Region:North America

Author(s):Rebecca

Product Code:KRAC2583

Pages:92

Published On:October 2025

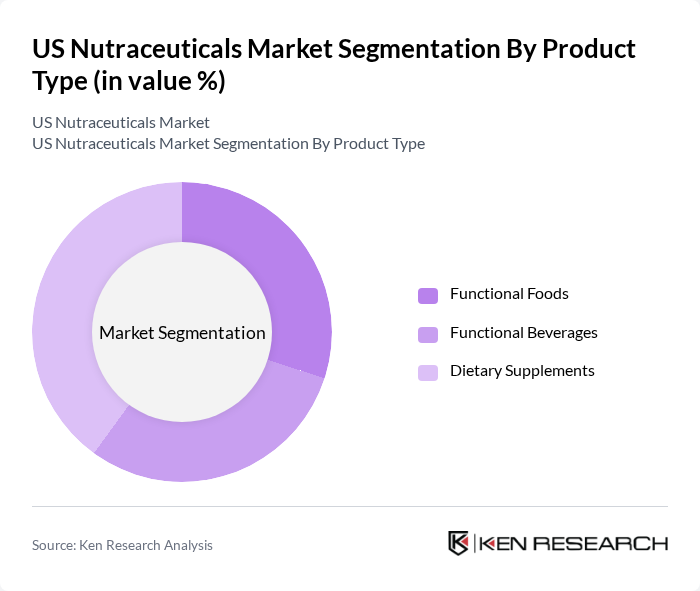

By Product Type:The product type segmentation includes Functional Foods, Functional Beverages, and Dietary Supplements. Each of these categories has distinct subsegments that cater to varying consumer preferences and health needs. Functional Foods encompass items like cereals, dairy products, and snacks, while Functional Beverages include energy drinks and fortified juices. Dietary Supplements cover a wide range of products, including vitamins and botanicals.

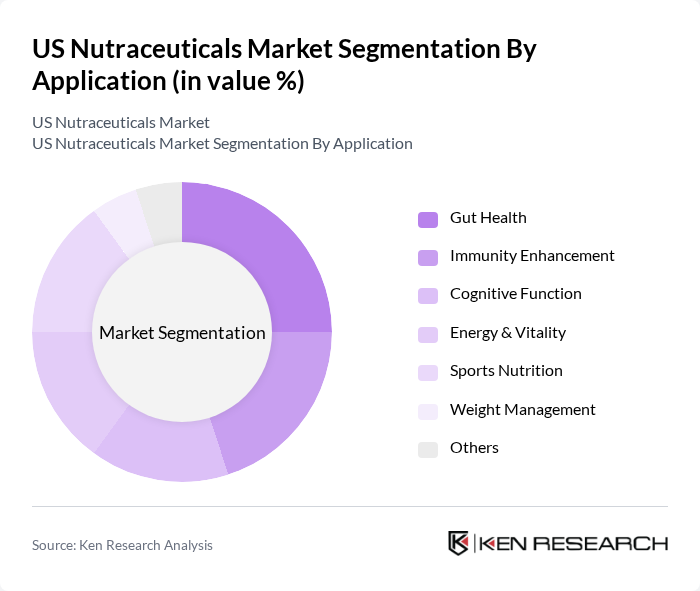

By Application:The application segmentation includes Gut Health, Immunity Enhancement, Cognitive Function, Energy & Vitality, Sports Nutrition, Weight Management, and Others. Each application area addresses specific health concerns and consumer demands, with a growing trend towards products that support overall wellness and preventive health.

The US Nutraceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., The Nature's Bounty Co. (now The Bountiful Company), USANA Health Sciences, Inc., Garden of Life, LLC, NOW Foods, Inc., Optimum Nutrition, Inc. (Glanbia Performance Nutrition), NutraBio Labs, Inc., Solgar Inc., MegaFood, LLC, Jarrow Formulas, Inc., Nature Made (Pharmavite LLC), New Chapter, Inc., Vital Proteins, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The US nutraceuticals market is poised for significant evolution, driven by advancements in technology and consumer preferences. As personalized nutrition gains traction, companies are likely to invest in tailored products that meet individual health needs. Additionally, the increasing focus on mental health supplements reflects a broader societal shift towards holistic well-being. These trends, combined with the expansion of e-commerce, will likely reshape the market landscape, fostering innovation and enhancing consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Functional Foods (Cereal, Bakery and Confectionery, Dairy, Snack, Other Functional Foods) Functional Beverages (Energy Drink, Sports Drink, Fortified Juice, Dairy and Dairy Alternative Beverage, Other Functional Beverages) Dietary Supplements (Vitamins, Minerals, Botanicals, Enzymes, Fatty Acids, Proteins, Other Dietary Supplements) |

| By Application | Gut Health Immunity Enhancement Cognitive Function Energy & Vitality Sports Nutrition Weight Management Others |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Convenience Stores Drug Stores/Pharmacies Online Retail Stores Other Distribution Channels |

| By Region | East West North South |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Nutraceutical Sales | 100 | Store Managers, Sales Representatives |

| Consumer Dietary Supplement Usage | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Insights | 80 | Nutritionists, Dietitians, Physicians |

| Market Trends in Herbal Supplements | 60 | Herbal Product Manufacturers, Industry Analysts |

| Impact of Regulatory Changes | 40 | Regulatory Affairs Specialists, Compliance Officers |

The US Nutraceuticals Market is valued at approximately USD 165 billion, reflecting significant growth driven by increasing consumer awareness of health and wellness, as well as a rising demand for preventive healthcare solutions.