Region:North America

Author(s):Geetanshi

Product Code:KRAA0535

Pages:97

Published On:December 2025

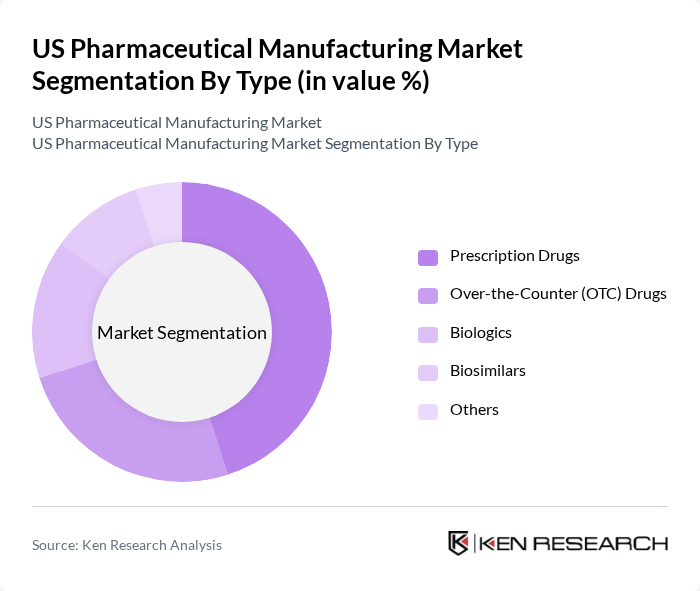

By Type:The pharmaceutical manufacturing market is segmented into various types, including Prescription Drugs, Over-the-Counter (OTC) Drugs, Biologics, Biosimilars, and Others. Among these, Prescription Drugs dominate the market due to their essential role in treating chronic and acute health conditions. The increasing prevalence of diseases and the growing aging population drive the demand for these medications, leading to significant investments in research and development.

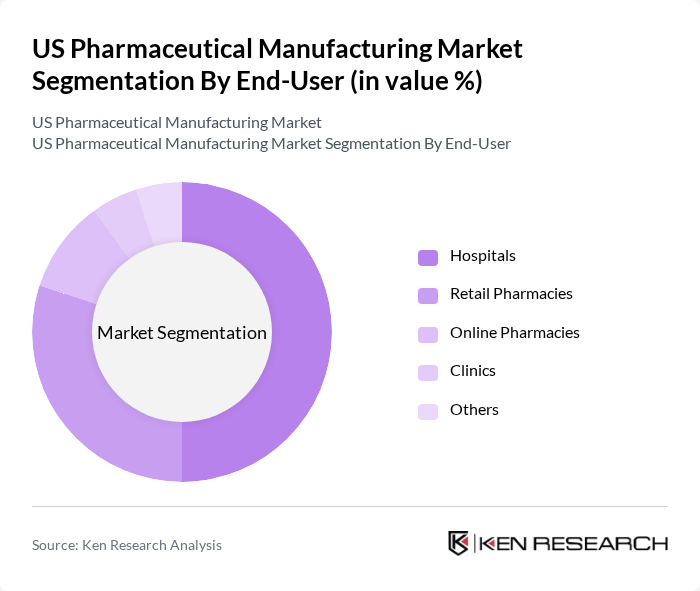

By End-User:The end-user segmentation includes Hospitals, Retail Pharmacies, Online Pharmacies, Clinics, and Others. Hospitals are the leading end-users, driven by the increasing number of patients requiring advanced medical care and the growing demand for specialized medications. The trend towards integrated healthcare systems and the expansion of hospital networks further contribute to the dominance of this segment.

The US Pharmaceutical Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Johnson & Johnson, Merck & Co., Inc., AbbVie Inc., Amgen Inc., Gilead Sciences, Inc., Bristol-Myers Squibb Company, Eli Lilly and Company, Novartis AG, Sanofi S.A., AstraZeneca PLC, GlaxoSmithKline PLC, Teva Pharmaceutical Industries Ltd., Regeneron Pharmaceuticals, Inc., and Biogen Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. pharmaceutical manufacturing market appears promising, driven by advancements in automation and AI technologies. Emerging automated manufacturing systems are enhancing production efficiency, enabling rapid scale-up of drug development processes. This shift towards digital solutions is expected to streamline operations, reduce costs, and improve the overall quality of pharmaceutical products. As companies adapt to these innovations, the industry is likely to see increased competitiveness and resilience against global market pressures.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Drugs Over-the-Counter (OTC) Drugs Biologics Biosimilars Others |

| By End-User | Hospitals Retail Pharmacies Online Pharmacies Clinics Others |

| By Distribution Channel | Direct Sales Wholesalers Distributors E-commerce Others |

| By Therapeutic Area | Cardiovascular Oncology Neurology Infectious Diseases Others |

| By Manufacturing Process | Batch Production Continuous Production Contract Manufacturing Others |

| By Product Formulation | Tablets Injectables Liquids Topicals Others |

| By Policy Support | Subsidies for R&D Tax Incentives Grants for Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturing Operations | 150 | Production Managers, Quality Assurance Directors |

| Regulatory Compliance and Quality Control | 100 | Regulatory Affairs Specialists, Compliance Officers |

| Market Access and Pricing Strategies | 80 | Market Access Managers, Pricing Analysts |

| Research and Development Insights | 70 | R&D Directors, Clinical Trial Managers |

| Sales and Distribution Channels | 90 | Sales Managers, Distribution Network Coordinators |

The US Pharmaceutical Manufacturing Market is valued at approximately USD 145 billion, reflecting a robust growth trajectory driven by factors such as reshoring initiatives, continuous manufacturing adoption, and advancements in AI-enabled quality control systems.