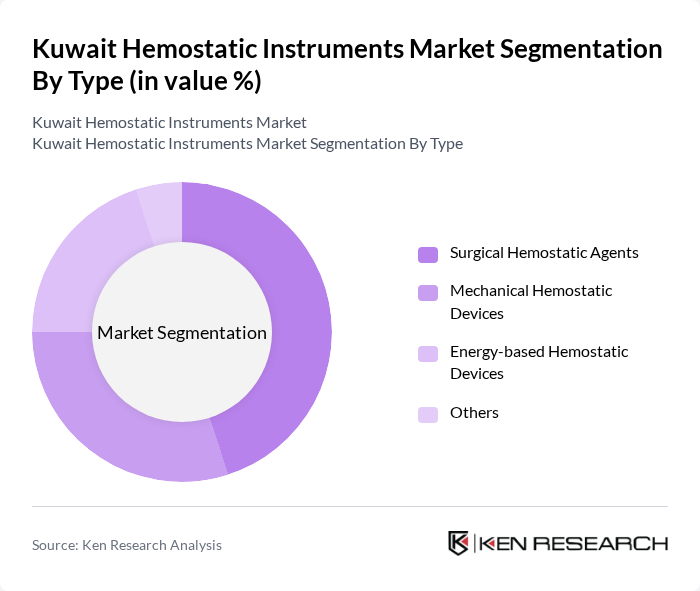

By Type:The market is segmented into various types of hemostatic instruments, including Surgical Hemostatic Agents, Mechanical Hemostatic Devices, Energy-based Hemostatic Devices, and Others. Surgical Hemostatic Agents are widely used due to their effectiveness in controlling bleeding during surgical procedures. Mechanical Hemostatic Devices are also gaining traction as they offer precision and reliability in blood management. Energy-based devices are increasingly adopted for their advanced technology and efficiency.

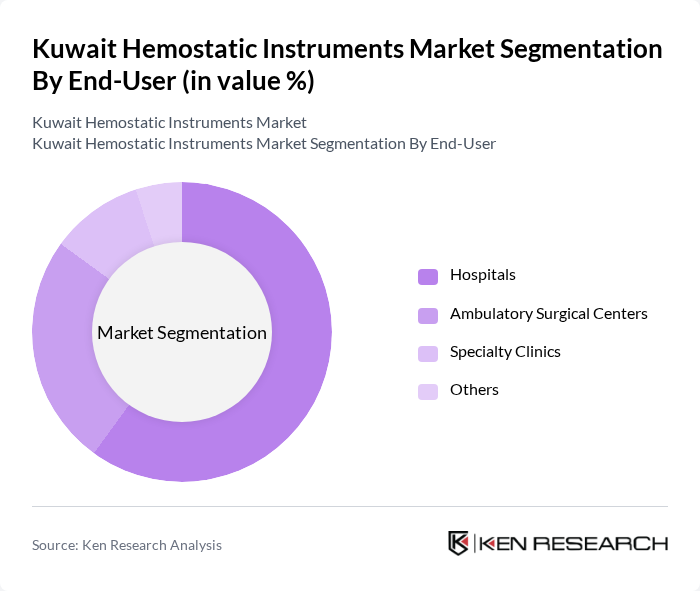

By End-User:The hemostatic instruments market is categorized based on end-users, including Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others. Hospitals are the primary end-users due to their extensive surgical operations and the need for effective blood management solutions. Ambulatory Surgical Centers are also significant users, driven by the increasing trend of outpatient surgeries. Specialty Clinics are emerging as important players as they focus on specific surgical procedures.

The Kuwait Hemostatic Instruments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic, Johnson & Johnson, B. Braun Melsungen AG, Stryker Corporation, Boston Scientific, Terumo Corporation, Ethicon (a subsidiary of Johnson & Johnson), Cook Medical, ConMed Corporation, Hemostasis, Inc., Integra LifeSciences, Abbott Laboratories, Smith & Nephew, Acelity, Baxter International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hemostatic instruments market in Kuwait appears promising, driven by ongoing advancements in medical technology and an increasing focus on patient safety. As healthcare infrastructure expands, the demand for innovative surgical solutions will likely rise. Additionally, the integration of artificial intelligence in surgical procedures is expected to enhance precision and efficiency, further propelling market growth. The emphasis on minimally invasive techniques will also shape the development of new hemostatic products tailored to these evolving surgical practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Surgical Hemostatic Agents Mechanical Hemostatic Devices Energy-based Hemostatic Devices Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Others |

| By Application | Cardiovascular Surgery Orthopedic Surgery General Surgery Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Product Formulation | Liquid Formulations Powder Formulations Gel Formulations Others |

| By Technology | Traditional Techniques Advanced Techniques Hybrid Techniques Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Surgery Departments | 100 | Surgeons, Department Heads |

| Emergency Medical Services | 80 | Paramedics, Emergency Room Physicians |

| Orthopedic Surgery Units | 70 | Orthopedic Surgeons, Surgical Assistants |

| Cardiovascular Surgery Teams | 60 | Cardiothoracic Surgeons, Anesthesiologists |

| Medical Device Distributors | 90 | Sales Managers, Product Specialists |

The Kuwait Hemostatic Instruments Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This valuation is influenced by the increasing prevalence of surgical procedures and advancements in medical technology.