Region:North America

Author(s):Rebecca

Product Code:KRAC8562

Pages:100

Published On:November 2025

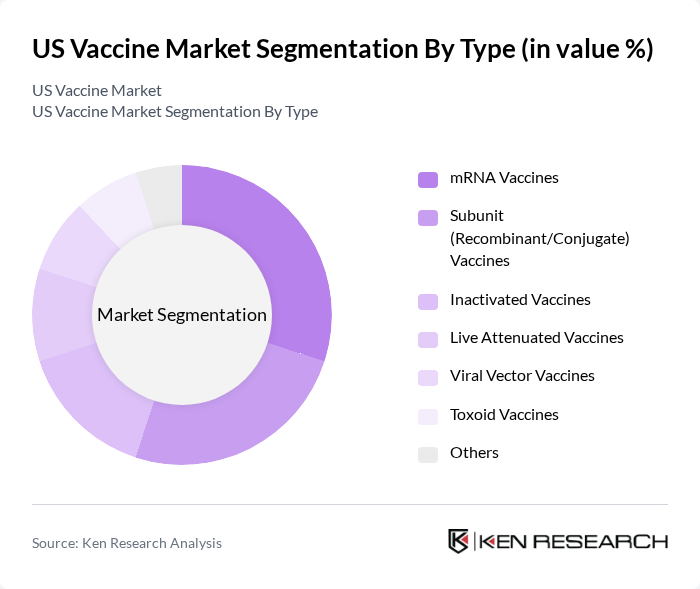

By Type:The vaccine market can be segmented into various types, including mRNA vaccines, subunit (recombinant/conjugate) vaccines, inactivated vaccines, live attenuated vaccines, viral vector vaccines, toxoid vaccines, and others. Among these, mRNA vaccines have gained significant traction due to their rapid development and effectiveness, particularly highlighted during the COVID-19 pandemic. The demand for inactivated and live attenuated vaccines remains strong, especially for routine immunizations. The mRNA type segment accounted for approximately 30% of the US vaccine market by value, while the recombinant/conjugate/subunit segment also held a dominant presence, driven by high adoption of vaccines such as Gardasil 9 .

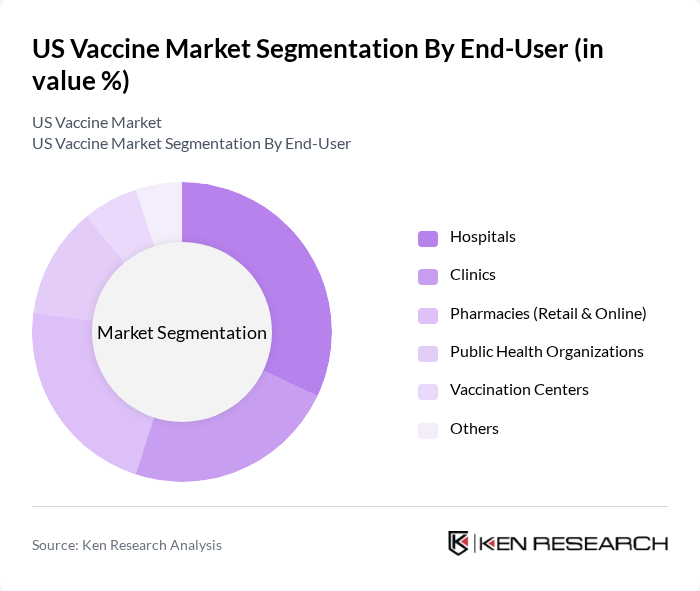

By End-User:The end-user segmentation includes hospitals, clinics, pharmacies (retail & online), public health organizations, vaccination centers, and others. Hospitals and clinics are the primary settings for vaccine administration, driven by their capacity to manage large patient volumes and provide comprehensive healthcare services. Pharmacies have also emerged as significant players, offering convenient access to vaccines for the general public. Government suppliers and hospital & retail pharmacies together account for the largest share of vaccine distribution channels in the US .

The US Vaccine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Moderna, Inc., Johnson & Johnson (Janssen Pharmaceuticals), Merck & Co., Inc., GlaxoSmithKline plc, Sanofi S.A., AstraZeneca plc, Novavax, Inc., Gilead Sciences, Inc., Seqirus (CSL Limited), Emergent BioSolutions Inc., BioNTech SE, Dynavax Technologies Corporation, Vaxart, Inc., Bavarian Nordic A/S contribute to innovation, geographic expansion, and service delivery in this space.

The US vaccine market is poised for significant evolution, driven by ongoing technological advancements and increased public health initiatives. As the focus shifts towards personalized medicine, the development of tailored vaccines is expected to gain traction. Furthermore, the integration of digital health technologies will enhance vaccine distribution and monitoring, ensuring better accessibility and compliance. These trends indicate a robust future for the vaccine market, with potential for improved health outcomes and expanded market reach.

| Segment | Sub-Segments |

|---|---|

| By Type | mRNA Vaccines Subunit (Recombinant/Conjugate) Vaccines Inactivated Vaccines Live Attenuated Vaccines Viral Vector Vaccines Toxoid Vaccines Others |

| By End-User | Hospitals Clinics Pharmacies (Retail & Online) Public Health Organizations Vaccination Centers Others |

| By Age Group | Pediatric Adult Geriatric Others |

| By Disease Targeted | Viral Diseases Bacterial Diseases Cancer Vaccines Allergy Vaccines Others |

| By Administration Route | Parenteral (Intramuscular/Subcutaneous) Oral Intranasal Others |

| By Distribution Channel | Government Suppliers Direct Sales Distributors Pharmacies (Retail & Online) Others |

| By Policy Support | Subsidies Tax Incentives Public Health Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pediatric Vaccination Programs | 120 | Pediatricians, Family Physicians |

| Adult Immunization Clinics | 100 | Nurse Practitioners, Immunization Coordinators |

| Travel Vaccine Providers | 80 | Travel Health Specialists, Pharmacists |

| Public Health Campaigns | 70 | Public Health Officials, Community Health Workers |

| Vaccine Distribution Networks | 90 | Supply Chain Managers, Logistics Coordinators |

The US vaccine market is valued at approximately USD 33 billion, driven by the rising prevalence of infectious diseases, increased public awareness of vaccination, and significant investments in research and development by pharmaceutical companies.