Region:Asia

Author(s):Shubham

Product Code:KRAC2191

Pages:86

Published On:October 2025

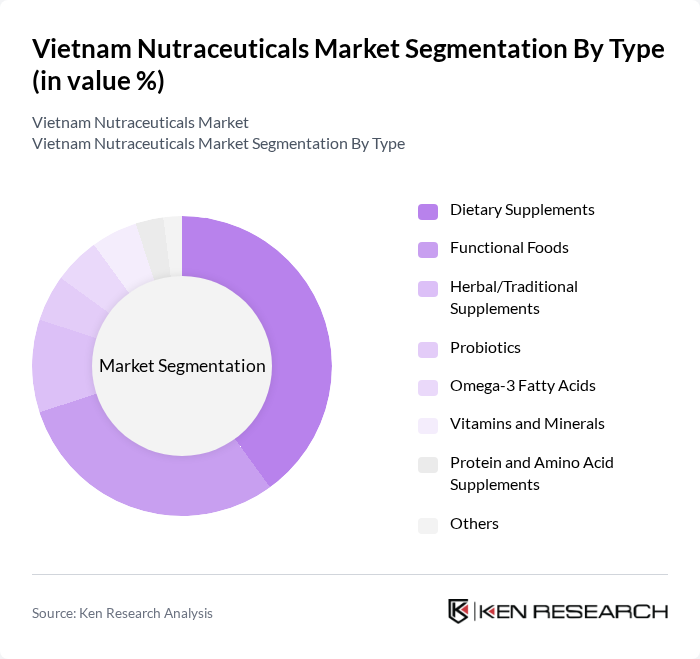

By Type:The nutraceuticals market can be segmented into various types, including dietary supplements, functional foods, herbal/traditional supplements, probiotics, omega-3 fatty acids, vitamins and minerals, protein and amino acid supplements, and others. Among these, dietary supplements and functional foods are the most prominent segments, driven by consumer demand for health-enhancing products. Dietary supplements, in particular, have gained popularity due to their convenience and effectiveness in addressing specific health concerns. Functional foods are increasingly favored for their ability to deliver targeted health benefits through everyday consumption, while herbal/traditional supplements maintain strong market share due to cultural acceptance and perceived safety .

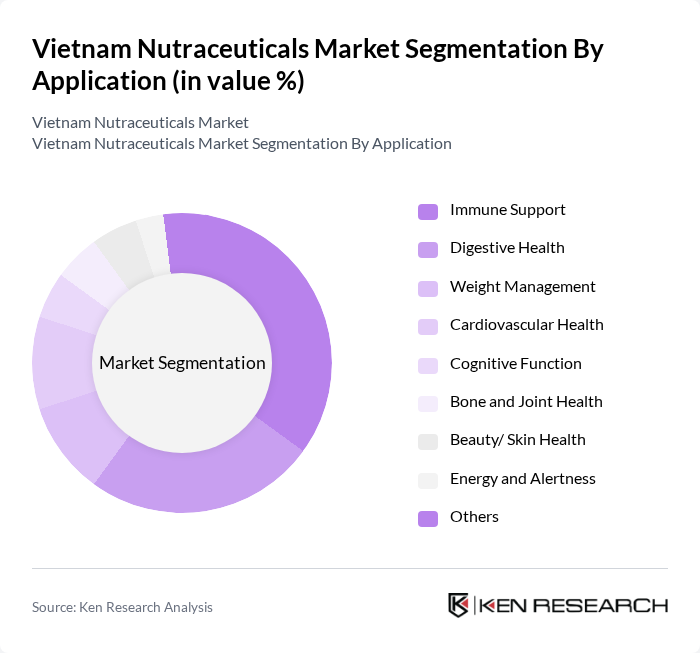

By Application:The applications of nutraceuticals are diverse, including immune support, digestive health, weight management, cardiovascular health, cognitive function, bone and joint health, beauty/skin health, energy and alertness, and others. Immune support and digestive health are the leading applications, reflecting consumer priorities in maintaining overall health and wellness, especially in the wake of global health challenges. Weight management and cardiovascular health are also significant, driven by rising rates of obesity and chronic diseases .

The Vietnam Nutraceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutifood Nutrition Food Joint Stock Company, Herbalife Vietnam, Amway Vietnam, Unicity Vietnam, GNC Vietnam, Nature's Way Vietnam, Blackmores Vietnam, Mega Lifesciences Vietnam, Traphaco JSC, DHG Pharmaceutical JSC (Taisho Group), Ecopharma JSC, Abbott Laboratories, USANA Health Sciences, Swisse Wellness, Nature's Bounty contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam nutraceuticals market is poised for significant growth, driven by increasing health awareness and a rising aging population. As consumers prioritize preventive healthcare, the demand for personalized and plant-based supplements is expected to rise. Additionally, advancements in technology will facilitate innovative product development, enhancing consumer engagement. Companies that adapt to these trends and invest in education will likely capture a larger market share, positioning themselves for long-term success in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Dietary Supplements Functional Foods Herbal/Traditional Supplements Probiotics Omega-3 Fatty Acids Vitamins and Minerals Protein and Amino Acid Supplements Others |

| By Application | Immune Support Digestive Health Weight Management Cardiovascular Health Cognitive Function Bone and Joint Health Beauty/ Skin Health Energy and Alertness Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies/Chemists Health Stores Direct Sales Drugstores/Para pharmacies Independent Small Grocers Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) |

| By Packaging Type | Bottles Sachets Blister Packs Jars |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Awareness of Nutraceuticals | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Distribution Channels | 60 | Retail Managers, Health Store Owners |

| Healthcare Professionals' Insights | 40 | Doctors, Nutritionists, Pharmacists |

| Market Trends and Innovations | 50 | Product Developers, R&D Managers |

| Consumer Purchase Behavior | 100 | Online Shoppers, Supermarket Customers |

The Vietnam Nutraceuticals Market is valued at approximately USD 2.0 billion, driven by increasing health awareness, a rising aging population, and a growing trend towards preventive healthcare among consumers.